Don’t write off zinc in 2017

Published 06-DEC-2016 15:15 P.M.

|

17 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having examined six copper stocks in our comprehensive take on the base metals picture for 2017 (Where to get your slice of base metal exposure in 2017) where we looked at macro issues that could also lead to increases in nickel, zinc and lead prices, we now look at six zinc/lead stocks that could outperform in the next 12 months.

Zinc was the best performing base metal in 2016 and many stocks exposed to the commodity have rerated strongly over the last 12 months. However, there still appears to be value in the sector, and in fact the share prices of some zinc plays have retraced over the last couple of months as investors have looked to take advantage of a rebound in nickel and copper.

Because lead is often found in conjunction with zinc it is best to cover both commodities under this banner. As mentioned in last week’s macro assessment, don’t underestimate the potential upside companies could experience from lead production, even though the metal tends to fly under the radar compared with copper, nickel and zinc.

As there aren’t any pure zinc plays in Australia we look at six companies in various stages of exploration and development. Investors looking for less speculative producers should consider those that are on the verge of coming into production.

However, investors should also keep in mind that commodity prices do fluctuate and caution should be applied to any investment decision here and not be based on spot prices alone. Seek professional financial advice before choosing to invest.

Those with a greater appetite for risk could do well to focus on companies we feature that have been delivering outstanding exploration results even though they are some way off bringing projects into production.

Red River Resources

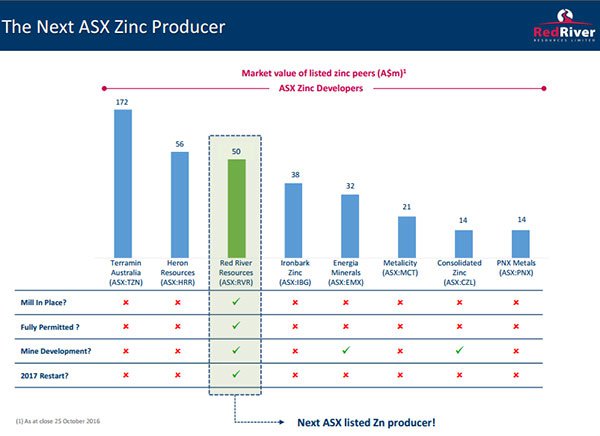

Red River Resources (ASX: RVR) is shaping up as the first new ASX listed Australian based company to come into production with last week’s $30 million capital raising providing sufficient capital to bring the Thalanga zinc project located in North Queensland into production in the second half of 2017.

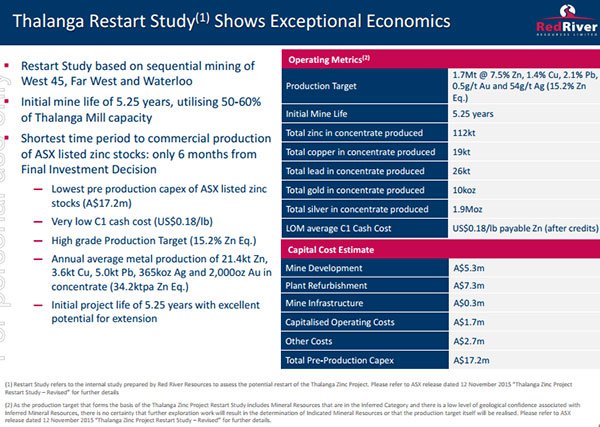

The following provides a useful snapshot regarding the attractive metrics of the Thalanga project.

Capital raising provides funding through to production

It has been a busy six months for RVR with the company conducting a heavily oversubscribed $8.9 million placement at 12 cents in July. The group’s shares subsequently hit a high of 15 cents supported by the highest volumes in the company’s history.

However, there was significant upside still to come with a high grade zinc discovery at Liontown East, part of the Thalanga project, resulting in the company’s shares hitting a 12 month high of 28 cents, close to the all-time high of 29.5 cents.

In November the company’s shares traded in a range between 17 cents and 23.5 cents, indicating that the placement price of 18.5 cents was at the bottom end of that range.

However, what needs to be taken into account is that the company is only briefly traded as high as 22 cents in the last three months, suggesting the placement price was a reasonable outcome.

Furthermore, the key focus from an institutional investment and offtake perspective will be the fact that there is financial certainty regarding bringing the project into production, and it wouldn’t be surprising to see RVR’s shares recover after the pullback to 20 cents that occurred last Friday.

Historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Hartleys likes the story, pointing to quick ramp up to production

Analysts at Hartleys ran the ruler across RVR in early November, projecting that the group would produce 16,000 tonnes of zinc equivalent in fiscal 2018, increasing to 33,000 tonnes in fiscal 2019.

However, these figures could change with financing approved earlier than some were expecting, suggesting that RVR could go close to achieving a full year’s production in 2018 providing the ramp up goes to plan.

On this note, management provided guidance last Friday pointing to completion of planned refurbishment by the third quarter of calendar year 2017 and commencement of production by the second half of 2017.

With regard to bringing the project into production, Mike Millikan from Hartleys recently suggested this could be fairly swift in saying, “Importantly for RVR, due to the existing infrastructure already in place at Thalanga (previously built by Kagara Zinc), the company has only six months development time frame from Financial Investment Decision (FID) to commercial production”.

He noted at the time that early stage refurbishment of the plant had commenced with minor works likely to progress to bigger ticket items in the New Year.

In terms of peer comparisons though, the following graphic provides a good insight into RVR’s progress compared with other players in that space.

Millikan’s modelling assumes an initial six year mine life with production commencing in calendar year 2017 subject to funding. On this basis he is forecasting the group to produce 16,000 tonnes of zinc equivalent in fiscal 2018 generating a net profit of $12 million.

However, in terms of valuing RVR the base case production figure of 33,000 tonnes for 2019 is a better indication because this is only expected to improve in ensuing years.

Based on this production, Millikan is forecasting RVR to generate a net profit of $31 million in fiscal 2019, representing earnings per share of 6.6 cents after allowing for the anticipated dilution from the capital raising.

Fiscal 2019 PE multiple of three looks cheap

This implies a PE multiple of approximately three relative to Friday’s closing price.

Prior to the capital raising, Hartleys had a speculative buy recommendation on RVR with a 12 month price target of 44 cents.

Given the capital raising removes the funding risk and taking into account the fact that the broker’s commodity price assumptions now appear conservative, it is likely that any adjustment to projections and valuations will be on the positive side.

As is the case with management, Millikan is upbeat about the prospects of exploration upside given the company’s success over the last six months.

Understand, however, that broker projections and price targets are only estimates and may not be met.

Summing up these latest developments, RVR’s managing Director, Mel Palancian, said, “We are very pleased to be fully funded for the development of, and imminent production from the Thalanga zinc project, particularly in light of the strong performance of the zinc, copper and lead prices”.

With regards to project expansion, Palancian said, “Our recent exploration results, including the discovery of our Liontown East prospect have demonstrated the strong exploration potential across the Thalanga region, and during the upcoming development and production phase we will continue to have a strong focus on exploration of known deposits and greenfield targets”.

Heron Resources

Shares in Heron Resources (ASX: HRR) for the best part mirrored Red River Resources in the first half of 2016 more than doubling from 8 cents to a 12 month high of 17 cents. However, they have been less volatile in the latter part of the year, mainly trading in a tight range between 13 cents and 15 cents.

HRR hasn’t had to withstand the impact of earnings per share dilutive capital raisings, and this arguably accounts for the lack of volatility compared with RVR.

Key share price catalyst throughout the year included the delivery of an impressive feasibility study for its Woodlawn zinc copper project located in New South Wales. This supported the viability of a ‘starter case’ to deliver quality zinc, copper and lead concentrates to market over a significant reserves based mine life.

Again, investors should note that past share performance is no indication of future performance.

The study resulted in the company taking the decision to accelerate pre-production initiatives including the securing of finance, with a view to bringing the project into production in 2018. Management recently said that it expected to have a financing package completed within the next 2 to 4 months with the likelihood of a mix of debt and equity.

Going hand-in-hand with this development is likely to be the execution of offtake agreements which often assist in the financing procedure as they provide a degree of revenue predictability.

This usually also rubs off on investors as they have some tangible numbers to work with, suggesting there could be share price momentum in early 2017.

