The bricks and mortar holding the building industry together

Published 04-OCT-2016 14:49 P.M.

|

21 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While Australia is best known for its mining materials, there are a number of highly successful consistent performers in the building materials space that rank well both domestically and overseas.

While most of the companies we will examine are exposed to the residential housing sector, as well as large commercial and infrastructure building activity, following on from our segment on developers of residential properties we will be assessing their leverage to the housing industry, as well as determining where in the cycle they will be recognising revenue.

Adelaide Brighton

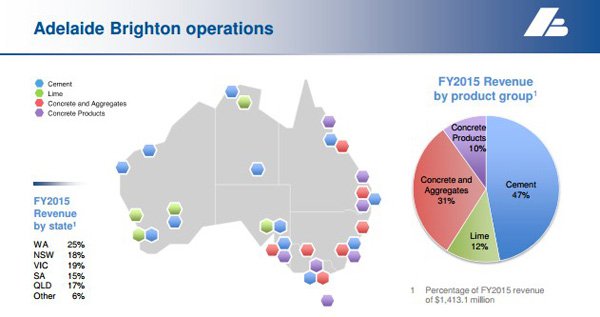

Adelaide Brighton (ASX: ABC) is Australia’s largest concrete producer, as well as being the leading importer of cement and clinker providing it with a strong competitive position in that market. This is important given that Australia imports circa 30% of its cement requirements, mainly in the form of clinker which is used in cement grinding.

The company is also the second-largest cement supplier in Australia. However, what is often missed is the group’s strong lime business. ABC is the largest lime producer in the minerals processing industry and it benefits from activity in the gold mining and aluminium processing sectors.

With the Australian dollar gold price performing strongly in the last 12 months and many companies either increasing or commencing production, this should be of assistance in the coming 12 months.

However it should be noted that commodity prices such as gold prices do fluctuate and are no guarantee to continue an upward trend, it is therefore wise to seek professional financial advice before making an investment decision in this stock.

Lime accounted for 12% of group revenues in fiscal 2015 with production coming from its operations in Western Australia, South Australia and the Northern Territory.

However, for the best part Adelaide Brighton is a cement, concrete and aggregates business with the company operating quarries, processing plants and distribution centres in most states and territories of Australia.

ABC has typically been viewed as a long-term value play that consistently delivers strong returns on equity. There hasn’t been one 6 month period in the new millennium when the company hasn’t paid a dividend.

However, the substantial share price growth between mid-2014 and mid-2016, a period in which the company’s shares doubled, resulted in significant yield dilution. Similar to the likes of the big banks and Telstra, yield seeking investors flocked to the stock, pushing its share price as high as $5.95.

Consensus forecasts are currently pointing to a dividend of 26.4 cents for the 12 months to December 31, 2016. A retracement to approximately $5.20 would imply a yield of circa 5%, much more attractive than what was on offer at $5.95. Consequently, don’t be surprised if support remains robust around the $5.00 mark.

Management noted when delivering its interim result for the six months to June 30, 2016 that demand for its products from the residential sector had been strong in New South Wales, while favourable conditions in south-east Queensland and South Australia should result in overall buoyant conditions for the remainder of the year.

Importantly, in Victoria demand for ABC’s key building products was led by multi-residential construction. The only state which received a poor mark in the first half was Western Australia.

In discussing the group’s outlook for the second half and its impact on the full-year result to December 31, 2016, chief executive, Martin Brydon said, “Sales volumes of pre-mixed concrete, aggregates and concrete products are expected to be significantly higher compared with the previous year”.

While most of the dynamics surrounding the company are positive, the fact remains that its share price increased some 50% from circa $4.00 to a 12 month high of $6.00 in the last 12 months which suggested it had to outperform in the six months to June 30.

This wasn’t to be with underlying earnings before interest and tax of $110.6 million below the expectations of Macquarie Wealth Management ($118.3 million).

This prompted the broker to slightly trim earnings per share forecasts for fiscal years 2016 and 2017 while downgrading the price target from $5.50 to $5.10, broadly in line with levels it traded at for most of September before rallying towards the end of the month.

Boral

Like Adelaide Brighton, Boral (ASX: BLD) is an S&P/ASX 100 company that has consistently paid strong dividends. Consequently, it is also closely followed by institutional investors and self-managed super funds.

Boral is Australia’s largest building and construction materials supplier with operations in all states and territories.

