Boost for biotech as big pharma faces patent cliff

Published 08-JUL-2016 13:34 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

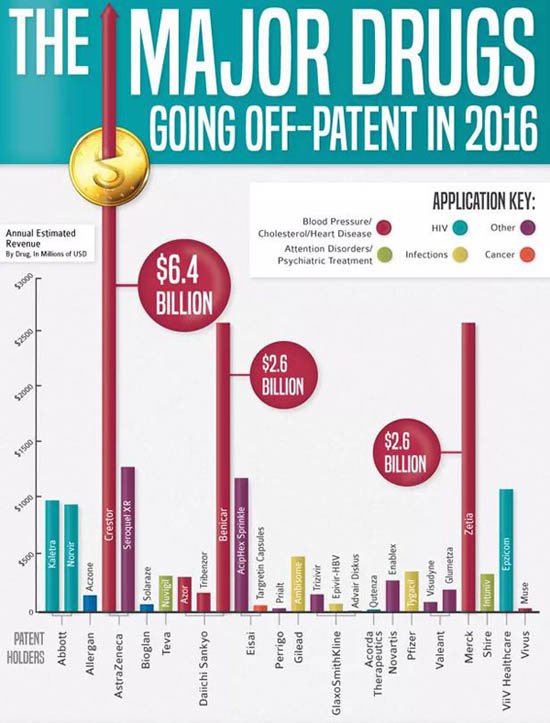

The Big Pharma industry is set for a major shakeup as many blockbuster drugs begin to come off patent.

Some high revenue generating drugs will soon no longer be covered by their protective patents, meaning cheaper generic drugs can flood the market.

AstraZeneca’s blockbuster cholesterol drug Crestor was one of the most prescribed drugs in 2015 and generated US$6.4 billion in revenue.

Revenues from Crestor are set to plummet 90%, with the FDA approving a cheaper generic version of the drug.

Typically being 30-80% cheaper, generic drugs can take up to 80-90% of the market share within their first year alone.

As a result, Big Pharmaceuticals will start to see their revenue streams dry up and will need to tap into new areas of the market.

“Blockbuster pharmaceuticals are on the verge of patent expirations while late-stage product pipelines are barren, thus shaking the foundations of an industry that was once the darling of Wall Street.” – Louis P. Berardi ,CFO EVP Corp. Development.

However, that’s easier said than done as the cost of bringing a drug to the market can be around US$2.5 billion, making research and development a costly exercise.

Further, very few products ever reach blockbuster status – $1 billion in annual sales.

This opens a door of opportunity for the biotech industry who are typically more-lean and focused on early stage development, replacing Big Pharma’s need for costly R&D expenditure.

Big Pharma buying up biotech

Historically big pharma has developed drugs to treat the symptoms of certain diseases, where biotech companies on the other hand, target the underlying disease itself.

With expensive R&D costs, combined with the patent cliff problem reducing revenues for Big Pharma, the trend has been towards mergers and acquisitions as a means of expanding business operations and product lines.

This has been evident over the past few decades, however has been an accelerating trend in recent years.

A PricewaterhouseCoopers report on the pharmaceutical industry predicted that 2016 would be ‘the year of merger mania’ and it appears that they were correct.

This year we saw the biggest deal ever in the pharmaceutical industry with Allergan and Pfizer merging in a deal valued at US$160 billion.

Whilst mergers between pharmaceuticals has been taking place for years, a more recent trend has emerged with Big Pharma moving into the biotech space to bolster its business model.

Big Pharma’s mergers and acquisitions of biotech companies in recent months include:

- AbbVie acquired cancer drug biotech Stemcentrx for US$5.8 billion.

- Big Pharma giant Novartis partnering with Xencon in a deal worth up to US$2.6.

- Leo Pharma agrees to US$1 billion deal with AstraZeneca.

- Bristol-Myers Squibb acquires Cormorant for US$520 million.

- Takeda signs US$400+ million deal with TiGenix.

- Johnson & Johnson to pay US$173 million for license from biotech OSE Immunotherapeutics.

It should be noted that Biotech companies do not always need Big Pharma to make it to market and can make it on their own, as proven with Australia’s big three: CSL, ResMed and Cochlear.

Although working with a pharmaceutical company with established sales channels and large cash reserves can be beneficial in advancing a drug or technology to market.

On a side note, it is often overlooked due to Australia being known for its natural resources, however the nation has been ranked in the top 5 countries in biotech for the third year running.

Why the healthcare sector is going to remain hot

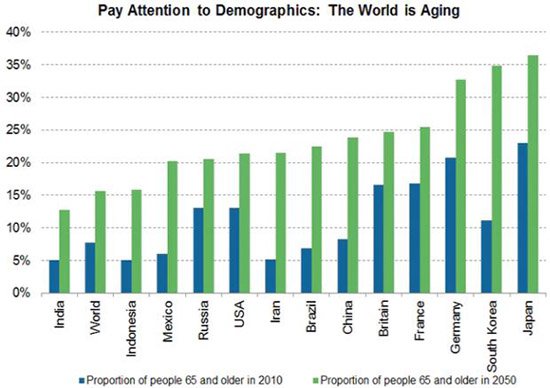

As life expectancy continues to increase along with the current 7.3 billion and growing global population, demands place on the healthcare industry are only going to increase.

Coupled with an aging population and the fact that half of all lifetime care expenditure occurs at 65 years of age upwards, the need for better healthcare solutions will persist.

Another key driver in the healthcare sector is the increased rate of chronic illnesses, which has been described as the biggest health challenge facing Australia, according to the Australian Institute of Health and Welfare.

With Big Pharma falling off the patent cliff and an increase in demand for healthcare services across the globe, the biotech industry will increasingly become the focal point of the healthcare industry.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.