Emerging gas players represent outstanding value

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The highly regarded International Energy Association (IEA), an autonomous group that incorporates 30 member countries, accounting for almost 75% of global energy consumption and more than half of global energy production has released a paper that points to a strong outlook for liquified natural gas (LNG).

The peak body says global trade in LNG is spurring a second natural gas revolution.

LNG from the United States, Australia, Qatar and elsewhere is expanding supply, underpinning the shift towards a more flexible, resilient and interconnected global gas market.

The IEA estimates that 50 countries will be importing LNG by 2025, up from only ten at the start of the century.

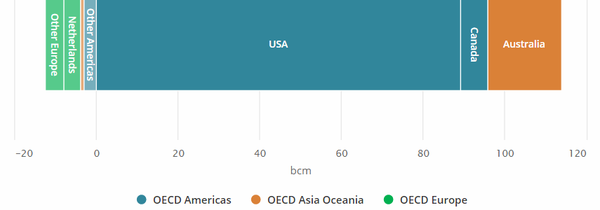

In 2018, the OECD natural gas production increased by 7.4% compared to 2017 and reached a record total production of over 130 billion cubic metres (bcm) in December 2018.

Production growth by country is illustrated in the following graphic.

Strong growth in Australia, and more to come

Most of the growth was observed in the OECD Americas (+9.3%) and originated from the US (+11.5%) where the shale revolution broke through.

The IEA reported that OECD Asia Oceania supplemented the natural gas production increase (+12.9%) as Australia (+15.9%) is still in the process of ramping up the output of the Ichthys gas-condensate field in the Browse Basin, and should meet full production over the next two years.

An arguably undervalued emerging player in the Browse Basin is IPB Petroleum (ASX:IPB), and while the company’s projects include an oil discovery at Gwydion-1, it is flanked by large gas fields such as Ichthys.

During the December half, IPB successfully completed a feasibility study into its proposed DLT Project which incorporates the Gwydion discovery.

This involves the proposed drilling of a well at Idris followed by a flow test of a subsequent horizontal well over an extended period to assess the extent of the oil discovered by Gwydion-1.

While the key objective of the project is to help better define reservoir size and resources, oil produced during the flow test is to be transferred to a chartered tanker and subsequently sold.

The generation of early stage income from oil sales is an important aspect to bear in mind for an emerging player such as IPB given that it will be used to repay proposed debt funding, with any surplus then distributed to the company and possible vendor financiers.

Supply constrained in Europe

Returning to the broader picture though, an important development in Europe was highlighted by the IEA.

From a broader perspective, the IEA said, “The gas industry faces plenty of uncertainties, but the key trends we identified by the IEA in 2011, including the exact level of gas demand in 2018, are now clearly visible in today’s gas markets.

“The IEA's Executive Director, Dr Fatih Birol, reviewed these developments on Thursday at the first EU-US High-Level Business to Business Forum in Brussels alongside US Secretary of Energy, Rick Perry, and European Commissioner for Energy and Climate, Miguel Arias Cañete.”

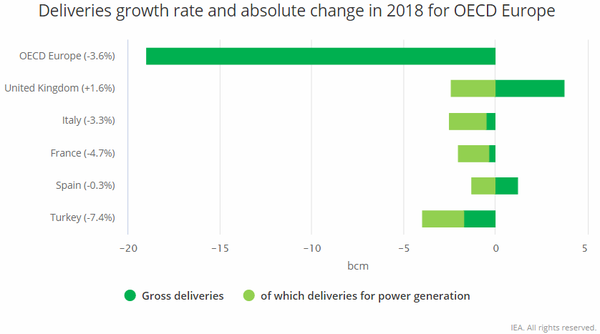

The IEA’s latest update on gas trends was released on April 24, and it highlighted that OECD Europe, experienced a 3.6% fall in its natural gas production following the commitment to reduce the exploitation of the Groningen field in the Netherlands (-9.6%).

