Is oil at its bottom?

Published 12-FEB-2016 12:48 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Sam Green, options educator at of Traders Circle delivers his view on the current state of the oil price.

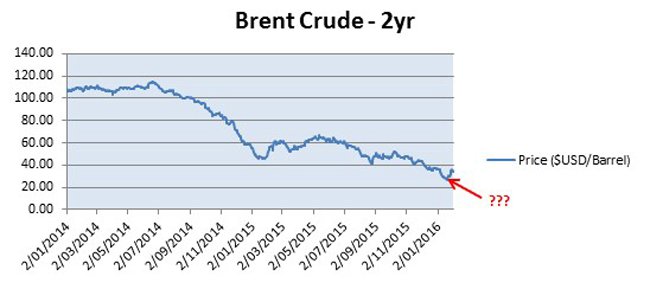

Over the past couple of weeks, several large and influential investment managers have been calling a bottom in oil prices; arguing that the current prices are unsustainably low, and due for a rise in the near future.

Whilst these calls coincided with a strong rally in oil prices, overnight prices resumed their falls with the most commonly traded oil benchmarks falling around 5-6%.

So is this the beginning of renewed falls in oil? Or just a blip in the gradual recovery of a commodity that has been decimated over the past 18-months?

On the bullish side, billionaires such as Stephen A. Schwartzman of Blackstone Group, and T. Boone Pickens, of BP capital management believe that the current prices are unsustainable.

Mr Schwartzman asserts that US supplies will reduce if prices stay low, especially oil supply from unconventional sources.

At the latest earnings call for Mr Schwartzman’s Blackstone group, the Blackstone president stated “These aren’t copper mines, which can produce for 50 years,”...”If you’re not drilling a lot of new wells and you’re producing, which is what’s happening, which is why there’s a surplus, very quickly supply self-corrects.”

Mr Pickens concurs, believing that the world is currently using approximately 95 million barrels a day, with a daily oversupply of around 1 million barrels, or 1.05%. He believes that this supply glut will be quickly corrected, pointing to the oil glut of the mid-1980s, that he states was oversupplied by 15 million barrels a day.

Mr Pickens stresses that whilst “We’re still building inventories, and we will for the next several months... then we’ll start to draw” and “Once you start to draw, you’re not going to start back building again.”

Mr Pickens expects oil prices to reach between $50 and $75 USD per barrel by the end of the year.

Whilst there is some early indication that US supply might be beginning to fall (with US rig counts dropping), the current oil market is also influenced by sentiment and geopolitics. Indeed, the recent upwards spike in prices has at least partially been attributed to comments from Russia’s energy minister that Saudi Arabia may agree to output cuts of up to 5%; in order to support the oil price.

This positive sentiment was dented last weekend when an OPEC official told a Saudi Arabian newspaper that it was too early to discuss an emergency OPEC meeting and cuts to the production target. Whilst this OPEC official may simply be positioning in order to encourage non-OPEC production cuts (and therefore to maintain or increase OPEC market share), his words sparked the renewed falls in oil prices – indicating that prices in the short term are highly susceptible to whims and rumours.

Additionally, the recent removal of Iranian economic sanctions threatens to increase Iranian oil supply to global markets. Iran, who is also part of OPEC, is also involved in a complex diplomatic conflict with Saudi Arabia, OPEC’s largest producer. This conflict has drawn in other OPEC producers and makes any agreement to limit OPEC production far more difficult to achieve.

Complicating OPEC’s position further is the damage the low prices are doing to the economies and finances of its member states; with practically every OPEC nation forecast to run large fiscal deficits this year.

Despite the prolonged falls in oil prices, OPEC hasn’t kept to a production ceiling for more than 18-months, and it looks unlikely to return to these ceilings in the near future. It is therefore likely that the oversupply in oil must therefore be corrected by non-OPEC producers if oil prices are to meaningfully recover in the short-term.

OPEC is therefore hoping that producers in countries like the US, Canada and Russia decrease their oil supply. And whilst there is some indication that this is happening, this is also a complicated situation, with a large amount of US and Canadian production sold forward, or hedged to high prices, and Russian production which has been held up by the falling rubble, and political factors (including their own disagreements with Saudi Arabia).

So be careful when listening to someone forecasting oil prices in the near term, as whilst oil may be over-sold, this does not necessarily mean that prices will quickly recover. Rather, prices look set to be determined by sentiment and speculation until a supply and demand equilibrium is firmly re-established.

Once that equilibrium is re-established, the long term fundamentals for oil do look good for a rising price. This due to the finite nature of the commodity (with between 40-80 years of oil remaining on earth at the current rate of production), which the widely accepted Hubbert peak theory asserts will cause supply to tail off substantially in the coming decades.

Article originally published on traderscircle.com.au

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.