In Australia, BLD supplies concrete, quarry products, asphalt, cement, bricks, plasterboard, roof tiles, timber and masonry which is used across numerous sectors including infrastructure, residential construction and commercial buildings.

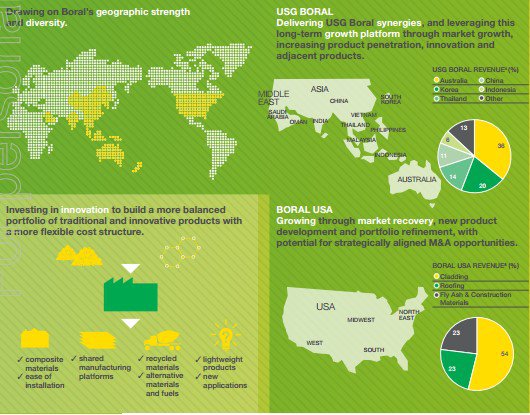

BLD also has a substantial presence outside of Australia through its 50% owned joint-venture with USG, the leading supplier of plasterboard and internal linings products across Asia and Australasia.

This geographic diversification also extends to the US where it has industry-leading positions in bricks, concrete and clay roof tiles, as well as manufactured stone and a small but growing composite products business.

BLD’s shares spiked nearly 50% in fiscal 2016, but it fell out of favour after delivering its full-year result in August, trading as low as $6.17 in mid-September. However, it seemed another one of those cases where sharp share price gains needed to be accompanied by outperformance rather than results that were in line with consensus forecasts.

Simon Thackray from Citi noted that core earnings from the group’s construction materials and cement division were 3% shy of his forecasts. Perhaps this contributed to negative sentiment.

However, to some extent the negative sentiment appears to have dissipated with much of the retracement from $7.40 on the day prior to releasing its result to circa $6.20 being regained as the company traded as high as $6.80 last week.

Macquarie Wealth Management ran the ruler across the stock in mid-September when its share price was trading at $6.24. The broker settled on a neutral recommendation with a 12 month price target of $6.60.

Macquarie noted that BLD was addressing some of the challenges in its US business. Optimising returns in this market will be extremely important for the company going forward as growth in residential housing is expected to outstrip that forecast in Australia.

The other factor working in BLD’s favour could be its exposure to increased infrastructure activity in Australia. The company has a strong position in the supply of asphalt which is used in the construction of roads and other essential infrastructure.

With regard to the group’s fundamentals, Macquarie is forecasting a fiscal 2017 profit of $283.4 million, representing earnings per share of 37.5 cents, indicating that the company is trading on a PE multiple of 16.7.

Given that the broker is forecasting compound annual earnings per share growth over the next three years of less than 10%, BLD looks fully valued.

From a yield perspective, the likes of ABC represents a far better option with BLD’s consensus dividend forecasts for fiscal 2017 implying a yield of less than 4%.

However, perhaps the key to BLD’s long-term success hinges on its diversification strategy which involves entry into new geographic markets, as well as the development of products that will be more in tune with environmental initiatives, as well as being more cost-effective.

The group’s diversification strategy is outlined in the graphic below.

BlueScope Steel

BlueScope Steel (ASX: BSL) is a global leader in premium branded coated and painted steel products. The group is the third largest manufacturer of painted and coated steel products globally and it also has a dominant position in the engineered steel buildings industry, holding down number one position in building and construction markets.

Management’s strategy is to drive growth in premium branded coated and painted steel markets in Asia Pacific while building on the strong value proposition it can offer customers across the Pacific Rim from Asia, Australia, New Zealand and the West Coast of North America.

Simon Thackray from Citi noted that BlueScope’s underlying fiscal 2016 earnings before interest and tax of $570.5 million, representing year-on-year growth of 89% was the company’s best performance since 2008.

The key takeaway for Thackray though is the fact that the group enters 2017 as a business that is much more structurally sound following efficiency and cost saving initiatives undertaken in its Australian operations over the last 12 months.

There were already signs in 2016 indicating management’s strategy was gaining traction with the above data indicating return on invested capital increase from 5.9% to 9.3% and net debt reducing by nearly $600 million in the six months to June 30, 2016.

North Star BlueScope Steel is the best performing steel plant in the US and one of the best in the world, delivering consistent financial performance and strong returns on invested capital.

One of BSL’s key initiatives in fiscal 2017 is to drive growth in premium branded coated and painted steel markets in the Asia-Pacific region after delivering 31% compound annual earnings before interest and tax growth in ASEAN, North American and Indian markets over the last four years.