This is the largest gas field in Europe, but drilling operations and works performed on site led to frequent earthquakes in the region over the past years.

Further highlighting the demand for natural gas in the OECD area, the IEA noted that the OECD Europe zone was again a net importer of natural gas.

Talon Petroleum - right place, right time

Talon Petroleum Ltd (ASX:TPD) undertook some company transforming initiatives in the March quarter as it entered into a binding heads of agreement for the purchase of all of the shares in EnCounter Oil Ltd.

The agreement with EnCounter is the second transaction executed by Talon as the company looks to build on its newly incorporated UK North Sea strategy.

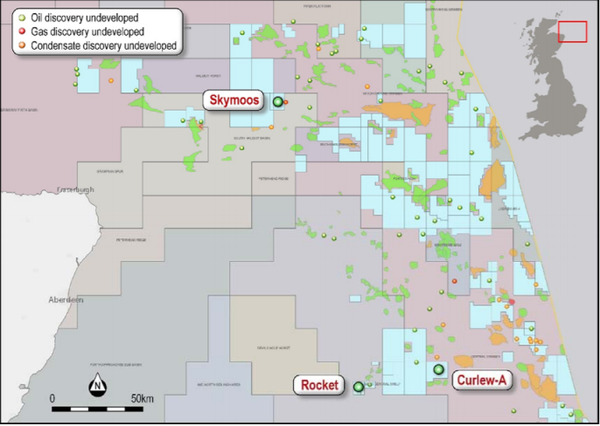

The transaction provides the company with 100% ownership of two recently awarded, high-impact exploration licences in Skymoos and Rocket.

The acquisition will also provide Talon with access to a significant technical database and a highly-experienced UK North Sea management team with previous exploration success.

As indicated below, the fields are situated in areas where there have been undeveloped gas and oil discoveries, and the close proximity to European markets is an important factor particularly given that there is extensive tie in infrastructure in the area.

Global oil and gas group Chevron is active in the North Sea, and one of its projects is adjacent to Skymoos.

Recent OGA data suggests that the current recoverable resource potential is in a range between 10 billion and 20 billion barrels of oil equivalent with 5.4 billion barrels of oil equivalent supported by existing reserves.

The acquisition of EnCounter Oil also included the farm-in to licence PE 2368 which lies to the east of Rocket and contains the Curlew-A discovery.

Farm-in provides contingent resource of 4.5 million barrels

The farm-in agreement provides Talon with 10% of the 45 million barrels of oil equivalent Curlew-A (2C) contingent resource, equating to 4.5 million barrels.

Drilling is planned for the September quarter of 2019, providing the group with low cost exposure to a highly prospective project portfolio.

Consequently, while Talon has flown under the radar recently, as exploration results come to hand share price catalysts could emerge.

It is worth bearing in mind the nearology aspect of Curlew-A - it is in an excellent neighbourhood with the blocks immediately to the west (light blue) owned by Shell.

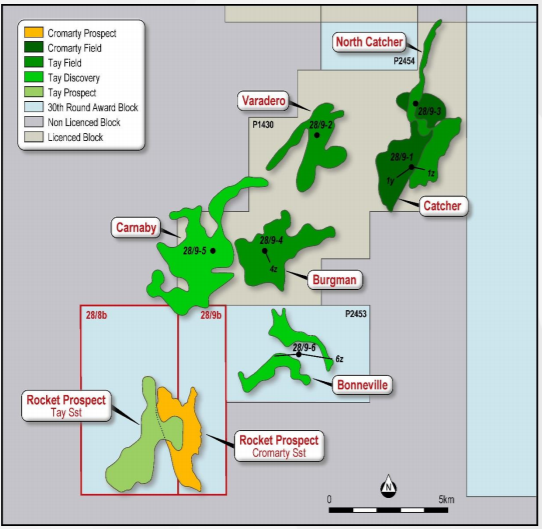

As indicated above, the Shell territory is also only a few kilometres to the east of the Rocket Prospect which has a best estimate prospective resource of 27 million barrels of oil.

