Investors are in the know… the TechKnow

Published 14-APR-2016 08:45 A.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

When investing in tech stocks it can be difficult to sort the wheat from the chaff. The next Facebook or Amazon (which are both currently down in trading), may not be so apparent anymore.

This may be due to the glut of tech companies putting on a publicly listed face and taking revenues from each other.

So how does an investor make an informed decision?

The idea is to go back to basics: analyse a company’s earnings, expected news, long term outlook etc...

The companies that presented at the recent TechKnow roadshow delivered that sort of insight recently to packed out conference rooms around the country.

In total, 17 companies laid out their financials, business models and goals to interested investors who can now go away and make up their own minds about whether to invest in drones, design or even shark mitigation.

On Monday, we reported Michael Eidne’s insights about the future of technology.

Today, we’ll look at the businesses and products.

9 Spokes

The conference was kicked off by Brendan Roberts of 9 Spokes International. 9 Spokes is an online tool that provides a real time view of a business’s financial and non-financial position, by integrating online software in one place.

This New Zealand company founded in 2012 has its sight set on the dramatic growth in cloud use by SMEs.

Roberts suggested that in 2016 small businesses will spend US$4.16 billion on cloud based apps. According to research he presented, 80% of US-based SMEs will have adapted to the cloud by 2020.

9 Spokes has already partnered with the likes of Xero, MYOB, Quickbooks and Dropbox among many others to make light work of software curation and it costs nothing for customers.

As far software as a service providers go, 9 Spokes has a pretty impressive business model.

You can read more about them here.

Covata

Next to the stage was Nikki Parker, VP Growth and Investor Relation at data security company Covata.

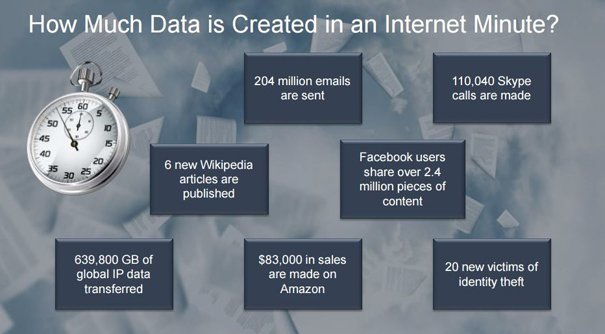

The following slide from Ms Parker’s presentation gives you an indication of just how important company security has become in light of the amount of data generated:

With the amount of data generated by companies, security should be front of mind.

Ms Parker said that more than 317 million new pieces of malware were created last year, meaning nearly one million new threats were released each day.

Bottom line: keep your data close and your security closer.

Decimal Software

When Fintech meets Robo advice. The jury is still out on financial advisory robots, but there is no doubt this is a growing industry. With the banks jumping on board, there is a shift occurring that must have financial advisors shaking in their boots.

Decimal Software’s Nic Pollock took us through the rise of robo finance and Decimal’s $10B+ total revenue opportunity for robo-advice by 2020.

Department 13 Inc.

The company sounds like a title from a New York police action movie... and in fact it’s not far off.

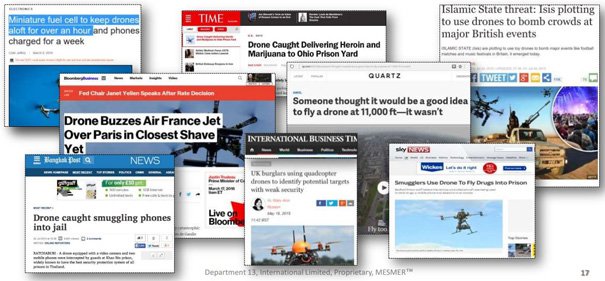

Department 13 is focused on counter-drone defence technology, focusing on the rapid rise of drone incursions.

With the proliferation of drones, strong security measures must now be taken against them.

The company listed on the ASX earlier this year and since then has positioned itself to secure key US government contracts.

In the following CNBC video, CEO Jonathan Hunter from Department 13 explains how the firm provides drone-detection services and the ability to override drone controls.

Dubber

You’ve probably heard of Dubber.

The company has built a platform that provides call recording, recording management, access and advanced functionality in the cloud. Recordings can be made, accessed and managed from anywhere in the world, instantly.