Management noted the much stronger performance in its Australian steel products had been driven by improved residential construction sales, particularly in New South Wales, Victoria and Queensland.

Importantly, activity in the alteration’s and additions market segment also played a significant role in delivering robust earnings growth. This could be a key factor going forward should new housing plateau or taper off, as it is often the case that homeowners and investors turn to renovations rather than investing in new properties.

BSL’s Colorbond business which includes the manufacture and distribution of roofing, guttering, fascias, garage doors and fencing is generally a beneficiary of an active renovation market.

When it comes to valuations analysts are divided on BlueScope Steel which isn’t all that surprising given the complexity of the business and the number of contributing factors that can potentially impact earnings, but are outside of management’s control. These extend beyond broader industry conditions to issues such as foreign exchange movements and commodity price variations. It is important to seek professional financial advice to understand these factors before making an investment decision.

Thackray is fairly bullish on the group having increased his price target from $10.00 to $11.03 in response to the group’s fiscal 2016 result. Macquarie Wealth Management has an outperform recommendation on the company with a 12 month price target of $9.85.

What is worth considering though is the fact that the recent pullback in BSL’s share price from a 12 month high of $9.24 in August to circa $7.50 could represent a buying opportunity given the steep discount to both Citi’s and Macquarie’s price targets.

Brickworks

Brickworks (ASX: BKW) is the overarching entity for an enterprise that manufactures and distributes clay and concrete products, as well as being involved in property development and other investments.

It isn’t a stock for investors who are looking for a pure play construction materials company, but because it has some strong brands and generates a significant proportion of income from this sector it is worth examining.

BKW’s performance in the first half of fiscal 2016 highlighted the need to drill through top line results in order to determine where its strengths and weaknesses lie.

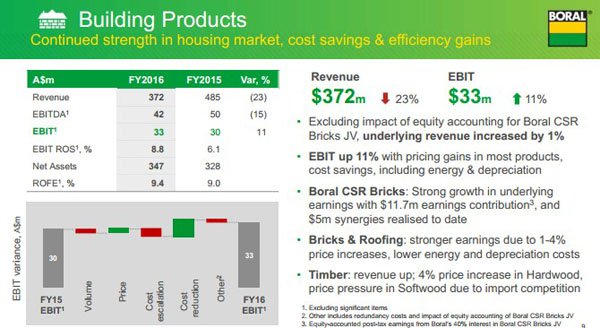

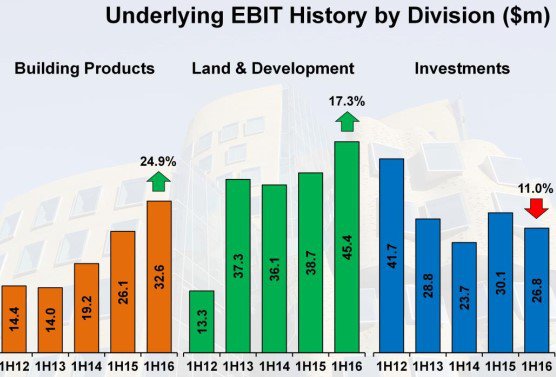

While earnings before interest and tax was $98.8 million, substantially ahead of the expectations of Macquarie Wealth Management ($92.7 million), the performance was significantly boosted by earnings in land and development of $45.4 million.

As highlighted by Macquarie, strength in its property division was driven by revaluations relating to its property portfolio.

On the other hand, earnings before interest and tax from the building products division was $32.6 million, only slightly ahead of the broker’s expectations.

While there was a short-term kick in the company’s share price post the result this quickly waned and since April the company’s shares have retraced from circa $16.00 to recently hit a 12 month low of $13.13.

When Macquarie reviewed the first half performance it maintained an underperform expectation with a price target of $15.45. Interestingly, as recently as early September the broker reaffirmed its underperform expectation despite the fact that the company was trading at a significant discount to its revised price target of $15.35.

However, it was only last week that Macquarie ran the ruler across the stock and lowered its 12 month price target to $14.50, but because of the substantial retracement in its share price the broker lifted its recommendation from underperform to neutral.

Notwithstanding the upgrade in recommendation, there appear to be options in this sector that offer better earnings visibility with less scope for unexpected negative developments from non-core divisions.

On this note, as recently as late August the company noted that following the completion of its asset impairment assessment an impairment of goodwill held with Austral Bricks Western Australia totalling approximately $47 million will be recognised in the group’s fiscal 2016 results.

