A definitive guide to ASX vanadium stocks (part 2)

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Welcome to part two of Finfeed’s definitive guide to ASX vanadium stocks.

If you haven’t checked out part one yet, you can do so here.

In case you weren’t aware: China is the world’s largest vanadium consumer, and its high strength rebar standard is now in effect.

Under the new legislation, grade three steel must contain 0.03% vanadium. This amount increases with each grade and tops out at 0.1% vanadium in grade five rebar.

This new rebar standard, in combination with the commodity’s ongoing prominence in the batteries sector, has been a major driving force behind record vanadium prices.

Vanadium redox flow batteries (VRFB)

While China’s new rebar standards have caused recent tightness, it’s the allure of vanadium redox flow batteries that's likely to drive long-term demand.

To get a better understanding of how VRFB technology works, check out the video below:

While VRFBs have a higher upfront cost than most other batteries, it’s their exceptional lifespan and flexibility that separates them from the pack.

VRFBs typically last at least 10,000 cycles, with future VRFBs lasting likely between 100,000 to 200,000 cycles as technology continues to be refined.

For a comparison, most lead-acid and lithium-ion batteries last between 500 and 4,000 cycles. Lithium-ion batteries don't provide the flexibility or scalability of their VRFB brethren, so it's little wonder there has been a renewed interest in vanadium in 2018.

Large-scale VRFBs are already gaining relevance in China, which is now home to the 200MW/800MWh Dalian VRFB, the largest chemical battery in the world.

In its 2017 study, the International Renewable Energy Agency (IRENA) examined the fundamentals of VRFB tech and its possible applications moving forward to 2030.

According to the study, VRFBs have extensive applications for network operators and electricity consumers in remote and rural locations. They could be particularly effective as restoration reserves for operators, injecting energy back into the grid to raise and stabilise frequency and perform load levelling in unpredictable regions.

For consumers connected to the grid, VRFBs would provide an adequate power reserve, providing energy for several hours in the event of a blackout.

While lead-acid and lithium-ion batteries can perform a similar role, their scaling inefficiency means they are more suited to rapid grid injection events.

The advantage of VRFBs' consumer side is their ability to reduce household overheads. In theory, they could provide users with the ability to cycle their energy use around peak and off-peak times. This is incredibly beneficial in regions that are subjected to a steep peak kWh price (such as South Australia or rural Victoria).

Given the continued transition to alternative power storage and sources, VRFB adoption should continue to increase and provide a long-term demand for vanadium.

With all of that in mind, here’s five more ASX-listed vanadium plays that are well-placed to capitalise on the growing demand for this new age metal.

Venus Metals (ASX:VMC)

Market cap: $13.94M

Current share price: $0.15

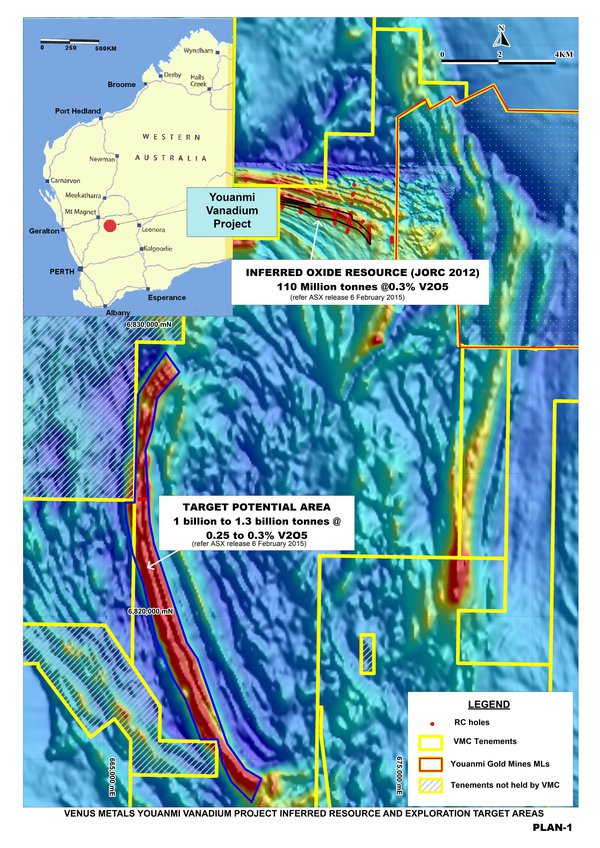

Venus Metals holds the Youanmi Vanadium Project in Western Australia. In February 2015, the company revealed a JORC (2012) Inferred Oxide Mineral Resource estimate for the project containing 110Mt at 0.3% vanadium.