Last year, The Australian said call recording was a global gold mine and given Dubber’s rapid ascent, they could be right.

Kabuni

One company that Finfeed has been tracking is Kabuni, an etsy-like platform built for designers and based on inspiration boards.

Kabuni is a platform for the home design community that gives designers, artists and local artisans the tools to collaborate and buy and sell their goods.

CEO Neil Patel gave an impassioned speech about building better homes for everyone.

The video below explains how it works, perhaps better than we can...

What sets Kabuni apart is its omni channel platform that looks a little like this:

KBU’s omni channel platform

Kabuni’s goal is to unify a fragmented marketplace, bring it all onto the one platform and, in the process, create a profitable and lucrative business everyone.

It is well on its way to achieving this aim and we’ll keep you updated on the company’s progress.

Livehire

Here’s an interesting concept: a sourcing and recruitment cloud based solution that delivers talent on demand.

That is how Livehire labels itself.

The company is scaling up at the moment, having spent four years and $3 million getting its platform right to take a first mover advantage.

It has some pretty significant people behind it including Geoff Morgan, chairman Morgan & Banks and Talent 2 and ex Chandler Macleod CEO Ian Basser.

Medibio

By now we are all aware of the complexities and complications involving mental health, particularly depression.

According to Medibio CEO, Kris Knauer 350 million people suffer from depression and one million suffer so badly they leave this mortal coil.

WHO estimates the global cost of mental illness as $2.5 trillion in 2010 and rising to $6 trillion by 2030.

Something needs to be done to curb this problem.

Medibio has built a digital mental health platform for the assessment and management of mental health through a quantitative, objective test that it believes will create savings for the health system and better patient outcomes.

Norwood Systems

Norwood’s World Phone sounds pretty cool, especially if you are a constant traveller.

The platform allows you to get a nearby number (local regional) so that your contacts can call you without the pain of dialling your international number.

You can set up one or more numbers in any of 70 plus countries worldwide.

The uptake thus far has been impressive with more than $700,000 in-App purchases and more than 4 million downloads.

ResApp Health

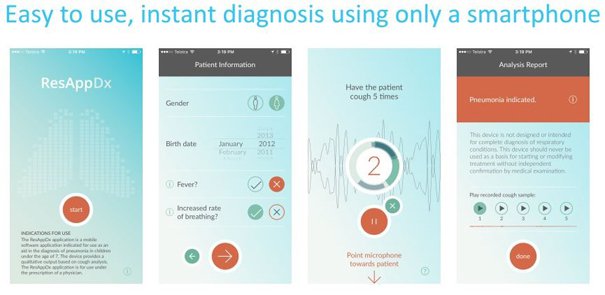

Imagine being able to monitor respiratory disease from your smart phone.

That’s how smart your phone has become and also how canny today’s medical fraternity is.

ResApp has developed the world’s first clinically-tested, regulatory-approved respiratory disease diagnostic test for smartphones.

Use your smartphone to diagnose your health.

The company is fully-funded to bring its product to market and has medical backing.

Schrole

Another nifty app.

Schrole Cover makes it easier to find relief teachers for schools.

CEO Rob Graham claims that by using the app schools can fill temp positions within three minutes.

The company is producing 10% growth per month and is ahead of revenue projections.

Shark Mitigation Systems

“Well this is not a boat accident! It wasn’t any propeller! It wasn’t any coral reef! And it wasn’t Jack the Ripper! It was a shark.”

That’s a classic line from Jaws and it should fill you with dread, like this...

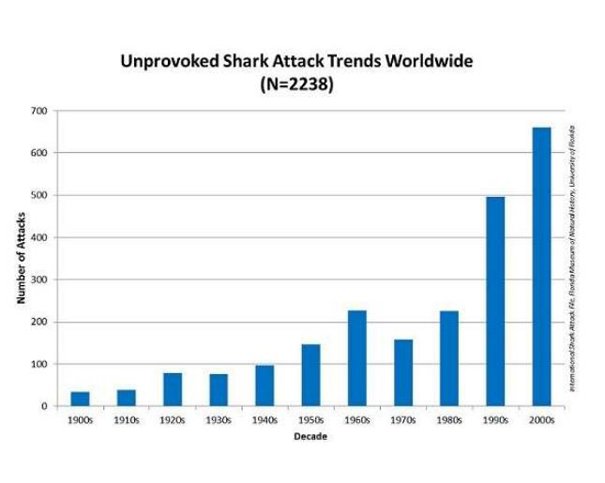

Now we’re not suggesting, there’s a monster shark out there looking to terrorise a town, however check out this table from Shark Mitigation Systems’ presentation.

