Gold glitters in perfect storm Part 2: Bloomberg’s McGlone says gold breakout is imminent

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While some equilibrium was restored to US markets overnight, as we discussed in part 1 extreme geopolitical volatility places gold squarely in the frame as a compelling investment option.

Investors need to ask the question whether the circa 300 point rally in the Dow over the last two days after a fall of more than 600 points on Monday was a show of confidence or a dead cat bounce.

As last night’s session unfolded, gold continued to trade around the US$1300 per ounce mark, suggesting there was still an undercurrent of support for safe haven investing.

However, as we outlined on Wednesday there are other dynamics at play aside from mere safe haven trading with accelerated buying activity in the commodity, particularly from China and Russia.

This indicates that a prospective surge in the gold price won’t necessarily be a function of panic driven safe haven buying, but a clinical rerating based on sound supply/demand fundamentals.

Bloomberg Intelligence senior commodity strategist, Mike McGlone is supportive of this theme, saying in an interview with Kitco that “fundamentals point to brighter days ahead for gold prices and a breakout is imminent.”

From a more technical perspective, McGlone said, “The key factor to watch for is the (US) dollar.

“The key thing I’m watching for is the trade-weighted broad dollar’s peak near its 16-year high, and last year we had the VIX volatility index on an annualized basis bottom,”

“That process should continue and that puts gold in a pretty strong trajectory higher.”

On the currency front, the Australian dollar lost further ground against the US dollar overnight, music to the ears of Australian gold miners who are now benefiting from an Australian dollar gold price of more than $1870 per ounce.

As we mentioned yesterday, some of the big players experienced strong share price momentum yesterday, in many cases building on considerable gains that have occurred over the last 12 months.

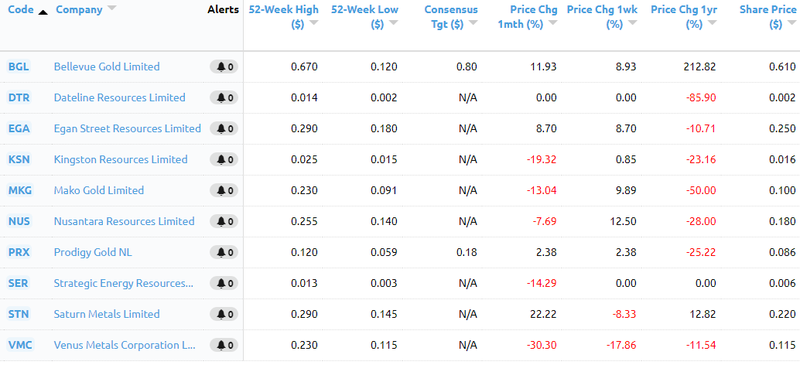

Finfeed has identified ten ‘under the radar’ gold stocks as listed below that may offer better value than the top end of town.

For readability, we've chopped this feature into two parts.

Bellevue Gold

Bellevue Gold Ltd (ASX:BGL) is advancing the historic Bellevue Gold Mine in Western Australia which was in its day one of Australia’s highest-grade gold mines, producing 800,000 ounces at 15 grams per tonne (g/t) gold.

The Bellevue Project is located in the northern part of the Norseman-Wiluna Greenstone belt in the Yilgarn Craton, host to many large discoveries and relatively close to Goldfields Ltd’s dual operations which have produced 6.5 million ounces of gold.

We mentioned the benefits of identifying emerging stocks, and Bellevue Gold is a good example of superior gains that can be achieved by employing this strategy.

As indicated in the table above, the company’s share price has increased more than 200% in the last 12 months.

Bellevue was one of three stocks that FinFeed featured in January as having the potential to deliver significant share price gains in 2019 as they moved closer to transitioning from exploration to production.

At that stage the company’s shares were trading at 42 cents, but in a matter of months they spiked more than 50% hitting a high of 67 cents.

Since January, they have traded in a tight range between 50 cents and 60 cents, and with further news flow imminent there are upcoming catalysts that could see it hit new highs.

The company started 2019 on a high note, increasing the inferred resource to 1.5 million ounces at a very high grade of 11.8 g/t gold.

Following the resource upgrade, drilling at the Viago and Tribune lodes has yielded further high grade results including 6 metres at 24.9 g/t gold and 6.2 metres at 22.2 g/t gold.