While this is a non-cash item, it highlights the complex nature of the group’s business, and from an operational perspective is arguably significant in terms of underlining risks related to its exposure to the Western Australian market.

CSR

CSR is another diversified building materials group with its operations covering areas such as bricks, gyprock, glass and more contemporary products such as Hebel. The company generated a net profit of $166 million in the 12 months to March 31, 2016, outperforming the expectations of Jonathan Snape from Bell Potter who was forecasting a profit of $160.6 million.

The main difference between Snape’s projections and that achieved by CSR was a stronger than expected contribution from its aluminium business, as well as higher than expected earnings in the building products business, largely resulting from the success of the PGH Bricks joint-venture.

The building products business delivered record earnings before interest and tax of $169.1 million including consolidated earnings from CSR 60% interest in the PGH Bricks joint-venture.

CSR’s Managing Director, Rob Sindel, noted that the company had strengthened its position in the multi-residential market by investing in building systems including AFS and Hebel. He believes the business is better for its diversification as it helps to insulate CSR from volatility in any one sector.

The group’s AFS business is a leader in load-bearing permanent form work solutions for external and internal concrete walls with its key brands being Logicwall and Rediwall. The products load-bearing qualities make it readily adaptable to high-rise buildings.

Given the boom in multi-residential housing CSR’s tilt at this market was timely. However, management believes the broader residential construction market still has legs, noting in May that the pipeline of residential construction activity continue to rise as total commencements for the 12 months to December 2015 were 221,000 compared to 192,000 in the previous corresponding period.

There are two areas of CSR’s business that can deliver lumpy earnings performances. One of these is its aluminium business which is exposed to shifts in commodity prices. The other is the company’s property portfolio which can be impacted by the timing of transactions.

Following the fiscal 2016 result, Snape increased his profit forecast for fiscal years 2017 and 2018 (at this point broadly in line with consensus) and increased the 12 month price target from $3.23 to $3.67. At this stage though the company was trading at $3.65, prompting the analyst to place a hold recommendation on the stock.

More recently CSR has retraced to sub $3.50 levels which imply a PE multiple of circa 11.

Fastbrick Robotics

Fastbrick Robotics (ASX: FBR) burst onto the construction industry scene and its share price soared. Since the company first came to attention its shares have increased from 2.7 cents to recently hit a high of 15 cents, representing an increase of more than 450%.

It should be noted that this is still an early stage play and as such still has a long way to go before becoming a significant player in the construction industry. It is important to take a cautious approach to an investment decision in FBR and seek professional financial advice.

However, it has been more than just investor awareness that has driven the company’s share price to incredible heights in such a short period of time.

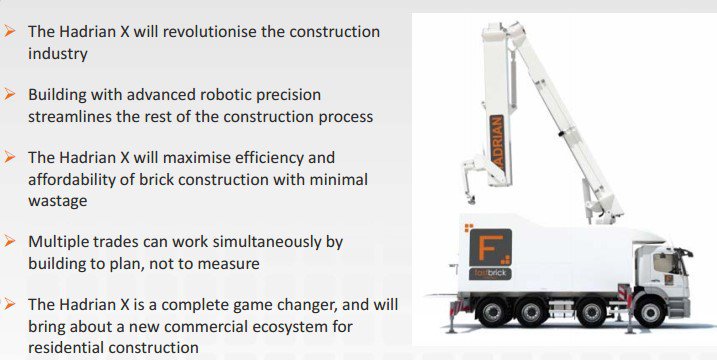

Finfeed has followed the story closely with one of the most significant events occurring in mid-July when FBR commenced construction of the Hadrian X machine, an automated device capable of laying 1000 standard bricks equivalent per hour.

The house reached lock-up stage in mid-September using a proprietary system of precision bricks and adhesives. The innovative house will form part of FBR’s pilot market strategy, and the group will use Perth as its test-bed market as the company follows on from its recent framework agreement with Archistruct Builders and Designers, which was negotiated in early September.

The agreement involves a collaboration between the two parties to build 11 homes using the Hadrian X within the confines of a standard building environment. Each house will have a minimum floor plan of 180 square metres, consisting of at least three bedrooms and two bathrooms.

Archistruct will be supplying the land and all the building services required to complete the 11 homes. The task for Hadrian X will be to build the brickwork from slab to ceiling, forming part of a residential home.

