Fintech’s feeding frenzy: why it’s time to stop, collaborate and listen

Published 30-AUG-2017 16:09 P.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Financial technology is nothing new. You could trace it back to 1865 when inventor Giovani Caselli brought the world the pantelgraph, commonly used to verify signatures in banking transactions.

The telegraph paved the way for financial globalisation; credit coins became the first method of credit payments in the late 1800s and by 1918; and the Fedwire Funds Service was established by the Federal Reserve Banks to transfer funds and connect all 12 Reserve Banks by telegraph using Morse code.

An overview of the history of fintech can be found here. Suffice to say, the current level of interest has been a long time coming – but the money and investment behind its growth is something quite contemporary.

In 2016, KPMG suggested US$24.7 billion was invested in fintech companies globally. Data accumulated by Financial Technology Partners, an investment bank focused on fintech, cites $36 billion across over 1500 funding deals from over 1700 unique investors (not taking into account M&A deals) as a more accurate figure.

Regardless of which figure is most accurate, it is clear that the rise of fintech presents an inordinate amount of opportunities.

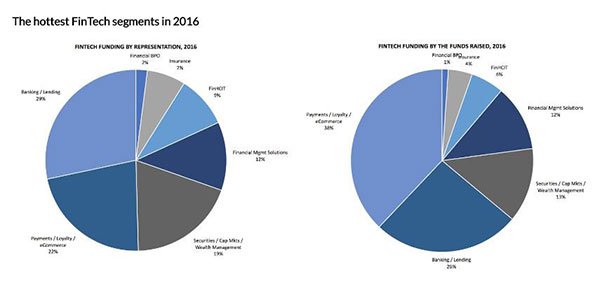

The following chart indicates which areas are heating up the fastest.

As it has done throughout history, the banking and lending industry is dominating the fintech landscape, with payments and e-commerce a formidable rival.

With many more industries now being influenced by financial technologies, opportunities to improve business, services, customer support and bottom lines are rapidly increasing.

Opportunity knocks

“Thanks to new technologies, both the incumbents and the disruptors in financial services have today an unmissable opportunity to do business in collaboration,” said Kim Fournais, CEO and founder of Saxo Bank Group.

In Sydney to accept this year’s Diploma of the Danish Export Association and His Royal Highness Prince Henrik’s Medal of Honour on behalf of Saxo Capital Markets Australia, Fournais said, “Given the size of the fintech opportunity, we’re seeing a shift across the financial services sector globally. Companies are becoming more collaborative, opting to leverage off the capabilities, the advantages and the expertise of other companies, instead of building and owning everything themselves.

“At Saxo Bank Group, we decided to open our trading infrastructure with open API so it can form the technology backbone of our partners’ businesses. The financial institutions we’re collaborating with benefit because they don’t need to allocate IT resources to develop their own technology. We benefit, in turn, from scale and more activity through our infrastructure. It is very much a win-win situation.”

Mr Fournais believes that in 15 to 20 years, the financial industry will look back at this current point in time, viewing it as one of the most significant transformations.

“We are likely to see some companies miss out from the opportunities that the new technologies give rise to, while others will succeed. The defining factor to separate the two will be their ability to work together.”

The Saxo Bank boss isn’t the only one pushing the fintech opportunity barrel. When the federal government released the 2017-2018 budget, part of the focus was on sustainable economic growth, employment and essential services.

The financial services and technology sectors are set for changes as the budget proposed a series of measures to encourage innovation in the fintech industry. This includes new legislation which, if implemented, is likely to allow crowd-sourced equity funding, tax concessions for start-ups and angel investors and fewer barriers to licensing of finance firms. The traditional banking sector could see more digital disruption arising from these changes which could subsequently create demand for top finance and technology talent.

Collaboration in law

Collaboration isn’t only occurring between fintech companies and those who need their service. With the constant evolution in tech offerings comes the need for regulation.

UNSW Scientia Professor Ross Buckley has joined forces with law professors from Europe and Hong Kong to research the laws and regulation of financial technology.

Since embarking on their collaboration early this year, the three experts, in cooperation with HKU PhD candidate Janos Barberis, founder of the SuperCharger TinTech Accelerator in Hong Kong, have produced four draft papers. Topics range from the impact of big data on the financial system to the challenges of regulating FinTech, a theory of smart regulation that considers different tools and their impacts on innovation, and a major analysis of the liability risk associated with blockchain technology.

