Gold hits seven-year high

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Gold hits a near seven-year high of about US$1590 per ounce overnight as the precious metal reasserted its position as the go-to safe haven commodity when there is a flight from assets such as equities that are considered more risky.

Last night’s increase also represented the ninth consecutive increase which has spanned late 2019 and 2020, a period in which the precious metal has increased by about 7% from approximately US$1480.

Foreign exchange rates are also working in favour of Australian gold producers with the Australian dollar fetching around US$0.69, translating into an Australian dollar gold price of approximately $2300 per ounce.

Average costs of production are in the vicinity of $1300 per ounce, implying a healthy margin of about $1000 per ounce.

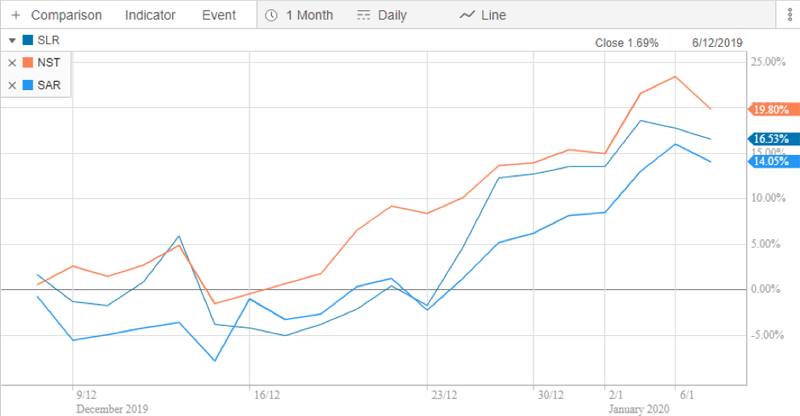

Investors have picked up on this trend with substantial increases in the share prices of prominent Australian producers occurring since late December.

These included Northern Star (+27%), Saracen Mineral Holdings (+20%) and Silver Lake Resources (+20%).

The following chart demonstrates their performance over the last month.

.... But there’s a bear in there

Central to the surge in the gold price has been geopolitical instability triggered by the killing of General Qassem Soleimani, one of Iran’s top military commanders.

This was linked to a US air strike near Baghdad’s airport.

The US has triggered significant tension across the globe in the last 12 months, mainly due to trade sanctions and warnings to various countries including North Korea regarding potential military intervention.

With the landscape unlikely to change in the near term, one could mount a case for further upside in the gold price.

However, Brien Lundin, editor of Gold Newsletter, was reported by MarketWatch.com as saying that geopolitical events aren’t a good reason to buy gold.

The following is an excerpt from the MarketWatch report

“The price almost always spikes before most investors can buy it and drops well before they can sell it,” Lundin told MarketWatch.

“So outside of high-frequency traders or insiders, everyone else ends up holding the bag.”

He also said these events “aren’t a logical reason to own gold since only those people in a specific troubled region might find the events a reason to actually own the precious metal.”

The gold market was “just beginning to get wider acceptance of the fundamental monetary issues that are driving the price of gold higher,” said Lundin.

“Now the market may confuse the driver as being geopolitical in nature, and the inevitable correction once things calm down may damage the outlook for gold.”

Maria Smirnova, senior portfolio manager at Sprott Asset Management, also weighed in on the argument with MarketWatch quoting her as saying, “The three main contributors to gold’s longer-term strength have been declining interest rates, slowing economic growth...and political instability,” particularly from concerns surrounding the trade wars and Iran.”

And the “thesis for gold rests on the global macroeconomic picture and the expansionary monetary policies of central banks around the world,” she said.

The consensus appeared to be that such macro conditions are unlikely to change significantly, pointing to relative stability in the gold price in 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.