Cash rate unchanged, Aussie dollar climbs

Published 07-OCT-2015 11:20 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

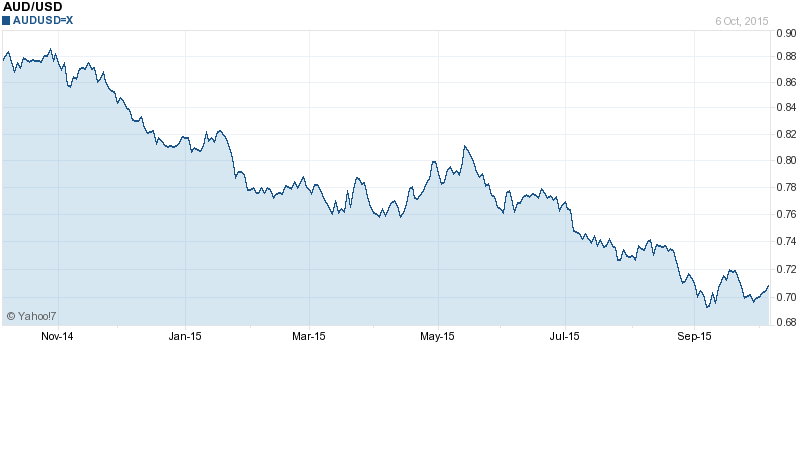

The Australian dollar climbed 0.5% to 72c compared to its US counterpart after the Reserve Bank once again left interest rates on hold. Rates have remained unchanged for five consecutive RBA meetings.

Daniel Dubrovsky of Daily FX says, “Looking at the Central Bank’s monetary policy statement, the RBA judged that leaving the cash rate unchanged at 2% was appropriate at this meeting. Further information on economic and financial conditions will continue to adjust the committee’s outlook for effective policy. Most of what the bank said, remained unchanged, yet the Aussie rallied.”

Future market expectations hint to a further cut in interest rates in the next 12 months. However this is tempered by a lack of a clear cut change in rhetoric.

“This has resulted in the markets becoming less certain of a rate cut in the near future,” Dubrovsky said. “Indeed Australian two-year government bond yields rallied more than 1.4% in the aftermath of the announcement as the Aussie climbed.”

AUD vs USD

In keeping the rates unchanged, Glenn Stevens said, “The global economy is expanding at a moderate pace, with some further softening in conditions in China and east Asia of late, but stronger US growth. Key commodity prices are much lower than a year ago, in part reflecting increased supply, including from Australia. Australia’s terms of trade are falling.

“The Federal Reserve is expected to start increasing its policy rate over the period ahead, but some other major central banks are continuing to ease policy. Equity market volatility has continued, but the functioning of financial markets generally has not, to date, been impaired. Long-term borrowing rates for most sovereigns and creditworthy private borrowers remain remarkably low. Overall, global financial conditions remain very accommodative.

“In Australia, the available information suggests that moderate expansion in the economy continues. While growth has been somewhat below longer-term averages for some time, it has been accompanied with somewhat stronger growth of employment and a steady rate of unemployment over the past year. Overall, the economy is likely to be operating with a degree of spare capacity for some time yet, with domestic inflationary pressures contained. Inflation is thus forecast to remain consistent with the target over the next one to two years, even with a lower exchange rate. In such circumstances, monetary policy needs to be accommodative...

“Regulatory measures are helping to contain risks that may arise from the housing market. In other asset markets, prices for commercial property have been supported by lower long-term interest rates, while equity prices have moved lower and been more volatile recently, in parallel with developments in global markets. The Australian dollar is adjusting to the significant declines in key commodity prices.”

According to Swissquote market analyst Arnaud Masset, the tone of the statement was slightly less dovish then the market had anticipated.

“Despite expectations, there was no downgrade in the global growth assessment or additional discussion on uncertainty in China. The RBA maintains the general view that ‘the global economy is expanding at a moderate pace, with some further softening in conditions in China and East Asia of late, but stronger US growth’.”

However Massett feels that regional growth is losing momentum and could potentially have a deeper impact on Australia than the RBA recognises.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.