“FinTech can tackle issues of transaction, compliance and risk management costs. But these benefits can come at a price – exchanging human errors for risks stemming from information technology. A smart, analytical approach is needed and this is where academic research can make a fundamental difference,” Professor Buckley said.

Professor Zetzsche said: “Smartly regulating financial innovation requires all stakeholders – the financial sector, start-ups, regulators and academics – to understand technology and law. Only global research is able to grasp the true speed and depth of these developments.”

Professor Arner agreed: “Financial technology, through big data, artificial intelligence, regulatory technology, crowdfunding, smart contracts, etc. changes the fundamentals of our regulatory system. Only financial centres that adjust their regulatory environment will be able to maintain and develop further their relevance.”

Movements in the FinTech space

You need only look as far as the collaborations being formed between service providers to understand how much momentum the fintech industry currently has.

Credit insurance provider Atradius recently launched its new digital platform ‘Atrium’, which provides customers and distribution partners with real-time data to better understand buyers, credit limits and risk. The platform is designed to drastically improve the user experience, including time efficiency – operations that used to take 15 minutes now only take three.

Eric den Boogert, Managing Director Atradius Asia said, “We’ve had strong positive reactions from customers who have piloted the new digital platform. The extended information about their buyers helps with business decision making and they like that everything is now organised around their customers, which is most important to them”.

The specific needs of brokers and agents are being built into Atrium, with a clear dedicated overview to manage multiple policies and customer portfolios.

Then there is Lenddo, an Asia-based fintech platform that uses non-traditional data to provide credit scoring and verification to economically empower the emerging middle class around the world. This short video ebsite explains how it works: https://www.lenddo.com/index.html

Lenddo is bringing its technology to Australia through a deal with Lodex – Australia’s first loans and deposits marketplace that operates via the social scoring technology.

Secure payments data platform, EFTsure, recently announced a new collaboration agreement with PricewaterhouseCoopers Australia. Under the agreement, PwC can advise certain clients of EFTsure’s innovative real-time payment verification technology and best practice payee management solution to help those clients to mitigate the risk of fraudulent or erroneous electronic business payments.

EFTsure CEO and Co-Founder, Ian Mirels said: “Banks ignore Account Names when processing electronic payments – they make payment by reference to BSB and Account Number only. Therefore there is no certainty that the Payee Name an authorising officer sees on the payment screen or payment report is the actual recipient of the funds.

“Vendor Master File (VMF) management is typically an area that is susceptible to internal control weakness due to the volume and dynamic nature of suppliers. These weaknesses are being exploited. We are seeing on average a 25 per cent anomaly rate in customer’s VFMs which require review to ensure they don’t lead to payment fraud or error, if they are not remedied.”

Other companies making inroads include UBank, one of Australia’s leading digital-only banks, which recently unveiled RoboChat, Australia’s first virtual assistant to help potential home buyers and refinancers complete their online home loan applications.

“If you’ve gathered all of your paperwork, the form can be completed in as little time as it takes you to have your breakfast,” said Lee Hatton, CEO of UBank.

“And, securing one of the most competitive rates in the market could help a customer save thousands of dollars in interest over the life of a loan.”

Trustees Australia and Cashwerkz announced a strategic merger of the two companies that brings together 31 years of traditional financial services experience with intuitive technology.

Traditionally, term deposits can take up to seven days to be placed. Cashwerkz cuts the average down to a few minutes.

“By moving the entire investment process online, while remaining regulatory compliant, we not only save investors time and effort, but also help maximise their cash investments. Term deposit rates are fairly low at the moment, which is why it’s more important than ever to be able to research and manage your defensive assets easily,” said John Nantes, Executive Director and Head of M&A.

“The merger provides investors with a greater offering without having to ever walk into a bank or go through a complicated and time-consuming process.”

Finding a place in FinTech’s future

With immense change happening on a global scale, traditional financial institutions are under siege. Some are moving too slowly, and their market share increasingly lost to upstarts with the agility borne of better technology and less bureaucracy.

The true disruptors and collaborators that are making the fintech space their own will be the ones that take the lion’s share of this multi-billion dollar industry in the not too distant future.

Interesting links:

https://www.goodcall.com/personal-finance/fintech/

https://finance.jaxlondon.com/blog/fintech-conference/top-20-social-influencers-fintech-2017/

https://www.fastcompany.com/3066666/5-fintech-startups-to-watch-in-2017

https://thefinanser.com/2017/06/50-hottest-fintech-firms-2017.html/

https://www.forbes.com/sites/janetnovack/2016/11/07/the-forbes-fintech-50-for-2016/#6fd778d81b10

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.