Investing Part 2: For some companies uncertainty is nothing new

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Yesterday I highlighted a number of factors that could be seen as justification for investing in more speculative stocks in the current environment.

Though seemingly counter-intuitive given the broader flight from equities to safe havens such as government bonds, gold and cash, the key argument behind investing in speculative stocks at this stage of the cycle is very clear.

The big end of town has been sold down because broadly speaking company investment fundamentals have changed markedly with their financial capacity to meet earnings expectations and pay projected dividends unlikely to be fulfilled this year and possibly into 2021.

In fact, one of the key factors that has spooked the Australian market over the last few days has been the number of companies releasing announcements that they are no longer able to provide profit guidance and that previous forecasts would not be met.

To the contrary, speculative stocks are attributed a valuation based on their prospects of achieving success in a very uncertain environment.

Sectors such as mining, energy, tech, communications and biotechnology are crammed with stocks that are trying to discover the next gold mine, find the next oilfield, develop a game changing piece of software, launch a new app or find a cure for the coronavirus - wouldn’t that be great?

The best these companies can offer investors during exploration, research and development and the likes of clinical trials are opinions from geologists, tech gurus and scientists.

Hence, these companies are cloaked in uncertainty and the coronavirus has very little impact on most exploration activities and laboratory analysis.

The junior miner that strikes gold for the first time will see its share price surge regardless of what the broader market is doing.

Shareholders in the company that achieves a ground-breaking medical development after three years of trials will be equally rewarded.

Finfeed looks at one stock from each of the aforementioned sectors that appears to be unjustifiably sold down, as well as being in a position to realise that game-changing event investors have been waiting for.

Galileo (ASX:GAL)

Galileo’s view to the future

In the 1500’s, physicist and astronomer Galileo invented a telescope that provided a whole new insight into the solar system, strengthening his belief that Earth and all other planets revolved around the Sun.