Importantly, FBR’s methods and materials used by the Hadrian X are compliant with regulatory requirements, ensuring the company can meet its goal of initiating a commercial pilot program in 2017. In answering the question as to whether there is room for a company such as FBR in the construction industry, the following numbers speak for themselves.

The Hadrian X construction was carried out using manual bricklaying methods and received engineering and Council approval. The bricks used in construction of the house feature interlocking perpendicular joints, which means the adhesive only needs to be applied on the top and bottom of the brick. This system also increases the thermal efficiency of the house and the strength of the structure.

While FBR doesn’t have the deep history associated with the likes of Adelaide Brighton, Boral and CSR, it is arguably the way of the future.

Just as Rio Tinto has its fully automated mega trucks removing ore from the Pilbara, FBR is at the cutting edge of automating at least one area of the construction industry.

Fletcher Building

Shares in diversified building materials group, Fletcher Building (ASX: FBU) surged after the company delivered a strong fiscal 2016 performance. In fact, the group has been one of the best performing companies in terms of share price performance post reporting season with a rally from $9.13 to a high of $10.79 in mid-September representing a gain of 18%.

While its shares have retraced over the last two weeks this has mainly been attributable to the company going ex-dividend and broader market weakness. Even comparing share price performances over the last three months, FBU has substantially outperformed ABC, BKW, BLD and James Hardie Industries (ASX: JHX), which we are yet to review.

The only company to match it with FBU’s BlueScope Steel which is level pegging. Of course, FBR has left these big players in their wake with a three month gain of more than 350% compared with gains of circa 25% made by BSL and FBU.

FBU has always been a well-run business with tight cost controls and a management team highly focused on maintaining strong margins as well as growing the top line.

In terms of year-on-year growth, it was the residential and land development business that thrived in fiscal 2016 with revenue growth of 44%. It also led the way on the earnings front with a gain of 27%.

While FBU is based in New Zealand it generates a substantial proportion of income from Australia and other global regions. In fiscal 2016, New Zealand accounted for revenues of NZ$5.4 billion, while Australia contributed circa NZ$3 billion.

The company also generates income from other areas such as Asia, North America and Europe, but revenues from these regions (NZ$1.2 billion) were relatively flat in fiscal 2016.

In the building supplies segment, FBU provides materials such as timber, frame, truss and concrete. While not considered a building materials segment, FBU is extremely diversified and it also generates income from the bathroom and plumbing sectors.

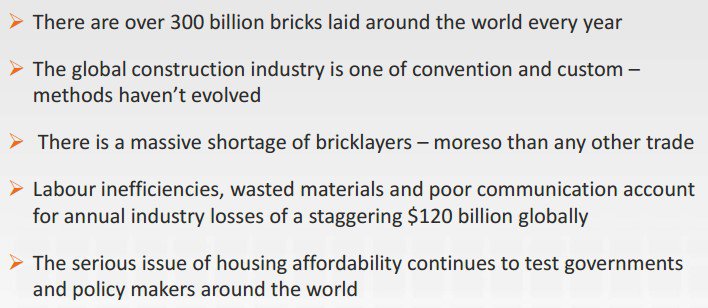

The following highlights the group’s strong fiscal 2016 performances across its cement, aggregates and plasterboard businesses.

Key drivers in the group’s residential and land development operations in fiscal 2017 are expected to be an acceleration of home building in Auckland and Christchurch, along with the benefits of maximising development opportunities from industrial landholdings.

From an international perspective, management is expecting a turnaround in its Formica business in Europe, particularly in the UK market. This is one of the company’s hallmark brands globally and the group will focus on optimising and fully loading its new laminate plant in China.

The company has a particularly strong position in this field as it also owns Laminex Australia and New Zealand. Other big brands owned by the company include pipe products such as Humes and Iplex and the well-known Tradelink stores that operate in Australia.

While all the signs are positive for FBU in fiscal 2017 its share price has run hard and the recent high of $10.79 isn’t all that far shy of its all-time high of $11.99 which it struck just prior to the global financial crisis.

It is also trading well ahead of the consensus 12 month price target of $9.17, suggesting there may be better value in some of the other stocks covered.

James Hardie Industries

James Hardie industries (ASX: JHX) manufactures and distributes fibre cement products that are used in internal and external construction of buildings both in the residential and commercial sectors.

The company delivered a solid result for the 12 months to March 31, 2016, but by the time it reported its result in mid-May its share price had run strongly, increasing from a low of $14.24 in January to circa $19.00.