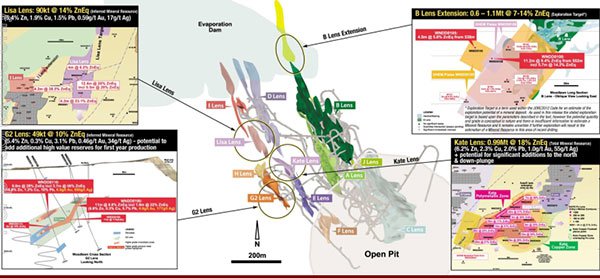

While it is difficult to determine exactly when production will commence, it is worth noting that the company already has substantial infrastructure in place and much of the exploration work has been completed, including the identification of new deposits that could contribute to production and extend the projects mine life.

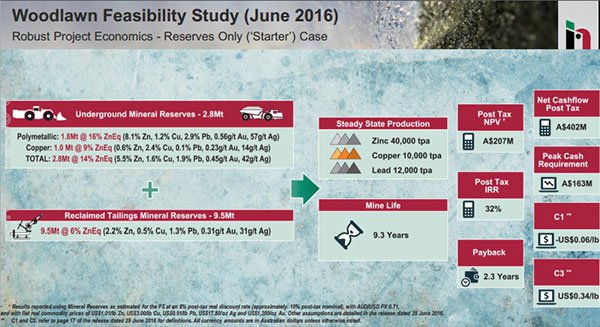

However, project metrics already look impressive based only on current reserves. The underground mineral reserve is 2.8 million tonnes grading 14% zinc equivalent.

Reserves to support 9.3 year mine life with more to come

This combined with a reclaimed tailings mineral reserve of 9.5 million tonnes grading 6% zinc equivalent is expected to support steady-state annual production of 40,000 tonnes of zinc, 10,000 tonnes of copper and 12,000 tonnes of lead.

The 9.3 year mine life should be extended substantially as reserves are increased and the company receives confirmation that ore can be sourced from recent high grade discoveries including Kate, Lisa, B North and G2 lenses. As can be seen below, these are all in close proximity to the main project.

Analysts at Hartley’s ran the ruler across HRR in late June. The broker had a speculative buy recommendation on the stock at the time with a 12 month price target of 25 cents, implying upside of approximately 85% to the company’s recent trading range.

Looking beyond the starter case, Mike Millikan from Hartleys said, “As further resources are converted it is anticipated that mine life will lift to over 11 years”.

Remember that broker projections and price targets are only estimates and may not be met.

Ironbark Zinc

Ironbark Zinc (ASX: IBG) is another emerging zinc play that Hartleys is impressed with, and is watching closely. While maiden production would appear to be further out than RVR or HRR, as analyst Trent Barnett highlighted at the end of November its financial metrics appear compelling.

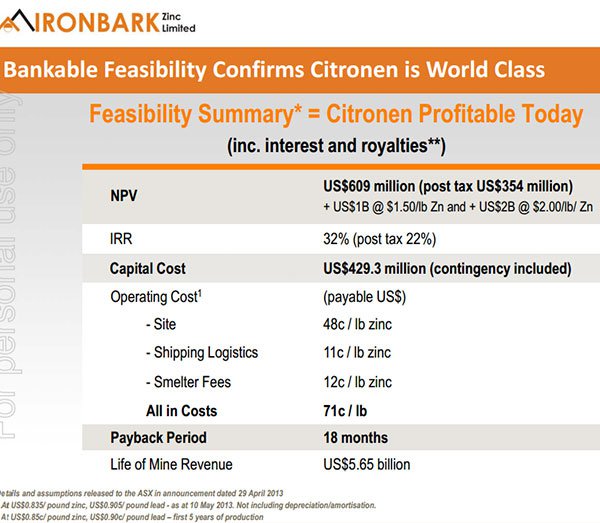

One of the key attractions of the Citronen zinc project which is based in Greenland is its size, which would translate into large production and a long mine life of 14 years based on the Bankable Feasibility Study (BFS).

It is worth noting that the BFS metrics outlined below are based on zinc and lead prices of US$0.85 per pound and US$0.90 per pound respectively, well below current levels for the first five years of production.

Working on maiden production of 83.8 thousand tonnes of zinc equivalent in fiscal 2020, Barnett estimates that this would generate a net profit of $34.7 million, representing earnings per share of 2.2 cents.

However, based on an indicative timeline, the project is really a 2021 story with spot prices currently indicating that the group would generate EBITDA of $369 million from revenues of $727 million in that year. This implies margins of 51% and would translate into a net profit of $173.4 million based on Barnett’s estimates.