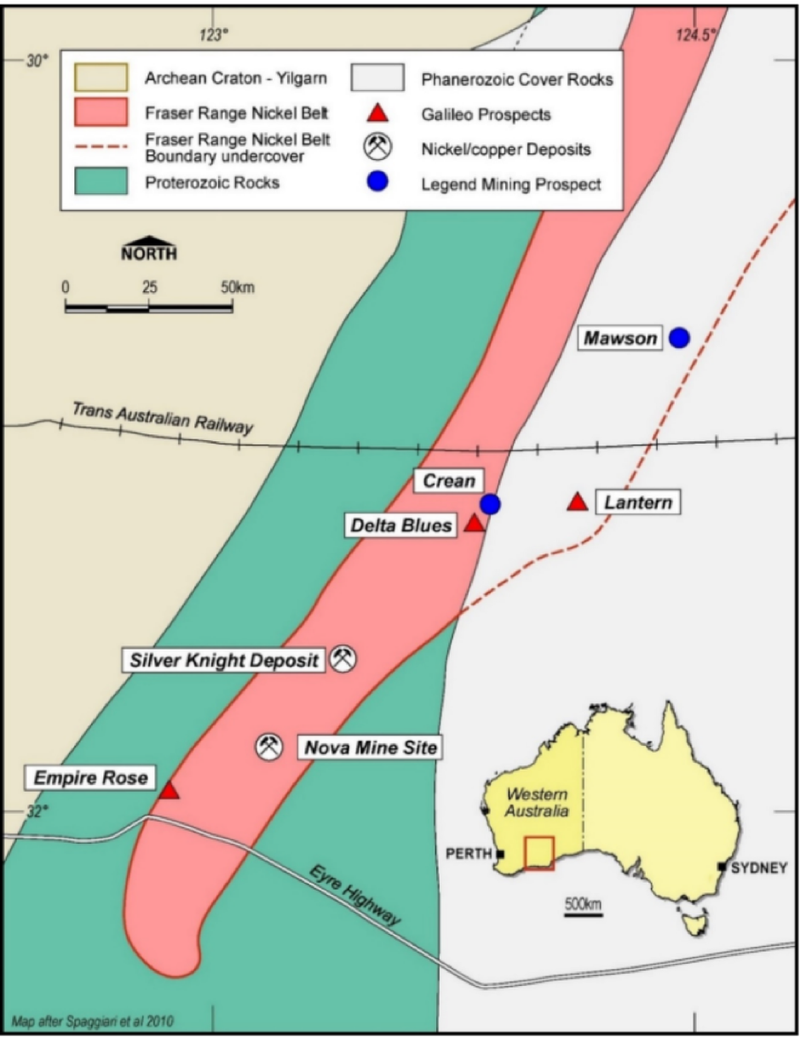

Founder and major shareholder of Galileo Mining Ltd, Mark Creasy has made his own share of significant discoveries in the mining industry. One of the most prominent was his involvement in being the Nova Bollinger nickel-copper-cobalt deposit in the Fraser Range, Western Australia.

And based on that achievement and his exploits since then it is fair to say that Creasy’s knowledge of the Fraser Range area compares very favourably with Galileo’s understanding of the solar system.

Just to indicate how lucrative it has been to transition from drilling holes to producing minerals, in its second year of production in fiscal 2019, Nova achieved total production of 30,708 tonnes of nickel, 13,693 tonnes of copper, and 1,090 tonnes of cobalt at a cash cost of $2.07/lb nickel.

Creasy also had a prominent hand in Legend Mining’s (ASX:LEG) Mawson nickel-copper-cobalt discovery which is also in the Fraser Range.

Note the location of the Nova mine site and the Mawson discovery in relation to Galileo’s Lantern prospect.

Legend owns 70% of the project with Creasy owning the remaining 30%, but Creasy also has a 26.8% stake in Legend Mining, providing him with plenty of leverage to what is shaping up as a highly profitable project.

The Mawson discovery was confirmed in December 2019, resulting in its shares increasing some 150%.

Creasy isn’t one to sit on his hands, and he founded Galileo not too long after Legend ascertained in early stage drilling that they may be on a winner.

Now Galileo is shaping up as a Legend in the making - click here to find out why.

And here to view a video of the site visit released on Thursday morning.

88 Energy (ASX:88E)

88 Energy at 3500 feet

88 Energy Limited (ASX:88E, AIM 88E) has worked long and hard on the North Slope of Alaska to uncover a company making oil discovery.

It has some heavy hitters backing it with this current hole Charlie-1, and success wouldn’t surprise.

Last week management confirmed that the Charlie-1 appraisal well had reached a depth of 3500 feet where the casing will now be run in the 12.25” hole prior to commencing drilling the 8.5” production hole.

Once again, this is a company that investors have flocked to, well aware of the uncertainties, but buoyed by a number of factors indicating that the risk/reward scenario could make for a lucrative investment.

So strong has been the support that the company’s shares more than doubled between October and January.

While they have retraced by about 40% in February/March, to put this into context, they have outperformed the majors.

Shares in Woodside Petroleum (ASX:WPL) have halved, while Oil Search (ASX:OSH) has plunged from $6.70 to about $2.50 in the same period, representing a decline of more than 60%.

Santos (ASX:STO) has also fallen more than 60% from $8.25 to close at $3.13 yesterday, a level it has traded at only once in the last 20 years.

Click here to find out more on the 88E story.