Bellevue is the first company to apply modern techniques and since exploration commenced in late 2017 the company has discovered new high grade lodes and extended known mineralisation, making it a ‘watch this space’ stock.

Dateline Resources

Dateline Resources Ltd (ASX:DTR) is well-positioned to achieve its goal of establishing a maiden JORC Resource at its Gold Links Project in Colorado in 2019 after raising $14.5 million.

When management reaffirmed this outlook in delivering its quarterly activities report on April 30 the company’s shares spiked 50%, and as exploration news comes to hand in the ensuing months further share price momentum is on the cards.

The funds will be used to examine an exploration target ranging in size between 520,000 tonnes and 650,000 tonnes.

The deposit contains particularly high grades, potentially ranging between 13 g/t gold and 17 g/t gold, equating to a prospective resource of between 250,000 ounces and 300,000 ounces.

The proposed project has been the subject of previous mining and exploration which has established that Gold Links hosts extensive, shallow high grade mineralisation.

Similar to Bellevue Gold, while the presence of high grade mineralisation has already been confirmed, Dateline’s exploration program will be the first time that the targeted area has been exposed to a widespread systematic exploration campaign using modern techniques.

Executive director Mr. Stephen Baghdadi said, “With the project now consolidated under a single ownership, with all the tenements on freehold land and a fully-funded exploration program set to go, we are on track to meet our goal of establishing a maiden JORC Resource in the December quarter of this year.”

Dateline will be undertaking a relatively simple cost-effective strategy by exploring for more gold directly below and in between areas where gold has previously been found.

While step-out drilling could identify mineralisation outside the core orebody, management’s decision to initially adopt a relatively low-cost measured strategy appears to be an astute approach at a transitional stage in the company’s progress.

EganStreet Resources

EganStreet Resources Ltd (ASX:EGA) is an emerging Western Australian gold company which is focused on the exploration and development of the 100%-owned Rothsay Gold Project, 300 kilometres north-east of Perth in Western Australia’s mid-west region.

EganStreet’s longer-term growth aspirations are based on a strategy of utilising the cash-flow generated by an initial mining operation at Rothsay to target extensions of the main deposit, facilitating exploration of the surrounding tenements, which includes an 18 kilometre strike length of highly prospective and virtually unexplored stratigraphy.

The Rothsay Gold Project currently hosts high-grade Mineral Resources of 454,000 ounces at an average grade of 9.2 g/t gold.

A key highlight during the March quarter was the release of an updated definitive feasibility study (DFS), providing a production target upgrade to 2.3 million tonnes mined at 4.4 g/t gold for 329,000 ounces of gold.

EganStreet has also had recent success with the drill bit, with particularly encouraging results from its Orient Shear reverse circulation (RC) programme which was completed during the December 2018 quarter.

Results indicate that the mineralisation on the Orient Shear is more extensive than previously thought with grades of up to 34.6 g/t gold intersected along 800 metres of strike on the Orient Shear, less than 200 metres west of the main Woodley’s Resource.

Management continued to progress approvals, permitting and project financing discussions for Rothsay during the quarter, putting the company in a strong position to make a Final Investment Decision (FID) and commence construction of a standalone mining and processing operation.

As these milestones are met there is the potential for a significant share price rerating.

The company's shares recently surged 10% in response to positive industry sentiment, and they are currently trading not far shy of the 12 month high of 28.5 cents.

Kingston Resources

As we trawled through the extensive range of emerging gold projects in Australia, we came across Kingston Resources Ltd (ASX:KSN), a company with a prospective high grade opportunity in Australia and a 70% stake in the well advanced Misima Gold Project in a proven area of Papua New Guinea (PNG).

The latter has a history of 130 years of successful and profitable gold mining, and the area is still the subject of active artisinal mining today.

The mine has an existing resource of 82.3 million tonnes at 1.1 g/t gold and 5.3 g/t silver for 2.8 million ounces.

Between 1989 and 2004 the average production was 230,000 ounces per annum, and a high of 370,000 ounces in 1992.

Such were the robust economics of the project that the mine only closed when the gold price fell below US$300 per ounce, US$1000 per ounce below where the precious metal is currently trading.

After funding further exploration in the March quarter, Kingston’s stake in the project is expected to increase to 75% with the group’s joint venture partner Pan Pacific Copper owning the remaining 25%.