However, he sees the current price environment as moderating by that stage and has based his 2021 assumptions on zinc and lead prices of $1.07 and 90 cents respectively.

This would deliver a net profit of $123.5 million, representing earnings per share of 6 cents which reflects a forward PE multiple of less than two relative to the company’s current trading range.

While this appears fundamentally attractive, there is no doubt that the group will have to raise substantial capital to fund development. This is likely to be a mix of debt and equity with the latter having an earnings per share dilutive impact on future earnings.

However, on this note, Barnett said, “Zinc prices are now high enough in our view for the equity market to consider funding the project (NPV is approximately equal to capex), and our price target of 33 cents implies a market capitalisation of $175 million”.

The most important near-term challenge and one that has been somewhat frustrating for management is the granting of a mining license. Interestingly, Barnett said, “We expect the award of the mining license any day, although we have already been disappointed substantially this year on timing”.

Given he is close to the company with a close understanding of the challenges to date, an ‘any day’ call suggests there may be something in the wind. This could be a catalyst for share price momentum given that it would provide a clear path to financing and development.

It is worth noting that investors haven’t lost faith in IBG with its share price having increased nearly three-fold in the last 12 months, and the current price is only just shy of the 12 month high of 11.5 cents.

Inca Minerals

Shares in Western Australian based microcap, Inca Minerals (ASX: ICG) spiked 40% after the company announced in July that it had discovered eight new highly mineralised veins at its Riqueza project located in Peru.

Of course, as we have stated, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The results included zinc grading 10.05%, silver grading 207 grams per tonne and lead grading 12.1%. Importantly, these results build on the identification of highly prospective mineralisation within rock chips in the prolific metal belt of Central Peru.

This is a very early stage project being undertaken in a region that can present operational challenges and as such makes the company a very speculative investment proposition.

However, this shouldn’t stop the company being targeted particularly by short-term investors as it was in mid-June and towards the end of the month when its shares doubled on the back of extremely high-grade zinc, lead, silver and gold assays from the same project.

Ausquest is operating in the same region and it is at an early stage of identifying copper gold targets. The group’s shares surged in July, highlighting the extent of news flow driven share price reratings that have been occurring.

However, while its shares have come off sharply since August, ICG has gone from strength to strength with its shares increasing five-fold between August 1 and late November when it hit a 12 month high of 2.1 cents.

Again, past performance is no indication of future performance and investment caution should be applied.

This has been driven by ongoing high-grade exploration results from Riqueza, notably assay results with peak values of 33.4% zinc, 540 grams per tonne silver and 25% lead.

Further exciting results emerged last week as assay results from samples collected at the Cerro Rayas project were unveiled. It is a zinc, silver lead focused project located 15 kilometres from Riqueza.

Important similarities between the two projects are the broad category of mineralisation (replacement style zinc/silver/lead) and the host unit within a limestone sequence. The zinc grades are high at both deposits with the most recent results featuring peak values of 42.7% zinc, 26.1% lead and 258 grams per tonne silver.

Interestingly, Riqueza is 6 to 9 months ahead of Cerro Rayas on the exploration curve, but as managing Director Ross Brown said, the company is in the enviable position of having a minimum of two high-quality exploration targets at Cerro Rayas, as well as the highly prospective Riqueza deposit where more exploration work will be undertaken on receipt of a drilling permit.

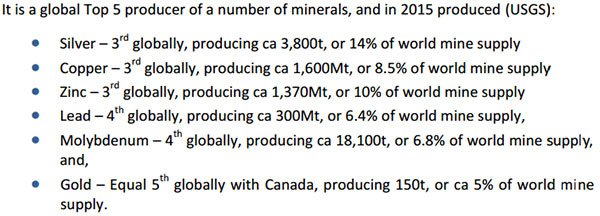

As outlined below, Grant Craighead from Breakaway Research recently highlighted Peru’s track record, particularly in relation to zinc, lead, copper and silver projects.

It would appear that ICG remains a news driven story with the potential to continue to rerate as exploration results come to hand.

