Is this the interest rate decision we had to have? Part 1

Published 08-MAY-2019 15:58 P.M.

|

10 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Despite a widening gap between the RBA’s inflation target and the Consumer Price Index (CPI), the board of the Reserve Bank of Australia (RBA) has decided to keep the cash rate target at 1.50%, a decision that was contrary to the expectations of many analysts.

The key reason was the ongoing strength in the labour market, with a significant increase in employment. The board is also cognisant of skill shortages in some areas.

Citi analyst, Josh Williamson said, “The unchanged cash rate decision went against our forecast for a 25 basis point reduction.”

Most market economists were in accord with Citi’s expectations.

The unchanged cash rate was despite the RBA signalling that it will lower its underlying CPI forecasts by 25 basis points (bp) to 1.75% this year and also by 25bps to 2.00% in 2020.

Williamson says, “Stated differently, the RBA will tolerate more downside miss on the bottom of the inflation target for longer.”

We will discuss the ramifications for equities markets at a later point, and highlight some sectors and stocks that may be worth consideration in an economic environment characterised by low growth and low interest rates, as well as equally subdued consumer and business confidence.

RBA takes glass half full approach

The RBA noted that the outlook for the global economy remained reasonable, although it conceded that the risks were tilted to the downside.

While acknowledging that growth in international trade had declined and investment intentions have softened in a number of countries, it was buoyed by the stance taken by Chinese authorities who have instigated support mechanisms for the economy, while addressing risks in the financial system.

Summarising its take on the broader global environment, the RBA said that in most advanced economies inflation remains subdued, unemployment rates are low and wages growth has picked up.

However, the latter can’t be said for Australia where poor wages growth is impacting consumer and business spending, as well as placing added pressure on a housing market that is under duress.

On the score of lending rates, the RBA said that some had declined recently, although the average mortgage rate paid is unchanged.

Citi analyst Tony Brennan seemed more realistic on the issue of borrowing rates, noting the multi-faceted dynamics that will continue to impact conditions in saying, “After a difficult 2018 with the Royal Commission (RC), 2019 hasn’t seen much abating of issues facing the banks.

“From the slowing in housing and retail banking earnings, to costs associated with responding to the RC’s findings, to unexpected developments like the extra capital sought in New Zealand, the prospects for the banks have remained clouded and complicated.

“One significant consequence is the persistence of low bank valuations, on most measures nearing the lowest in a few decades in relative terms.

“The valuations highlight the concerns, which seem to relate mostly to the risk of a substantial credit cycle, something Australia hasn’t really experienced since the early 1990s.”

And what happened in the 1990s

Of course the 1990s was marked by Paul Keating’s famous words, “This is the recession we had to have.”

Leading up to this event, Labor via the Hawke-Keating government and their stronghold on most state administrations were too reluctant to temper the industrial might and inflationary wage claims of the union movement.

Consequently, it applied cripplingly high interest rates to constrain high inflation and while the RBA cash rate was still very high at around 13%, it was down from a peak of 17.5% earlier that year, a stark contrast to today’s cash rate.

The lesson that was learnt during this period, but may have been forgotten as the federal election approaches, is that improvements in wages and conditions need to be closely linked to improved productivity, which in a healthy economy will see the cash rate generally in sync with other dynamics.

Consequently, at a time when bricks and mortar retailers, including the hospitality sector are struggling to break even let alone grow earnings, a return to onerous penalty rates appears difficult to justify.

Similarly, when the ageing population is experiencing constrained income as a result of record low fixed deposit rates, erratic superannuation returns and rampaging health insurance costs, introducing policies that would negatively impact benefits from property investment and income from franked dividends seems counter-productive.

Using interest rates to increase or decrease inflation was the flawed strategy that led to the recession we had to have, suggesting the RBA needs to look at the big picture, particularly in terms of fostering productivity, improving borrowing conditions and stimulating consumer and business confidence.

It’s all about productivity

In terms of productivity, the RBA indicated that the central scenario is for the Australian economy to grow by around 2.75% in 2019 and 2020.

This outlook is supported by increased investment in infrastructure and a pick-up in activity in the resources sector, partly in response to an increase in the prices of Australia's exports.

However, Williamson isn’t in agreeance, citing retail sales data that was also released yesterday.

We will sift through the retail sales figures later, but Williamson said, “We’d highlight that today’s weak real retail trade result points to downside risk to household consumption and Q1 GDP.

He believes that there is a real risk that the RBA will not have its household consumption and GDP forecast for June 2019 achieved.”

These dynamics are tied into the profitability of businesses, as well as business confidence and spending, which in turn impacts productivity.

Businesses need to feel confident in borrowing to fund future growth and they need a lending environment that is accommodating in terms of having accessibility to funds at reasonable rates, and without some of the constraints that have emerged as a result of the Royal Commission.

The Royal Commission we didn’t need

With regard to borrowing conditions, it appears that the negative impacts of the Royal Commission haven’t been recognised by the RBA.

Assessing lending applications used to be fairly easy – does the borrower have the capacity to repay the loan based on disposable income, and if repayments aren’t made, will the sale of the asset being borrowed against retrieve the amount being lent?