Kingston Resources should be in a position to move relatively quickly in 2020, given it is developing a project that was previously in production.

Not only has Kingston been successful in delineating much higher grade mineralisation than that indicated by the current resource, it has also extended the size of the resource.

Misima field work commenced in December 2017, delivering immediate success with the discovery of a new prospect, Ginamwamwa, located adjacent to the former mill site.

Channel samples at surface included 14 metres at 12.2 g/t gold and 35.5 g/t silver, as well as thicker intersections such as 34 metres at 3.2 g/t gold.

It was further exploration work at east Ginamwamwa that extended a large area of high-grade shallow gold mineralisation including 14 metres at 17 g/t gold which featured fine visible gold.

There was also a small intersection of 2 metres grading 140 g/t gold.

Commenting on this development, Kingston Resources’ managing director, Andrew Corbett said, “Ginamwamwa is continuing to deliver some amazing gold grades near surface.

“We are seeing bonanza gold grades immediately west of some artisanal workings where we identified gold in veins in September, and 100 metres further east of that, on the other side of the creek we are seeing more high grades in an intersection of 8 metres at 14.2 g/t with individual samples up to 39 g/t.”

With multiple targets untested ground over eight kilometres of prospective strike there is enormous upside potential from exploration, and there is a school of thought that this could provide feed for a high-grade, near surface, starter pit.

Kingston has another iron in the fire with its Livingstone Gold Project which holds a 50,000 ounce resource and is the site of a number of high grade historic intersections.

The project is 140 kilometres north-west of Meekatharra in Western Australia and it is situated in an area that hosts numerous old workings, many of which featured high grade gold mineralisation.

Drilling in October 2018 revealed shallow intersections such as 20 metres at 2.9 g/t gold and 8 metres at 3 g/t gold.

However, there was even better news to come as the company revealed assay results in November that featured both strong grades and broad intercepts.

These included 4 metres at 76.2 g/t gold from 88 metres and 28 metres at 2.3 g/t gold from surface.

In the near term, it is likely to be exploration results that will be the main share price catalysts.

Mako Gold

Mako Gold Ltd (ASX:MKG) is an Australian based exploration company with gold projects in Côte d’Ivoire and Burkina Faso in the gold-bearing West African Birimian Greenstone Belts which host more than sixty gold deposits of more than 1 million ounces.

The company’s focus is to explore its portfolio of highly prospective projects with the aim of making a significant high-grade gold discovery, and its experienced management has a proven track record of high-grade gold discoveries in West Africa.

Mako also has a very experienced player in the North African region on its share register in Resolute Mining Ltd (ASX:RSG).

With mines in Mali, Ghana and Australia the company produced 130,000 ounces of gold in fiscal 2018, but as it develops current deposits, management is confident that the group will exceed annual production of 500,000 ounces.

The Syama gold mine in Mali will be a major contributor, accounting for more than 300,000 ounces of gold per annum.

Resolute’s presence on the register is encouraging because it is unlikely to be content with a 19.5% holding if the size of the prize at either of Mako’s projects looks enticing.

With cash, bullion and listed investments of nearly $120 million, the company has ample head room for acquisitions.

Aside from corporate activity though, Mako has plenty going for it having recently completed its maiden drilling program at the Napié Project in Côte d’Ivoire.

This is the group’s flagship project and Mako is earning up to a 75% interest in Napié under a farm-in and joint venture agreement with Occidental Gold SARL, a subsidiary of West African gold miner Perseus Mining Ltd (ASX/TSX:PRU).

Like Resolute, Perseus has extensive experience in operating producing mines in Africa.

Drilling at Napié intersected multiple zones with significant widths and grades of gold mineralisation with individual 1 metre assays up to 29.89 g/t gold, and separately widths up to 28 metres at 4.86 g/t gold.

Mako has also had exploration success at its Niou Project in Burkina Faso, announcing a new gold discovery in January following its maiden drilling program.

Drilling intersected multiple zones with significant widths and grades of gold mineralisation with individual 1 metre assays up to 53.80 g/t gold and separately widths up to 24 metres at 2.73 g/t gold.

Further drilling at both Napié and Niou will be undertaken in the June quarter, and given the calibre of exploration results to date the return of high-grade assays could be a share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.