Dragontail surges 20% on back of YUM! deal

Published 31-MAR-2020 10:40 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While there has been very little positive news within the hospitality industry recently, an announcement yesterday by Dragontail Systems Limited (ASX: DTS) certainly got the market interested with its shares rallying 20%.

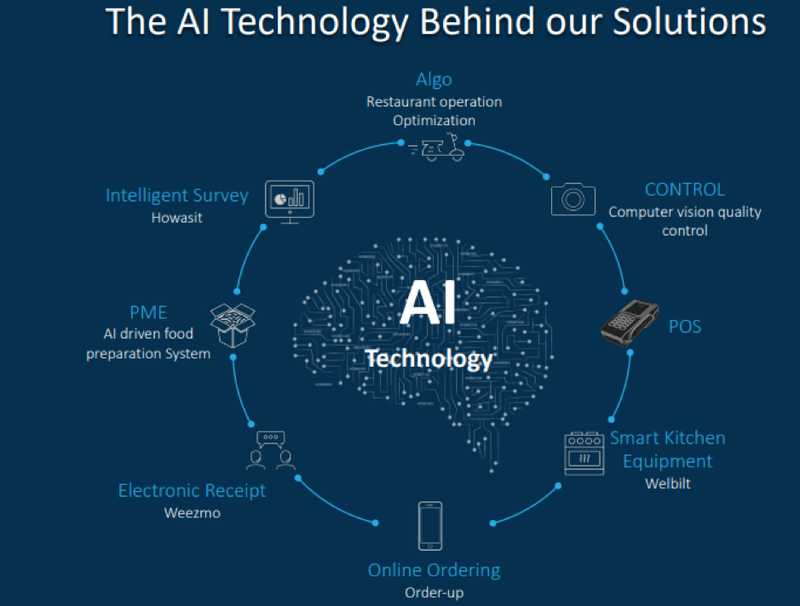

Dragontail is revolutionising the Quick Service Restaurant (QSR) and food service industry with its Algo Platform and computer-vision QT quality system that uses artificial intelligence (AI) machine learning.

The Algo Platform uses a sophisticated patented algorithm to optimise and manage the entire food preparation process from order to delivery.

It is the first system in the world to fully automate and streamline the kitchen flow to deliver an immediate and significant return on investment to fast food and quick service restaurants and is currently installed in approximately 1,250 stores.

What triggered a very positive reaction yesterday was news that the company had entered into a Statement of Work with YUM! Restaurants International, Inc for deploying its Algo Platform in Pizza Hut stores for Telepizza Group S.A., a company incorporated in Spain.

Telepizza is the largest Pizza Hut franchisee in the world with over 2,500 stores primarily in Europe and Latin America.

Installation in Telepizza's 943 Latin American Pizza Hut stores is to commence once the testing phase in the first two stores in Ecuador is successfully completed.

Telepizza is a significant pizza delivery business, listed on the Spanish stock exchanges, with a presence in more than 20 countries through more than 2,500 franchised and owned stores, operating in Spain, Latin America and other countries of the Europe.

The collaboration started with a successful implementation of the Algo Platform in two stores in Ecuador following the integration with the POS (Point of Sale), and after a successful completion, will continue to other Telepizza markets in the Pizza industry.

Management anticipates that Algo will maximise efficiency and accuracy in the food preparation, kitchen function and delivery processes.

Dragontail appears to be on a winner given the highly scalable nature of the fast food industry.

The company’s technologies are transferable across most fast food and quick service restaurants, and it was only last week that the group signed a Technology Master Services Agreement, establishing Dragontail and Pizza Hut Asia-Pacific Franchise strategic relationship.

Pizza Hut APAC currently has approximately 3,000 stores in 15 countries.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.