However, in the current environment banks need to lend on a ridiculously high serviceability basis in relation to allowing for interest rate rises, and the impost of state taxes is much more onerous.

Furthermore, we are in a Catch-22 situation with the Royal Commission having contributed to falling house prices, leading to banks now being in a position where depressed property valuations are limiting their capacity to lend.

In highlighting the severity of the situation, Geordan Murray, HIA Senior Economist did a good job in fleshing out the salient points we refer to in the following response to the ‘on hold’ decision.

“The contraction in the housing market over the past six months has occurred faster and is larger in scale than the contraction experienced after the GFC.”

“This decline in industry activity has occurred in an environment when lending rates have remained relatively stable.

“Had the RBA lowered rates today it may have eased some of the pressures in the housing market, but the acceleration in the downturn in building activity during 2018 was largely due to regulatory imposts from state and federal governments.

“Governments should be looking at measures to make home ownership more accessible to households, both as owner-occupiers and investors.

“Removing the counter cyclical measures introduced at the peak of the housing cycle would be a good place to start.

“This includes reviewing the appropriateness of assessing loan serviceability against an interest rate of 7%, almost double the current market rate. Reversal of the punitive rates of stamp duty on foreign investors is also overdue.

“These measures would assist in restoring the confidence in the housing market that was lost in 2018.

“The industry continues to complete work on existing projects but there are now fewer new projects getting underway.

“Approvals for the construction of new homes for the first three months of 2019 equates to an annualised level of home building of around 180,000 starts. This compares to 220,000 starts in 2018.

“Unless there is an improvement in housing activity, employment conditions in the building sector will continue to ease during 2019.

“Any measures that increase the tax burden on homes, such as an increase in Capital Gains Tax, would cause a further contraction in the market and exacerbate employment losses,” concluded Mr Murray.”

First home buyers feel the brunt of regulatory changes

The following excerpt from the RBA’s statement released yesterday touches on all the key points one would expect in an environment of constrained and selective lending and depressed consumer confidence.

The adjustment in established housing markets is continuing, after the earlier large run-up in prices in some cities. Conditions remain soft and rent inflation remains low. Credit conditions for some borrowers have tightened over the past year or so. At the same time, the demand for credit by investors in the housing market has slowed noticeably as the dynamics of the housing market have changed. Growth in credit extended to owner-occupiers has eased over the past year. Mortgage rates remain low and there is strong competition for borrowers of high credit quality.

Of particular note is the ‘strong competition for borrowers of high credit quality’, indicating that there is a shrinking pool of prospective borrowers that will be able to successfully secure financing, with first home buyers particularly disadvantaged.

In closing, the RBA judged that it was appropriate to keep the cash rate on hold in the belief that there was still spare capacity in the economy and that a further improvement in the labour market was likely to be needed for inflation to be consistent with the target.

Given this assessment, the RBA said that it will be paying close attention to developments in the labour market at its upcoming meetings.

Retail sales mixed with housing to impact negatively

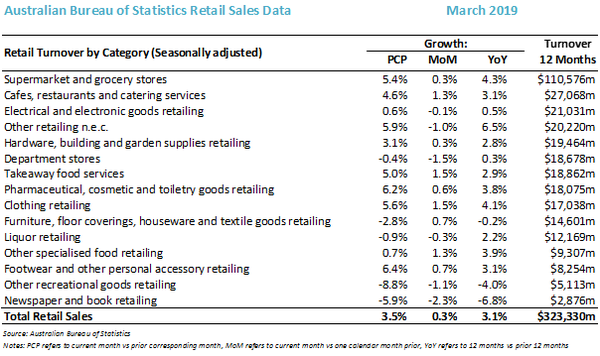

The Australian Bureau of Statistics (ABS) Retail Sales data for the month of March 2019 was again mixed, but reasonably strong versus the prior corresponding period (March 2018).

Compared with previous corresponding period (PCP), total seasonally adjusted retail sales were up 3.5% for the month of March 2019 and up 3.1% for the year to March 2019.

The original unadjusted data series for March 2019 indicated retail sales were up 1.7% compared with the previous corresponding period with the timing of the Easter holidays in March 2019 versus April 2018 having impacted positively, with a contra impact being expected in April.

Footwear, Pharmacy, Clothing, and Other Retailing (stationery, antiques, flowers, other) had a strong month versus PCP. Food retailing also continued to be strong. Other Recreational Goods, Newspapers & Books, Furniture, and Department Store sales all declined versus PCP.

At the state level, Queensland and Victoria were the top performers, each comfortably beating the national average. Northern Territory sales once again declined versus PCP.

Reflecting on the March data and casting an eye towards April, Blue Ocean Equities analyst Phillip Pepe said, “We expect more mixed results for the April 2019 Retail Sales data, especially given the timing of Easter this year.

“The recent slowdown in the Australian housing market will likely continue to impact negatively on the housing-related categories.”

In part 2 of this article we will look at six potentially bulletproof stocks to consider in the current economic climate.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.