Will Codan benefit from a new era of fossicking Australia?

Published 18-JUL-2017 14:09 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

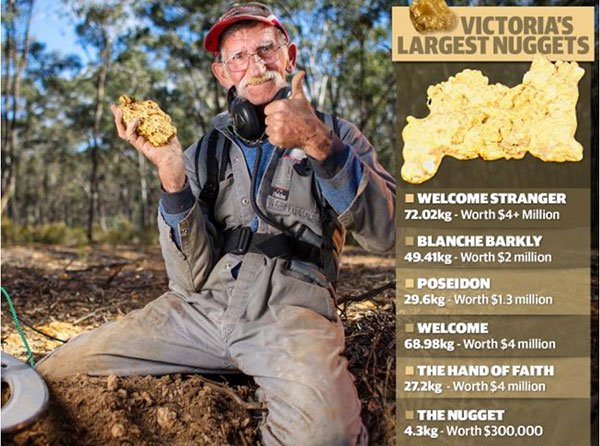

What could be called amateur gold prospecting is experiencing a boom, boosted by some successful finds in recent years. Take this recent success story of one prospector in the Victorian goldfields who found a 4kg nugget.

Just as the makers of picks and shovels were the winners out of the 1850s Australian gold rush, one ASX listed company Codan (ASX:CDA) has a long history of developing high-tech metal detection devices, and could be set to benefit from this new gold rush.

Especially as its equipment attracts the likes of prospectors such as Syd Pearson.

This is gold! An Aussie larrikin gold fossicker and former garbo, Syd Pearson sets out with his metal detector, discovers a 4.3 kilogram gold nugget, lights up a cigarette, throws on the Billy and the rest is history.

However, what makes this story even more interesting is that other recent events have demonstrated there are still plenty of nuggets in ‘them thar hills’, and Australians are gaining a renewed interest in gold fossicking at a time when the commodity price is attractive and metal detectors have reached a whole new level of sophistication.

This is not only providing amateur fossickers with a professional advantage, but the new technology has improved to the extent that they are helping big miners on the global stage.

Just last week ASX listed mining company, Artemis Resources (ASX: ARV) informed the market that it and its joint venture partner Novo Resources had uncovered near surface gold nuggets at Purdy’s Reward near Karratha in Western Australia.

Of course ARV is still an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

While assay results hadn’t been undertaken when the announcement was made last week, ARV was able to clearly show the size of the nuggets, the largest being four centimetres long.

In commenting on what led to the find, Novo said, “The floor of the first 2 x 2 metre pit was swept with a metal detector to evaluate distribution of any gold resulting in multiple zones of coarse gold being evident”.

It is worth viewing the YouTube footage as it demonstrates the efficacy of a simple handheld device in detecting gold at the site which was in the top one metre of the 11-metre horizon.

Codan to benefit from increased personal prospecting?

While fossicking for gold has traditionally been extremely prevalent in Africa, there are a number of reasons why the Australian market could experience substantial growth in the near to medium-term.

Though personal prospecting has tended to be a means of income in Africa, CDA has indicated over the years that demand in the Australian market is driven by families and weekend enthusiasts, as well as keen gold prospectors.

Just as the ageing population is seen to be a significant driver of local tourism in Australia, it could be that retirees make up a substantial proportion of new age fossickers.

Syd Pearson’s story and the latest development involving ARV aren’t isolated events. In the last 12 months, a 145-ounce nugget was found in a similar area to where Pearson had success.

This was on the southern edge of central Victoria’s famous ‘Golden Triangle’, and was located only a foot below the surface. The same prospector had found a nine-ounce nugget just the day before.

Based on today’s prices these two nuggets would fetch in the vicinity of $250,000 and $12,000 respectively.

CDA produces a range of five detectors priced from between US$1000 and US$10,000. The features of the Rolls-Royce GPZ 7000, which is effective at the depths referred to by Novo Resources, are shown below.

Minelab driving strong profit growth

The GPZ 7000 is driving strong growth within the company, to the extent that its contribution was instrumental in driving a recent profit upgrade. The company is now forecasting a net profit of $44 million in fiscal 2017, representing earnings per share of approximately 25 cents.

These figures imply a PE multiple of approximately 9.5 relative to Monday morning’s opening price of $2.37, which appears fairly conservative given that guidance represents earnings per share growth of 100% in fiscal 2017, which follows on from EPS growth of circa 75% in fiscal 2016.

CDA also has a high profile radio communications division which develops and distributes long-range digital radio and land mobile radio devices with applications in defence and emergency services sectors.

The radio communications division has been bolstered by the January acquisition of the 9300 range of military tactical antennas from Stealth Telecom FZC of Sharjah, UAE. This includes the purchase of proprietary intellectual property and tooling. And there is scope for further acquisition-led growth with the company being in a net cash position of $20 million as at April 30.

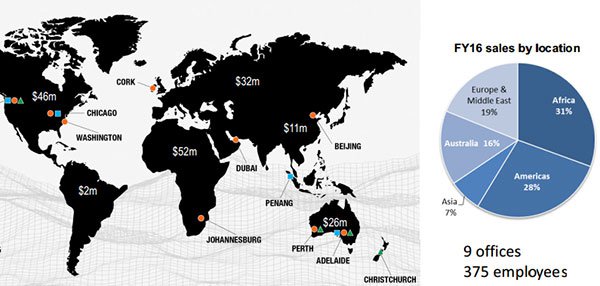

This arm of the business also provides diversification during periods of volatility in the mining sector – and combines well with the fact that CDA is highly diversified in terms of its spread of revenues across international markets:

So if, like most of us still in the workforce, you don’t have the time to go fossicking for gold – you can profit-share with the ‘picks and shovels’ makers of the 21st century via a shareholding in a company like CDA.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.