Getting schooled in the newest tech boom

Published 29-JUL-2017 15:23 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

You’ve almost certainly heard of fintech – a wave of digital disruption impacting all sorts of traditional commerce systems and models. There’s also adtech (technology in the advertising world), insurtech (insurance), agritech (agriculture) and biotech (biotechnology).

You may not have heard of Edtech, however. That’s where individuals and companies study and practice the improved facilitation of learning and education through technological resources. It’s a huge area of growth in both the developed and developing worlds.

While edtech hasn’t drawn as much attention yet as fintech – possibly due to significant impact on the banking industry – edtech companies can tap into an enormous range and magnitude of markets worldwide.

No matter what side of politics, we likely all agree that excellence in education is an important aspect for any progressive society. It impacts every one of us at some point in our lives – either as a student ourselves, or as parents trying to raise one. In 2014 the global education sector was worth ~$4.4 trillion dollars.

Unlike some Silicon Valley-centric tech industries, the edtech realm is not necessarily colonised by players from the West. Some of the most interesting startups are popping up in places like Thailand.

However, if you are considering investing in edtech companies in exotic locations, remember any investment is speculative and investors should seek professional financial advice if considering these stocks for your portfolio.

Like Taamkru – a platform created in 2013 to stimulate kindergarteners’ learning as well as allow parents and educators to track their child’s performance in real time. It offers comprehensive platforms to schools for testing purposes, with over a million questions already in its datasets.

In 2014 it raised $620,000 in funding from Japanese venture capitalists, and recently partnered with Kyna, a Vietnamese e-learning platform with the aim of exploring markets beyond Thailand.

Vietnam is another country that has seen major growth in edtech. Last year, its home-grown Everest Education platform raised $1 million from individual investors. Everest provides supplementary courses in Math, English, test preparation, computer programming, private tutoring and STEAM camps (science, technology, engineering, arts and math).

Edtech is so much on the rise in the region that there’s now an ongoing annual Edtech Asia Summit, with this year’s event taking place in Ho Chi Minh City this weekend.

Of course, southeast Asia is not the only region feeling the edtech boom. Take the US-based Udemy, an open online marketplace where anyone can upload and sell a class – the tagline being ‘Learn anything, on your schedule’.

Not only has Udemy appealed to its own marketplace of learners, it has become a platform for corporations to create customised training courses – with major clients like Goldman Sachs.

Early on Udemy, AKA ‘The Academy of You’, raised $1 million in venture funding. The following year, it raised $3 million; the next year, $12 million and so on. In its most recent round of capital funding in 2016 it snapped up $60 million in funding.

If you still aren’t convinced edtech has significant scalability, consider the ASX-listed $150 million market-capped 3P Learning (ASX:3PL). Its popular Mathletics platform – an interactive online learning tool which aligns with school curriculums – has approximately 3.5 million users in more than 10,000 schools worldwide.

In the last six months, 3P Learning has crept up ~12% in share price:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Although the recent direction is right, the stock is currently trading at ~$1.08 – a far cry from its peak of $2.63 in May 2015. However, 3PL acts as an example of the level of scalability for edtech companies who are onto a winning idea.

Tipping the other end of the scale

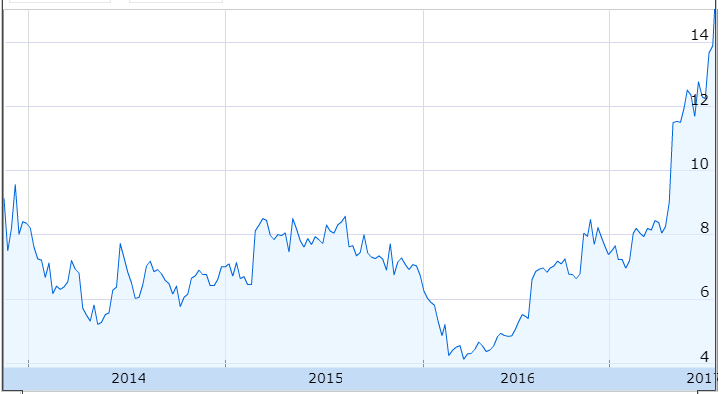

A start-up success story that’s now well and truly made it to the big leagues is US-based Chegg Inc (NYSE:CHGG) – capped at $1.44 billion – which went public in 2013 and never looked back.

Since April this year it has gained 86% to ~$15.00 a share:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Chegg is a little different to the other edtech companies mentioned above. It made its mark with the catchphrase ‘Don’t pay full price for textbooks’ – the core service being an online platform where high school and college students can rent textbooks. Part of the brain wave behind Chegg, according to its founders, came from noticing the success of online rental services like Netflix.

In this case, the latest in online capabilities are used to offer a service that supports a more traditional form of learning – textbooks. Yet the idea of combining technological innovation and educational resources is still what makes the whole concept stick.

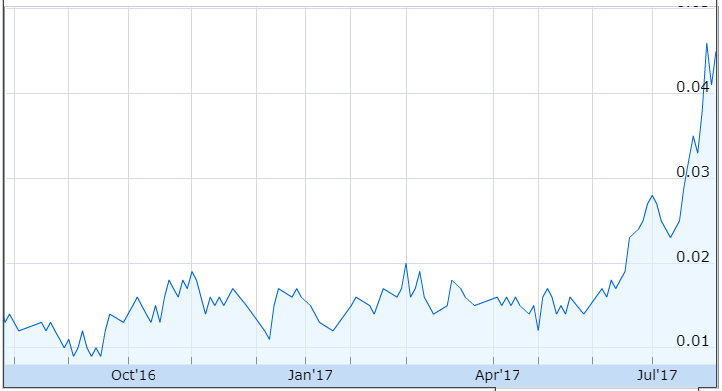

One ASX-listed small cap using gaming technology to offer products to school-aged children is Kneomedia Ltd (ASX:KNM) – a company that has launched its KNeoWorld game in the US, UK and Asian markets.

The company offers game based learning programs online to global markets – to use the fun new term, it’s classified as ‘edutainment’. In the last year KNM’s share price has gained 246%:

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

An industry that knows no bounds

The edtech effect does not look likely to be limited by a startup’s size, country or the age or language of the end user.

In fact, edtech startup and English language school Globish sees the breaking down of barriers, language in particular, as a key objective. It utilises a customised learning system to help users feel more confident in speaking English.

A key element of Globish is the teaching of a collection of relevant words and simple grammar to a level deemed adequate for the user’s purposes; the idea being that everyone and anyone will have the ability to communicate via a global version of simplified English.

These examples are all evidence that the full applications of this industry are virtually limitless. Given high-demand markets, and lower barriers to entry with the affordability of online or e-based learning, edtech could bring education that bit closer to equal, on a global scale.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.