From ‘happy snaps’ to a share price slide: Snap Inc

Published 26-JUL-2017 15:38 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

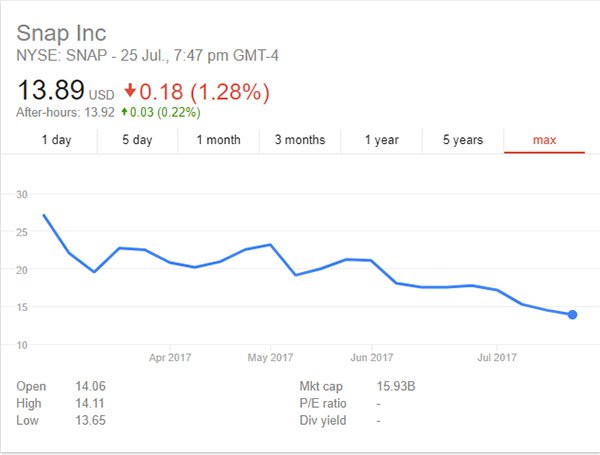

Banking giant Morgan Stanley has admitted it was ‘wrong’ about SNAP Inc., which fell below its initial $17 initial offering price (IPO) for the first time earlier this month.

The company’s flagship app, Snapchat, took the world by storm in late 2011.

The image messaging and multimedia mobile application raised over $1.8 billion in equity from investors in May 2016, and one year later it had amassed over 160 million active users the world over.

Snap’s IPO had the company valued at between $20 and $25 billion, making it the largest IPO on the US exchange since e-commerce giant Alibaba ($168b) in 2014.

Unfortunately, things haven’t exactly gone well for the makers of the popular app since.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Snap shot up 44% on its first day, peaking at $29.44 on March 3, clearly charming the investor world like it had its smartphone customer base.

Of course share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

It’s been a depressing slide since those highs, with the company reporting a $2.2 billion quarterly loss in May 2017.

The ‘bend and snap’ of Snap Inc

Investors may have seen Snap Inc as a safe bet considering the app’s widespread popularity. After all, the four largest companies in the world are tech companies, meaning investors are familiar with the whirlwind scalability of a young tech play with a winning formula. So where did Snap go wrong?

There could be an argument to be made that Snap let their app’s success go to their heads, and got a bit complacent. Brian Nowak, an analyst at Morgan Stanley, recently chimed in on the topic: “We have been wrong about Snap’s ability to innovate and improve its ad product this year (improving scalability, targeting, measurability, etc.) and user monetization.”

Morgan Stanley expects Snap to fall well short of its projected revenue for 2017, and has forecast a significant slowdown in new users moving forward.

Nowak’s statement carries particular weight considering that Morgan Stanley was the lead underwriter for Snap’s IPO. It believed Snap would fare better against major competitors – but there’s already signs that its popular app will go the way of its share price.

Instagram (owned by Facebook) is in direct competition with Snapchat and has some 250 million daily active users.

Nowak believes Instagram is winning the battle. “Snap’s ad product is not evolving nor improving as quickly as we expected and Instagram competition is increasing. We believe Instagram has become more aggressive in competing for Snap’s ad revenue,” he said.

Tom Buontempo, president of Attention Global, believes Instagram is striking at the opportune moment. He pointed to the platform’s recent introduction of free campaign trials as a sign it’s looking to snap up Snapchat’s user base.

Despite recent inroads from Facebook, Snap has begun to ramp up its efforts to win advertisers back, and is exploring a native approach for users. Native ads are designed to blend into other videos on the platform, aiming to preserve user experience. But is the idea likely to work?

According to David Cohen, Snap’s platform is not optimal for video advertising. Cohen, who is the North America president of ad agency Magna Global, suggested that Snapchat could not compete with more traditional ad platforms like Youtube. “You are a thumb click away from something else. The idea of ad skipping is a reality,” he said.

Despite Snap’s recent and highly publicised troubles, some are remaining optimistic.

Brian White, a leading analyst with Drexel Hamilton, believes Snap could soon reach $30 a share. White, who recently spoke on ‘Squawk Box’, noted that Facebook was down 60% after it went public. He believes Snap could find a foothold in the mobile ad market and was bottoming out at present, stating: “I think it’s a great buying opportunity. If you look at a lot of high growth companies, in the first three years after an IPO, they trade at nine to 22 times enterprise value to revenue.”

There’s no doubt that Snapchat is one of the most popular apps in the world, but it’s survival seems dependent on its ability to incorporate effective advertising. Whether it can find a solution before its users are snapped up by competition remains to be seen – but its investors will very much be hoping it can.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.