Is ASIC going after SMSF auditors?

Published 03-DEC-2015 16:03 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It appears on the surface that the Australian Securities and Investment Commission (ASIC) has its sights set on auditors of self-managed super funds, with three auditors gone within a week.

ASIC has moved to ban three SMSF auditors in quick succession, having previously only banned one for the entire 2015.

In the past week, it has banned James Dermody, Abe Samuel, and Manoj Abichandani, all from New South Wales.

The cases were referred to ASIC from the ATO.

“Auditors are important gatekeepers who play a crucial role in the SMSF sector. SMSF auditors must maintain high standards or ASIC will hold them to account,” ASIC commissioner John Price said of Dermody’s black-balling.

However, Finfeed understands that this is a coincidence rather than a targeted campaign.

SMSF auditors were first required to be registered back in 2013 as a way to make sure auditors met base standards.

While the ATO is responsible for the regulation of SMSF funds, ASIC has a role to play in the regulation of SMSF auditors.

While the latest black-balling is coincidental and not part of a particular pattern or investigation, it does highlight the ongoing importance of the SMSF sector.

SMSFs have always been an important piece of the puzzle, and in fact represent roughly a quarter of all financial assets held in superannuation funds.

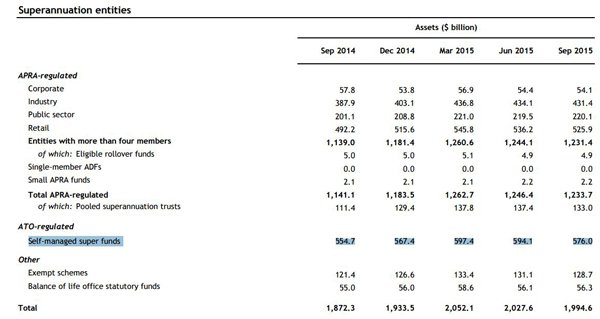

According to the Australian Prudential Regulatory Authority’s latest quarterly bulletin, SMSFs held a whopping $576 billion in assets.

The value of assets held in Australian superannuation accounts

However, while regular super funds like ones offered through unions or through banks are regulated by APRA, SMSFs are regulated by the Australian Tax Office.

The role of SMSF funds in the superannuation sector has long been an issue kicking around since the GFC, when the proportion of SMSFs against regular superannuation funds went up.

While there is no one singular reason for the rise, one of the reasons is that members fed up with seeing their funds making losses during this period decided to pull up stumps and give it a go themselves.

With more people electing to run their own superannuation accounts, there has been increased scrutiny of the regulation and activities of these funds.

It also unleashed a wave of people and organisations offering to set up SMSF accounts for people for free.

ASIC in the past has taken several of these operators to task for suggesting the set-up of the funds would be free, when in reality it wasn’t.

The increased scrutiny of SMSF auditors plays into the increasing oversight of SMSF funds, which traditionally have allured those with a more lassaiz-faire attitude.

With the popularity of SMSF funds not abating for the next little while, regulators will and are almost obliged to do everything in their power to make sure those with SMSF funds are afforded the same protections that those in a regular fund are.

The banning of auditors by ASIC is simply one part of this.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.