Creso to reap the rewards of building a robust business

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In 2018, a record number of companies publicly listed on exchanges with a combined capital accumulation of over US$18billion.

Canada became the second and the largest country in the world to regulate cannabis for adult use.

The US signed the Hemp Farm Act of 2018, effectively de-scheduling hemp and cannabidiol (CBD) as schedule 1 narcotics and regulating the hemp industry on a federal basis.

South Korea became the first South-East Asian country to legalise medical cannabis.

Ahead of these developments, Creso Pharma established itself as an early mover in the industry, making significant inroads in 2017.

This was reflected in its share price as it became one of the best performing stocks leveraged to the cannabis sector in that year with its shares increasing from about 20 cents in January 2017 to hit a high of $1.34 in November that year.

What impressed about Creso Pharma during that period was its commitment to build a business rather than ride a trend.

The company has gone on to grow the relationships forged during that period across all areas of the supply chain, as well as paving the way for entry into new markets that should generate substantial revenues in coming years with immediate traction likely to occur as early as 2020.

Further, the group has launched new products and it has a portfolio of 13 high quality Swiss Made GMP (Good Manufacturing Practices) certified products, four of which have already been commercialised.

Cashing in on a US$148 billion industry

With this profile, Creso Pharma presents as one of the pick companies leveraged to the sector as management positions it to capitalise on a market that is forecast to reach US$148 billion by 2026.

One factor that has worked against the company in the last 12 months has been the distraction of a proposed takeover which was deemed to be neither fair nor reasonable by the independent expert.

Though the failure of a takeover under these terms would normally imply that the subject of the offer is undervalued, creating upward share price momentum, such has been the negative sentiment towards the broader industry in 2019 that Creso Pharma’s shares have lost ground.

Management has invested heavily in laying the foundations for a robust business, the fruits of which investors should start to see immediately in 2020 with the potential for exponential growth thereafter.

However, this level of investment has placed a strain on the company’s balance sheet, and if one had to identify another factor that has dragged on its share price this would be it.

Management has moved quickly to address this issue saying on Monday that it had ‘’secured convertible debt and share placement financing to bolster its balance sheet and is now in a strong position to pursue its renewed growth strategy.’’

Selling established products into high demand markets

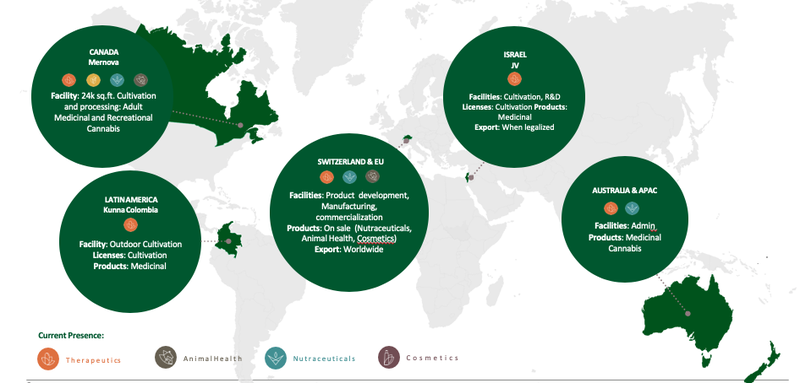

From a broader perspective, Creso Pharma’s portfolio of cannabis and hemp-derived products focuses on the four key areas of therapeutics, nutraceuticals, animal health, and cosmetics.

The company currently has a portfolio of 13 products which have been developed with pharmaceutical expertise and methodological rigour by a qualified pharmaceutical team.

Four products have been commercialised, and are generating sales, and nine are pending commercialisation.

All of Creso Pharma's products are made with standardised dosing and formulations through the application of pharmaceutical rigour, Good Manufacturing Practices (GMP) standards and proprietary, innovative delivery technologies.

In addition, they carry the well-known "Swiss Made" label that is synonymous with premium-quality products.

In human health, Creso Pharma anticipates signing with more commercial partners to expand the commercial reach of its two existing products cannaQIX® 10 and cannaQIX® 50 and to introduce the newly developed products in additional European countries.

The company is prioritising Spain, Portugal, the Scandinavian countries, as well as Poland and Israel.

Creso Pharma’s launch of cannaQIX® 10 into South Africa is planned for the March quarter of 2020 as the first CBD based product to be commercialised as CAM (Complementary Alternative Medicine), followed by a phased entry into other African countries, as well as expanding to additional CBD based products with the same partner pharmaceutical company.

In animal health, Creso Pharma's partner Virbac is introducing the two initial anibidiol® products into further countries in Europe and will be launching Creso Pharma's new animal health products in the near future.

For both human and animal health, Creso Pharma has initiated its reach into North America, where it is in discussions with a number of potential partners to introduce its human and animal products into selected US states.

In South America, Creso Pharma has filed its animal health products in Argentina and Uruguay together with PharmaCielo and is at the last stage of approval.

Commercial partners have been identified, terms negotiated, and a plan outlined for a long-term collaboration on the existing range of products as well as on the new products that Creso Pharma has developed which are ready for launch.

Mernova an important cog in supply chain management

In any manufacturing and distribution business effectively controlling all aspects of the supply and distribution chain will invariably result in optimum margins, efficiencies of scale and reliability of supply with the latter being essential in terms of establishing strong relationships with those who pay for the product that they take to market.

Creso Pharma offers just that with a key link in the chain being its Mernova Medical facility in Canada.

The granting of a licence in February to cultivate at Creso Pharma’s “Mernova Medical” facility in Nova Scotia made Creso the only ASX listed company that has 100% ownership of a Canadian licensed producer.

