Israel: the tech start-up capital of the world

Published 22-AUG-2016 15:24 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With a population of eight million people, Israel has made a name for itself as the Silicon Valley for tech start-ups.

An innovator in the tech field, Israel has over 6000 start-ups in operation and attracts more venture capital per person that any other country in the world.

Private equity brokers including Blackstone, SilverLake, KKR, Apax Partners, TPG, JPMorgan and Morgan Stanley, have swarmed to the country in recent years writing up some large sum cheques to get in on the action.

The Chinese are also moving in on the scene by joining Israeli VC funds as limited partners as well as investing directly into the start-ups themselves.

Despite the vast sums of money being thrown around, a Business Insider investigation into the industry found that many Israeli start-ups were turning down US$1-30 million offers in the hopes of becoming the next big thing.

In 2015, 104 Israeli start-ups were sold for a total of US$9 billion...that averages to $86.5 million for each company sold.

So how did the Israelis build such a strong start-up scene?

In 2011 the Israeli government introduced tax breaks for Israeli and foreign investors in Israeli tech firms. The change in legislation saw investors move money into the sector to write off costs on investment for tax purposes, helping lay the fertile soil for the current start-ups to sprout from.

As a result there are now over 300 R&D centres of leading tech companies including the likes of Google, Microsoft, Facebook and HP operating in Israel.

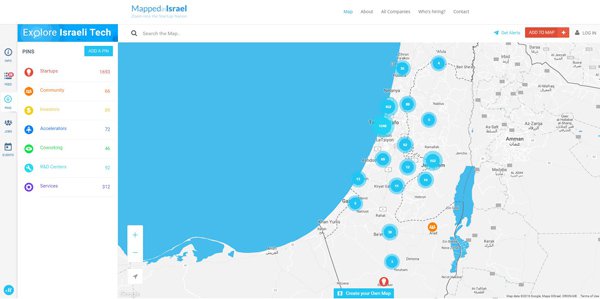

In taking a look at the smaller start-ups, website ‘Mapped in Israel’ allows you to zoom in on the many start-ups operating in Israel and see what they’re up to:

Through the site users are also able to search and apply for jobs, find out about upcoming events, look for investment opportunities and contact relevant start-ups directly – making it easier to link relevant stakeholders and connect people in the scene.

Another website called ‘Founded in Israel’ lists just some of the many prominent companies that were founded in the vibrant Israeli start-up scene.

Here are some of the companies that have gone on to dominate their market:

Two market leading online advertising and content discovery platforms used by many of the largest sites in the world.

Wix:

A free website builder without the need for coding skills. Easy to customize.

An instant messaging and VoIP app for various mobile operating systems. Users can also exchange images, video and audio media messages.

A cheap way to get odd jobs done like logo design, marketing services, whiteboards and more, starting from only $5.

Zeek:

A marketplace to buy gift cars from leading brands and retailers at discounted rates. Users can also sell their gift cards over the online market place.

An in the field itinerary management and mobile travel service.

There’s no doubt about it, the Israeli start-up scene is hot, but which country will be next to step it up in the tech space?

With Australia’s commodity boom drying out it may be time for the once natural resource dominant economy to start looking at other industries it can dominate.

Perhaps by taking a leaf out of the book of the Israelis and investing in a future based on tech.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.