Zinc of Ireland

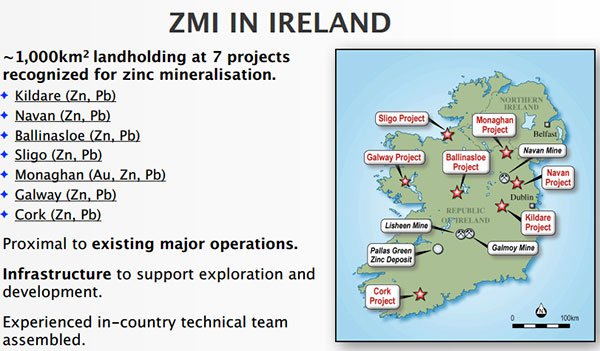

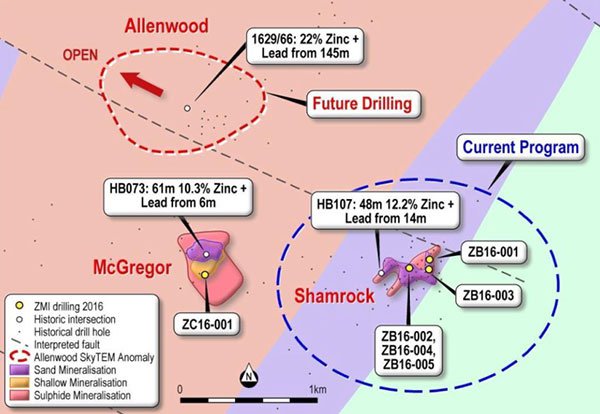

Since completing acquisition of Zinc Mines of Ireland in July 2016, Zinc of Ireland (ASX: ZMI) has been quick to impress with results from the Kildare project, being its initial target, delivering thick high-grade results.

The project is located 40 kilometres south-west of Dublin where over five district mineralisation events have occurred in the project area and significant drill intersections from past works have demonstrated the regions high prospectivity for zinc and lead.

A total of $2.2 million was raised to fund the project acquisition. Since then the company has raised a further $1.44 million at 2.4 cents per share. However, the dilutionary impact of the capital raising appeared to take its toll on the company’s share price and it is now trading in the vicinity of 1.2 cents, arguably representing a useful entry point given exploration success in the last three months.

Yet, the past performance of this product is not and should not be taken as an indication of future performance and caution should be exercised in assessing past performance.

From a strategic and financial perspective ZMI’s position has been further strengthened by the partial divestment of its non-core Leonora gold project. This will free up funds in the near term while providing an equity interest in any potential upside.

ZMI now more zinc focused

As mentioned though, the main game is progressing the group’s zinc assets, and exploration results from a maiden drill program at Kildare were promising and suggest that further upbeat news may be imminent.

Results included 15.65 metres grading 11.17% zinc and 14.19 metres grading 7.28% zinc. There was also significant lead mineralisation encountered at various depths.

While drilling confirmed historical results, the company also targeted mineralisation in new zones which yielded good results. On this note, ZMI’s managing Director, Peter Van der Borgh commented, “These thick, high grade zinc intersections represent a solid start to the company’s operations at Kildare and confirmed the presence of zinc mineralisation at four distinct stratigraphic horizons within our license area”.

He noted that the tenure of mineralisation within the ‘sub-reef’ zone was particularly encouraging given that it can now be correlated at considerable width and grade for more than 150 metres.

The following graphic indicates where recent drilling has taken place at the Shamrock prospect, and it also shows the highly prospective nature of adjacent tenements owned by ZMI.

We have been following Zinc of Ireland closely since it acquired the zinc assets in Ireland and by visiting this link you will be able to examine a full rundown on the company just after the acquisition (July 28, 2016), along with follow-up commentary on the group’s progress.

Energia Minerals

Energia Minerals’ (ASX: EMX) Gorno zinc project is located in northern Italy. It is a brownfield project that was partially developed by an Italian multinational Corporation (ENI) before the group closed down its worldwide base metal and uranium operations in the early 1980s.

In March, EMX announced Gorno’s maiden resource of 3.87 million tonnes grading 7.7% zinc and lead, and 25 grams per tonne silver. Shortly after this was announced, management said that a scoping study focused on the mineral resource currently defined had confirmed its belief in the competitive advantages of the Gorno project, prompting the company to proceed to carry out a Definitive Feasibility Study (DFS).

However, by its own admission, management informed the market recently that slower than expected drilling would result in a slightly delayed release of a revised mineral resource estimate and DFS.

Despite the slower than expected progress though, the above exploration results suggest the project will be economically viable with the potential for a significant increase in resource.

The company is now targeting February and March respectively for the release of the revised mineral resource estimate and the DFS respectively.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.