Shark attacks are now more prevalent.

That’s a pretty significant increase in shark attacks, hence the raison d’etre for SMS, which has developed deterrent technology now embedded in a range of products including wetsuits. Its Clever Buoy technology also assist in keeping beaches safer.

The company has gained significant global attention and listed earlier this year.

Stargroup

Another we have our eye on.

Regular readers would have followed Stargroup’s progress over the course of the last six months.

It is run by Todd Zani who was previously the founder of Ezeatm in early 2000, which became the largest ASX listed ATM deployer with a market capitalization of $34.45 million.

The way Stargroup is growing quarter on quarter, he is expecting to repeat the feat.

Contrary to the rise of cashless payments, the ATM market is still growing with $140.8 billion in cash withdrawn from ATMs.

Meanwhile eftpos is also continuing to grow, particularly with the introduction Paywave, which also plays into Stargroup’s hands.

On the back of its growth, Stargroup’s Gross revenue FY 2015 was $1.5mil – an increase of 840%. Its estimated revenue for FY 2016 is $5mil, an increase of >200%.

That says it all really.

Syntronic wireless

This is a company with some clout behind it, including a former President of Sprint and a former VP and General Counsel at Facebook. Meanwhile its principal investors include a former COO at Facebook and former President at EMC, which was acquired by DELL.

It allows for brands to pay for consumer access to the mobile internet.

Put more simply, its Freeway platform enables application developers, content providers, mobile operators, and advertisers to pay for a subscriber’s mobile data usage, for instance Coca Cola could give subscribers free access to the ICC World Twenty 20 as part of a brand building exercise.

Syntronic has several catalysts to look out for in 2016, including its ASX listing and capital raise and the launch of Freeway 2.0, with expansion into Latin America.

Tech Mpire

The global internet advertising market grew to be worth US$11 billion per annum in 2013, so it’s a pretty good space to be in.

Mpire, through its cloud based software platform nxusTM acts as an intermediary between advertisers and clients and its network of affiliates that deploy digital advertising marketing to consumers.

Mpire has a solid growth track record with quarterly growth shown at 40% and half year revenue reported at $17.6 million.

Thred

Do you wish you could aggregate your social media platforms?

Well, that’s what Thred does.

The Thred application allows users to integrate multiple social networks, including Facebook, Twitter and LinkedIn.

The current social media landscape is large and Thred is currently the only system that combines the many platforms available and eliminates social media noise.

Aggregate your social media.

The Thred application recently grabbed public attention when Microsoft Corporation announced it is integrating Thred into Office 365 and its cloud based Azure platform.

It is now seeking $10 million for its ASX listing.

Topbetta

Topbetta gamifies betting on sports.

It’s a comprehensive wagering business which combines fantasy wagering with traditional wagering and betting supported by extensive content.

It’s the fantasy wagering that interests us most.

TopBetta offers fantasy wagering with revenue generated from entry fees that are charged when a customer enters a tournament.

TopBetta customers “buy-in” to the tournament, and each buy-in increases the prize pool.

Sounds dangerous, but fun.

The last word

The TechKnow conference, hosted by Vertical Events, is still in its infancy but growing rapidly.

Jaxon Crabb, Vertical Events Business Development Manager, said, “Series 2 of TechKnow Investment Roadshow has exceeded expectations with over 600 investors turning out in Brisbane, Sydney and Melbourne to hear from 17 companies with exciting investment opportunities.

“The challenge within the team of Vertical Events, DJ Carmichael, Fosters and PPR was to make Series 2 as good as Series 1.”

According to Vertical Events MD Stewart McDonald, they need not have worried.

“Fifteen new companies came on board quickly with two from series 1 being the first to sign up,” McDonald said.

“After presenting in Brisbane, one company MD breathlessly reported a purchase of 1-million shares by an investor,” said Crabb.

“The mood among the investment attendees was positive with many impressed by the advances in technology and the investment opportunities they now represent.”

Series 3 is slated for October.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.