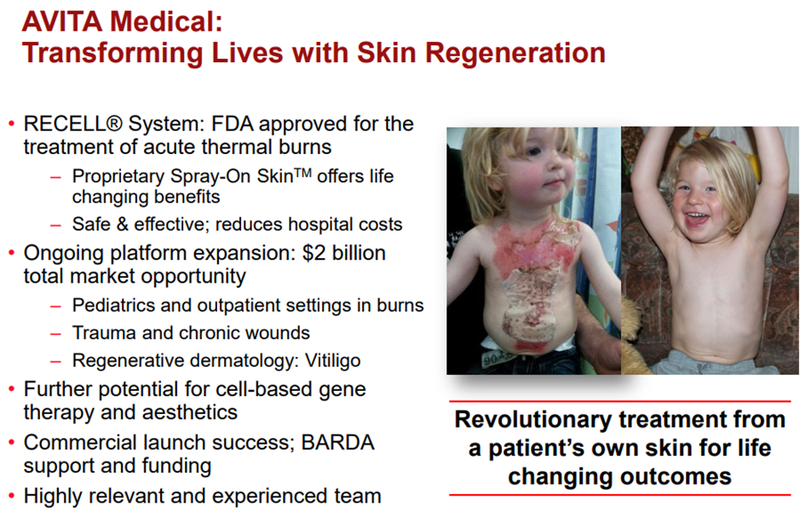

Avita Medical Ltd (ASX:AVH)

2019 ten bagger can be bought at bargain basement price

Avita Medical was one of the best performing biotechs in 2019 with its shares increasing nearly ten-fold from 7.9 cents to a high of 74 cents.

The company is just as good as, if not a better investment today, but the company’s shares have been sold down from 86.5 cents to 34 cents in the space of a month.

As a backdrop, Avita and its subsidiaries are a regenerative medicine group with a technology platform designed to address unmet medical needs in patients with burns, chronic wounds, and aesthetics indications.

The company’s patented and proprietary collection and application technology provides innovative treatment solutions derived from the regenerative properties of a patient’s own skin.

Avita’s medical devices work by preparing a Regenerative Epidermal Suspension (RESTM), an autologous suspension comprised of the patient’s own skin cells that are necessary to regenerate natural healthy epidermis.

This autologous suspension is then sprayed onto the areas of the patient requiring treatment.

Unlike many biotechs, Avita has been generating sales, and Bell Potter expects revenues to increase from $7.7 million to $22.6 million in fiscal 2020.

The company made a good start to fiscal 2020 with sales revenue increasing from $6.9 million for the six months to December 31, 2018 to $13.5 million in the first half of fiscal 2020, indicating that it is more than halfway towards meeting Bell Potter’s full-year forecasts.

Further, the broker expects revenues to more than double over the following two years to $47.9 million.

Bell Potter ran the ruler across Avita at the start of March, increasing its recommendation from hold to buy and placing a price target of 83 cents on the stock.

The broker noted that the first patient had been enrolled in the soft tissue injury clinical trial, as well as paediatric scalds.

The company meets our criteria in terms of being a beneficiary of ongoing trial data, but it also provides the added attraction of generating sales revenue.

RXP Services (ASX: RXP)

RXP Services ready to benefit from new business model

While my stock selection in the IT sector only has a market capitalisation of about $40 million, the company has a rich history, and in recent years management has tweaked its service offering to better align with the businesses it supports.

I believe RXP Services is poised for a turnaround in fiscal 2021 with signs of improvement already evident at the half-year mark.

RXP’s operations revolve around assisting businesses in executing on digital transformation services, and this specific area accounts for about 80% of revenues.

In fiscal 2019 the company achieved robust growth across its human centred design, analytics and digital platforms work.

This was a good sign in that digital projects are typically larger in size, command higher margins than traditional consulting and are increasingly spanning the full breadth of the group’s capabilities.

With the accelerating rate of change and technology disruption putting pressure on businesses, RXP is well positioned to help its clients navigate this change through innovative solutions that accelerate digital transformation and enhance customer experiences.

Indeed, the ramifications of the coronavirus in underlining the benefits of being able to adapt to working remotely could well drive an increase in digital transformation activity, allowing staff to access most areas of the businesses infrastructure and activities by simply using devices such as phones and laptops in remote locations.

RXP has a broad range of government and private enterprise clients that span a multitude of industries and geographic locations as indicated below.

This should work in the company’s favour post coronavirus as some sectors will take longer to recover than others.

RXP generated underlying EBITDA of $6.7 million with strong cash conversion of 127% in the first half of fiscal 2020.

Step back to the start of February and RXP was trading in line with the current consensus valuation of 47 cents.

However, its shares have halved since then, closing at 24 cents on Wednesday.