As a holder of a cultivation licence, Mernova Medical is permitted to sell and distribute dried and fresh cannabis, cannabis plants and cannabis plant seeds to other companies that hold certain licences under the Cannabis Act.

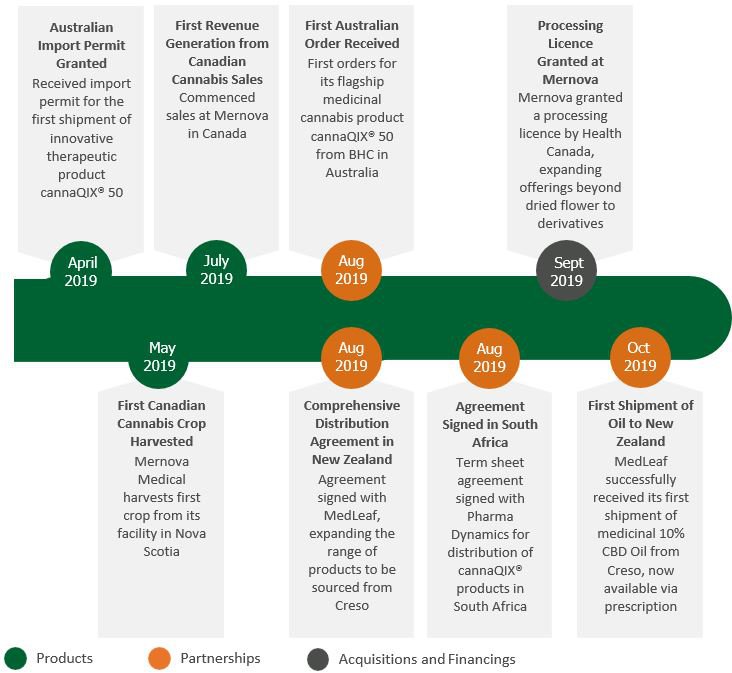

In addition Mernova Medical Inc., was granted a licence to process cannabis by Health Canada on 13 September 2019. The processing licence expands Creso Pharma’s offerings beyond the cultivation and sale of dried flower from the Halifax-based cannabis facility and enables the Company to produce and wholesale distribute cannabis oils, concentrates and other derivative products in Canada and abroad.

The Company is pleased to announce that Mernova is also actively engaged and in advanced stages of securing European GMP certification.

This certification is granted by the European Medicines Agency, with the Good Manufacturing Practice (GMP) describing the minimum standard that a medicine’s manufacturer must meet in their production processes.

Once Creso Pharma has secured EU GMP certification, it will be one of only very few EU GMP certified producers in Canada, allowing the Company to export and sell to Europe and especially in Germany and Switzerland.

There is a very high demand in Germany and Switzerland for medicinal cannabis from European GMP-certified growing facilities and the Company is prepared to capitalise on this with the high-quality flower produced at Mernova’s Nova Scotia facility.

Germany, which legalised medical cannabis in March 2017 and has a population exceeding 80 million, is positioned to become one of the largest medicinal cannabis markets in Europe. Creso Pharma has already secured commercial partners in Switzerland and Germany to purchase flower and oil from Mernova, and is also negotiating long term monthly orders of larger quantities in these regions.

Secure storage for concentrated product valued at $100 million

With a fully automated climate control and irrigation facility and 10 growing rooms with total production of 3500 kilograms per year, Creso has the infrastructure to generate substantial revenues from selling into a wide range of markets.

This has already started with first sales achieved in July 2019.

Creso has a supply agreement with TerrAscend Canada, a Licensed Producer (LP), to provide its premium cannabis product, securing revenue for 2019.

In terms of managing the supply chain, a key strategic advantage of the Mernova Medical Windsor facility is the secure storage room which allows for Mernova Medical to wholesale acquired cannabis products from other licensed producers or even import low cost cannabis products from Creso’s Colombian operations.

The secure storage room can house up to $100 million in concentrated product which could be utilised by Creso as an input into medicinal based delivery technologies for the massive European market and through its established distribution channels.

The Colombian connection

Though Mernova will be central to Creso’s success, its wholly owned Kunna S.A.S operation also opens up new markets, most notably Latin America including Argentina, Colombia, Chile, Mexico and Uruguay.

Kunna S.A.S. holds a suite of 5 licenses, which will be important, especially when one considers that Colombia is predicted to export more than 40.5 tons of medicinal cannabis oil by 2019.

Reuters reported in September that Colombia could export $6 billion a year in medicinal cannabis products, making marijuana its third-largest source of foreign exchange.

While investors have called for simpler regulations for marijuana producers, Colombian law already regulates the possession, production, distribution, sale and export of seeds and other marijuana products like oils and creams.

However, it is a little like gaining permits and licenses for mining in South America as the wheels of progress can move slowly and at times unpredictably.

That is where Creso Pharma has a distinct advantage in terms of being able to source product and move it through the production and distribution chain in Canada.

Creso Pharma also has a strategic partnership with Cohen Propagation Nurseries in the cultivation of medicinal cannabis in Israel and its reach is broad.

Cohen’s products are famous for high quality, sterility and hygiene and are supplied with a special quality certificate from Israel’s Ministry of Agriculture Plant Protection and Inspection Services.

It has 550 highly trained staff working on 15.7 hectares of green houses.

By partnering with leading global companies in product development, manufacturing and distribution, Creso Pharma has been able to, and will continue to accelerate the development and distribution of its products worldwide.

The company also boasts a strong in-house team, and it is this combination of registered quality brands, global reach and professionalism which differentiates Creso from other medicinal cannabis companies, leaving it positioned to deliver a stellar performance in 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.