From a broader perspective, it borders to the south of the Catcher, Varadero, and Burgman discoveries which were all made by the EnCounter team whilst at EnCore.

The Rocket Prospect is analogous to Catcher Area fields to the north, and the greater Catcher Field Development Area is now producing at a rate of 70,000 barrels of oil per day.

Invictus Energy sitting on mega-prospect

Invictus Energy Ltd (ASX:IVZ) is another undervalued emerging player that stands to benefit from increased demand for gas.

Through its 80% stake in the Cabora Bassa Project in Zimbabwe, Invictus has the opportunity to secure first mover advantage and a dominant acreage position covering what could potentially be the largest, seismically defined, undrilled hydrocarbon structure onshore Africa.

The project includes the Mzarabani prospect which lies within the 250,000 acre tenement of the Cabora Bassa Basin.

It was mapped extensively by Mobil in the early 1990s, and studies concluded that the prospect contains conventional gas-condensate reservoir properties.

This knowledge provides Invictus with a decided advantage as it will help to shape a targeted drilling campaign.

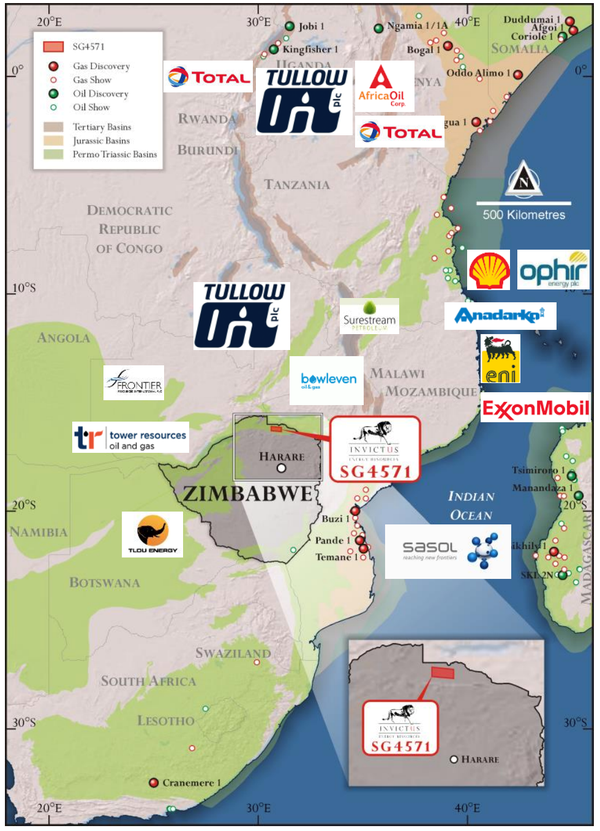

Furthermore, the prospect is surrounded by major players in the oil and gas industry that are either in production, have made discoveries or are undertaking aggressive exploration campaigns.

The following map shows the high level of activity in the region.

In terms of the supply/demand equation there are few countries in the world aside from Africa where the amount of energy supply falls so far short of that required to maintain adequate standards of living, while also providing sufficient power to industry.

Consequently, a commercially viable gas discovery is all that is required, as it is a ‘build it and they will come’ scenario.

This was evidenced as recently as yesterday when Invictus announced that it had negotiated a Memorandum of Understanding (MoU) with Sable Chemical Industries Ltd which if ratified would see the producer of ammonium nitrate supplied with up to 70 million cubic feet per day of gas for a period of 20 years.

This early stage MoU demonstrates the huge local gas demand in an energy starved market in Zimbabwe, and Invictus expects to enter into additional gas supply MoUs in the future.

The market responded positively to the Sable development, and one would expect that further MoUs may result in sustained share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.