The first half performance enabled the company to pay a dividend, and with $25 million in contracts won between December and January, management expects underlying earnings in the second half to eclipse that achieved in the first half.

RXP entered the second half of fiscal 2020 with a solid balance sheet, providing it with scope for continued expansion.

The company had $8.1 million in cash and net debt of $13.9 million, which is expected to reduce to $10.5 million by year-end.

Even if RXP doesn’t outperform in the second half, but generates earnings in line with the first half, this will still imply a PE multiple of less than 10.

If the company matches its first half dividend payment this will bring the full year dividend to 2 cents, implying a yield of more than 8% based on yesterday’s closing price.

Vonex (ASX:VN8)

Vonex launch of much anticipated Oper8tor App

The communications sector has been one of the more resilient market segments over the last month with the S&P/ASX 200 Communications Index (ASX: XTJ) having fallen about 20% compared with a 30% fall in the ASX 200.

Vonex (ASX:VN8) is a good way to play the sector as it has a broad range of product offerings that similar to RXP target a diversified client base that doesn’t leave the company overexposed to anyone industry.

In a time of uncertainty, identifying stocks that generate recurring revenues is a good strategy.

As well as achieving strong revenue growth in the first half of fiscal 2020, it is important to note that Vonex is accelerating its recurring revenue streams as the company develops, delivers and licenses its own advanced communications technology, a factor that provides investors with earnings predictability.

The following chart highlights the significant increase in annual recurring revenues during the 12 months to 30 September, 2019.

Vonex has recently acquired the 2SG wholesale business which provides Australian Managed Service Providers, ISPs and System Integrators with access to the latest in hardware and connectivity solutions from leading brands.

This provides direct and established relationships with Optus and NBN, while boosting Vonex’s wholesale business from 20 to more than 160 the wholesale partners

These carrier relationships are valuable in facilitating better support, rates, control of customer internet and cost of supply.

Importantly, the 2SG acquisition will provide a substantial boost to annualised recurring revenues which are expected to increase to more than $14 million on completion.

It is also expected to contribute $750,000 in fiscal 2021, its first full year under the Vonex banner.

Vonex has demonstrated strong innovative skills in the past, and the imminent launch of its Oper8tor App could pave the way for a significant uptick in revenues and earnings.

Third party testing has been completed and the group is ready to launch the disruptive aggregated communications platform, targeting the inclusion of Conference, Voice, Message and Video functionality, facilitating user communication across different channels.

Testing included cross-platform message and call blast functionality, which ultimately verified Oper8tor’s cross-platform message functionality across several social media platforms as well as SMS and its ability to call blast landline and mobile numbers.

“The development of Oper8tor to date has been a credit to our team in getting it from concept stage through many phases of development and testing to a functional app, said Vonex Chief Technology Officer, Angus Parker.

“We are now moving forward involving larger scale controlled users to give us the feedback we need to improve functionality of the App, including user experience.”

In further good news for the company, Vonex also announced that its innovation track record was recognised through enhanced intellectual property protection.

Vonex was recently granted a patent from the US Patents Office for the unique Oper8tor platform, which will allow the company to progress Oper8tor’s development with less risk to commercialisation.

In terms of commercialisation, Vonex engaged London-based investment advisory firm Ragnar Capital Partners LLP to target potential partners who could help take Oper8tor through its rollout and commercialisation phases.

“Now we are looking for a partner that could bring complementary expertise and support to further enhance the application’s design and functionality as we roll it out and commercialise,” managing director Matt Fahey said.

“Ragnar has reach into Europe and the Asia-Pacific regions which is a good fit as we target the right partner to help drive Oper8tor into the market,” Fahey concluded.

The same benefits that Oper8tor promised to afford Vonex shareholders are just as relevant as they were prior to the advent of COVID-19.

The company’s robust financial performance and the potential upside offered by Oper8tor have been instrumental in the company trading as high as 14.5 cents in the last four months.

With these factors still in place, the recent sell-off that has seen the company’s shares halve appears to be unjustified, particularly given the Communications Sector is only off 20%.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.