This weighed on the sentiment of some brokers with Simon Thackray from Citi downgrading his recommendation from neutral to sell on the basis that the company’s shares were trading in excess of his target price of $18.60.

However, plenty of investors were undeterred and its shares hit an all-time high of $23.09 in late July. Thackray has since revisited the stock, and he now has a neutral recommendation on the company with a 12 month price target of $20.80, broadly in line with the group’s current trading range.

The positive sentiment towards the company has been driven by its exposure to a predicted recovery in the US housing market. On this note, Macquarie Wealth Management recently highlighted that the group offered the highest exposure to favourable US housing market dynamics and this is a contributing factor in underpinning the broker’s outperform recommendation and price target of $23.00

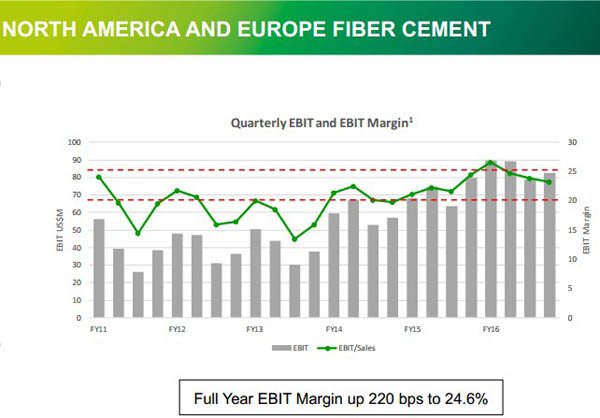

JHX earns a substantial proportion of income from its operations in the US. In fiscal 2016 group sales totalled US$1.7 billion, and the company’s North American and European fibre cement business accounted for sales of US$1.4 billion.

The company generates strong margins from its fibre cement business with EBIT margins in North America and Europe (24.6%) slightly ahead of its Asia-Pacific operations (23.8%). Margins have always been a good indicator of how JHX is performing as they are a good measure of underlying efficiencies and cost controls.

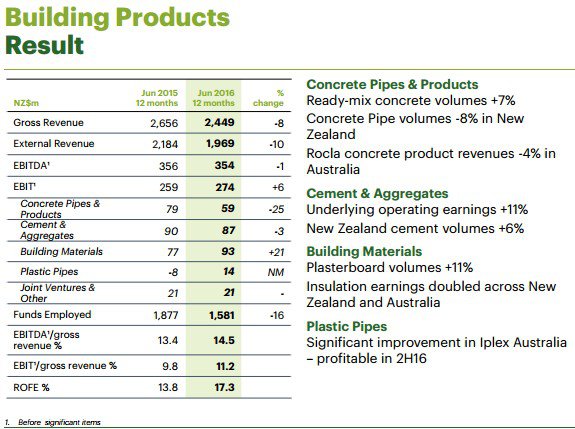

They are also a fairly accurate share price guide. In the following table which shows quarterly margins over a five-year period in its core North American and European business it can be seen that margins hit a five-year low in 2013/14.

At this point the company’s shares were trading at sub – $10.00 levels. However, its share price has maintained a fairly consistent upward trajectory over the last three years, basically mirroring the margin table.

While the table demonstrates a slight quarter on quarter dip in mid-fiscal 2016, there was a recovery in the fourth quarter, and in any case margins are close to historically high levels. Consequently, if this were to be used as a share price indicator, one could draw the conclusion that there is support in the vicinity of $20.00.

However, historical share price trends may not be replicated in the future and this should not provide the basis for an investment decision.

With regard to industry conditions, much has been said of a strong rebound in the US housing market, but this is yet to materialise and even JHX noted in its outlook statement that it expected moderate growth in US housing in fiscal 2017 based on a forecast for new construction in the US of between 1.2 and 1.3 million new starts.

However, the company is still expecting strong growth from that region, accompanied by robust margins which are tipped to be at the top end of management’s target range of between 20% and 25%.

When delivering its full-year result management said that it expected the Australian market to trend ahead of the average growth level for domestic repair and remodel, as well as single detached housing in the eastern states of Australia in fiscal 2017.

With regard to new starts in the detached eastern states housing sector, JHX anticipates they will be in a range between 100,000 and 110,000 in calendar year 2016.

It should be noted that broker projections and past share price performances are not an indication of future earnings and trading patterns, and should not be used as the basis for an investment decision.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.