Finders Resources looking promising with record quarterly production

Published 24-JUL-2017 12:19 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finders Resources operates in Indonesia, a region which currently carries high sovereign risk. Those considering this stock as an investment should take this very high risk environment into account and seek independent financial advice for further information.

FinFeed caught up with Finders Resources (ASX: FND) Managing Director, Barry Cahill on Friday shortly after he provided a promising update on the group’s Wetar Copper Project in Indonesia.

Cahill reflected on the encouraging signs that started to emerge in the latter half of 2016, indicating FND was poised to benefit from its concerted exploration campaign conducted over recent years.

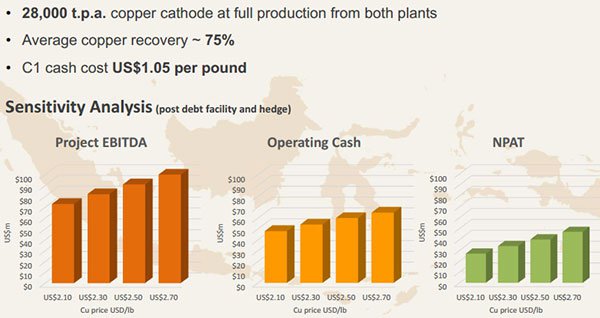

With plant construction and tweaking now complete, Cahill is buoyed by the fact that during the June quarter the company demonstrated it is capable of delivering maximum capacity of 28,000 tonnes of copper cathode per annum.

Following a period of fine-tuning, he is now basing his projections on the achievement of steady-state production rates of 28,000 tonnes per annum.

FND has worked up to that rate over the last three quarters with production of circa 6,160 tonnes in the December 2016 quarter and 6,130 tonnes in the March quarter. However, the June quarter was outstanding with production of 6,800 tonnes, representing close to an annualised rate of 28,000 tonnes.

Cahill also pointed out that cash costs reduced to US$1.02 per pound in the June quarter – not only slicker than the previous two quarters, but lower than the life of mine fundamentals of US$1.05 per pound.

With copper experiencing a strong run, Cahill referred to the project fundamentals. As highlighted below, the current copper price of circa US$2.70 per pound would result in calendar year 2017 EBITDA of circa US$95 million and a net profit in the vicinity of US$42 million. That’s equivalent to circa AUD$53 million based on current USD/AUD exchange rates.

This represents earnings per share of approximately 7 cents, in line with consensus forecasts for the 12 months to December 31, 2017. Based on these metrics, FND is trading on a PE multiple of 2.6 relative to Friday morning’s opening share price of 18 cents.

Yet commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

Strong cash flow could trigger fund expansion

With FND likely to be generating operating cash flow in the vicinity of $75 million in 2018, the company is well-placed to fund exploration initiatives which could expand the resource size and mine life of the Wetar project.

Cahill also highlighted the fact that FND would move to a debt-free position in 2018, which opens up the way for capital management initiatives.

Cahill said at this stage he would probably lean towards paying a dividend; even if a share buyback program was conducted, it would no doubt have a positive impact on the company’s share price, particularly given its conservative trading multiple.

Promising exploration results

Cahill pointed to the Lerokis and Meron deposits, which have already demonstrated promising grades. However, a full-scale exploration program could well open up a sizable open pit resource with the prospect of extending the project’s mine life and substantially boosting cash flow given that ore would be processed through established infrastructure.

Importantly, both deposits are close to the current processing facilities with Lerokis situated four kilometres from the plant and Meron located only one kilometre from the leach pads.

An updated mineral resource at Lerokis is expected in the second half of 2017, and this could be a share price catalyst given it will provide an indication of the potential mine life extension.

Is FND undervalued?

Canaccord Genuity analyst, Larry Hill, believes FND is substantially undervalued based on the merits of the established Wetar project and the prospect of exploration upside.

Hill has a buy recommendation on the stock with a price target of 35 cents.

It should be noted that broker projections and price targets are only estimates and may not be met.

Interestingly, Hill is predicting a dividend of three cents per share in calendar year 2018, implying a yield of circa 17% relative to FND’s current share price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.