Something that differentiates Youanmi from other vanadium plays is its unique oxide vanadium ores, which start at surface and have zero open pit strip ratio to the ore base.

VMC recently completed an extensive geological review of the project, which returned highly promising results, indicating that high vanadium values were distributed evenly across the Inferred Resource from the surface to around 50m depth.

Metallurgical test work has since been undertaken, confirming vanadium recovery rates from the abundant oxide core at between 66.9% and 69.58% vanadium.

The Inferred Mineral Resource is a continuous zone 3.5km long and 350m wide, presenting an ideal bulk open pit mining option.

VMC is now expediting the development of the Youanmi site, which includes a 6000m+ RC drilling program, scoping study and mining lease applications.

QEM Ltd (ASX:QEM)

Market cap: $17.5M

Current share price: $0.175

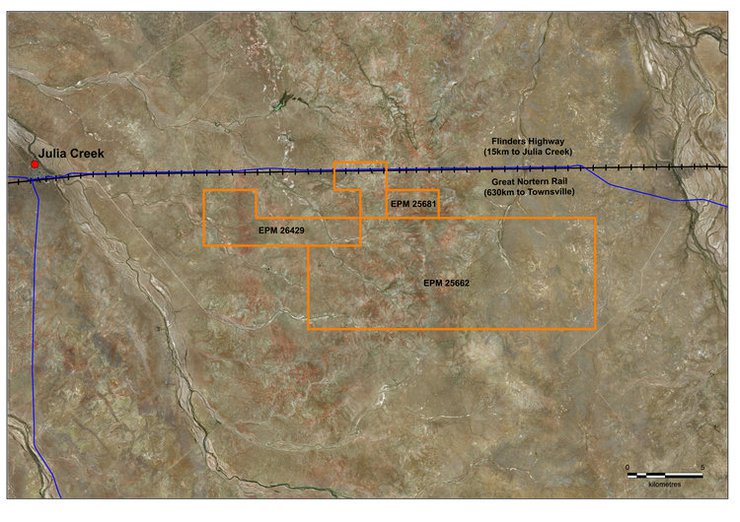

ASX newcomer QEM’s promising Julia Creek Project is located in north-west Queensland, targeting both vanadium and oil shale prospects.

In 2015, the company conducted an initial exploration program onsite, which resulted in a maiden JORC Inferred Resource of 1,326Mt with an average yield of 0.36% vanadium.

In March 2018, meanwhile, QEM upgraded that Resource by 35% to 1,700Mt at an average yield of 0.34% vanadium, with high-grade target zones up to 0.74% vanadium.

These results are the strongest indication yet that the site presents an opportunity for a world-class vanadium mine.

The company’s upcoming stage two exploration program includes:

- 3000m of drilling to upgrade resource from Inferred to JORC Indicated/Measured

- Increase resource base with inclusion of additional targets/zones

- Commence landowner and stakeholder engagement

- Complete pre-feasibility studies, including metallurgical test work, research processing options and upgrading the tenement model

Pursuit Minerals (ASX:PUR)

Market cap: $2.93M

Current share price: $0.034

Pursuit Minerals is an emerging mineral exploration company which holds a world-class vanadium project in Scandinavia.

The company has recently confirmed high-grade assay results at its Airijoki Project in northern Sweden, where historical analysis delivered results including 178m at 1.33% vanadium from 9m.

Another hole 1km down strike returned 10m at 2.01% vanadium from 77.15m.

PUR also has an eye on Germany, which currently does not produce its own vanadium. The nearby country is ramping up its renewable energy efforts as it phases out nuclear energy.

Neometals (ASX:NMT)

Market cap: $135.9M

Current share price: $0.25

Neometals is looking to develop the promising Barrambie deposit in Western Australia.

Barrambie’s eastern band is one of the highest grade hard rock titanium deposits in the world, containing a Mineral Resource (2005) of 48Mt at 22% titanium. During the acid leach process, the company aims to recoup vanadium from the Barrambie deposit.

Surefire Resources (ASX:SRN)

Market cap: $6.67M

Current share price: $0.01

Surefire Resources holds two vanadium projects: Unaly Hill and Victory Bore.

Both are located around 560km north-east of Perth. Combined, they contain an Inferred Mineral Resource of 237Mt grading at 0.42%-0.44% vanadium.

The company is now in the advanced stages of planning for its drill program at Unaly Hill, with the same targeting rationale and geophysics to enable similar methodology to be applied to the hitherto untested Victory Bore area.

In part 3 of this guide we will cycle through the remainder of ASX listed vanadium plays.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.