Innovation and competition in Li-ion battery manufacturing intensifies

Published 20-AUG-2020 14:25 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

A new report, "Li-ion Battery Patent Landscape 2020", released by IDTechEx, provides insight into lithium-ion (Li-ion) innovation and trends.

The report highlights the Growth in the Li-ion market and the significant investments being made into building out capacity for manufacturing Li-ion batteries and their components.

This growth comes on the back of demand for Li-ion batteries.

However, alongside this growth is the fact that current Li-ion batteries are beginning to reach their performance limits, which means any improvements to battery technology could prove lucrative.

It is why we are seeing, competition between battery manufacturers intensify, emphasising the importance of battery R&D and protecting innovation.

Delving into the trends being seen in patent applications and filings can be used as a tool to provide insights into the key areas of innovation in Li-ion batteries, areas of development favoured by key players, and where R&D innovation is taking place.

The recent report from IDTechEx, "Li-ion Battery Patent Landscape 2020", reviews key Li-ion patent topics and trends.

IDTechEx’s search finds that since 2010, the total number of Li-ion patent applications that have been filed has grown by approximately 300%, mirroring the growth in the Li-ion market.

This growth in patent applications has occurred across various technology groups, including NMC/NCA and Li-Mn-rich cathodes, silicon anodes, electrolytes and electrolyte additives, separators and nano-carbon use.

Significant growth in the number of applications per year was seen particularly between 2010-2015 and while all areas covered have seen growth since 2010, the number of patents regarding the use of nano-carbons in Li-ion have seen the most substantial growth over the past 10 years, in line with the growing hype, and recent utilisation, of graphene and carbon nanotubes in Li-ion batteries.

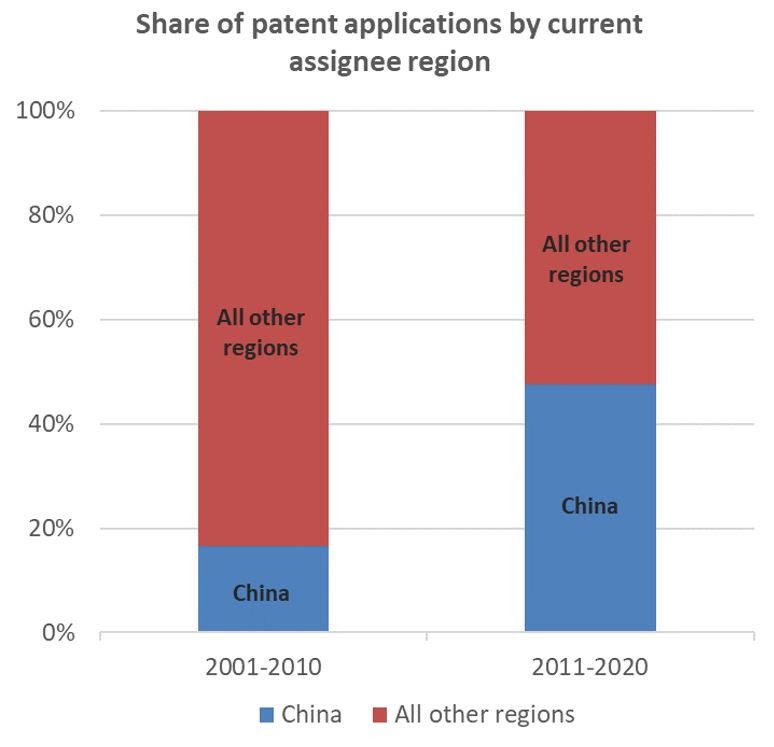

Geographically, Chinese assignees have been particularly active and have been responsible for much of the growth in total Li-ion patent applications over the past 5-10 years. Since 2011, Chinese assignees have responsible for approximately 47% of all patent applications, compared to just 17% during the period 2001-2010.

The above graph illustrates the growing importance of Chinese players in Li-ion development and suggests that beyond their dominance in processing and manufacturing, China may move into a dominant IP position too, especially if assignees start to file outside of China, which tends not to be the case currently.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.