Bezos' split: Will Amazon get divorced, too?

Published 22-JAN-2019 10:21 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

When CEOs get divorced, particularly when there's no prenuptial agreement, there’s the possibility of a lot of wealth changing hands. When it’s a publicly listed company, you add the possibility that a founding CEO may lose their holding stake on the company, because their spouse can claim rights to up to 50% — or in same cases, more.

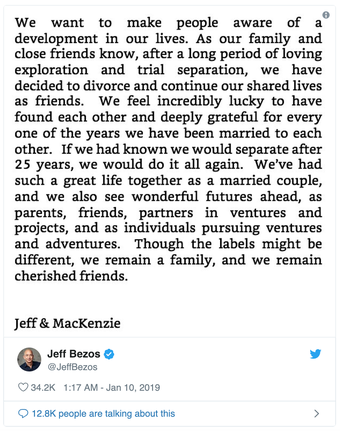

The bigger the company, the bigger the potential for major flow-on effects, which is why the recent announcement from Jeff and MacKenzie Bezos of their intention to divorce made the headlines.

Jeff Bezos is currently the richest man alive, and the company he founded — Amazon.com Inc (NASDAQ: AMZN) — is worth US$829.39 billion. In fact, just days before the divorce announcement, the world learned that Amazon surpassed Microsoft to the become the most valuable public company in the world. Both had been in a tight race with Apple and Alphabet for the title.

The company’s share price has increased ~15% in the last month, so the news of the divorce doesn’t seem to be unsettling shareholders too much.

The question is, should it?

In 2013, Leland Stanford Junior University (an American private research university in California) adopted the term ‘separation anxiety’ to describe the impact of a CEO’s divorce on shareholder sentiment. The article uses past examples of CEOs of public companies going through a divorce and suggests that “shareholders should pay attention to matters involving the personal lives of CEOs and take this information into account when making investment decisions”.

It also identifies three potential risks. First, and most obviously, a loss of ownership or control over the company through a major reduction in the CEO’s stake and the uncertainty that surrounds it. A prenuptial agreement would eliminate this risk, yet in the case of Amazon, neither party has confirmed whether a prenuptial agreement exists, suggesting (some might say) that it does not.

Second, the stress of going through a divorce can pose a major distraction for a CEO who would ideally be focussed on running the large company.

And third, the article argues that it could impact on the CEOs own attitude towards risk. Why? Because CEOs are usually incentivised by compensation programs — in essence, watching their own wealth head northwards is usually a key motivator for most CEOs. If something happens that sees half their wealth taken away, it could (theoretically) influence how risk-averse they are in making future decisions.

In the case of Amazon, there’s a lot that’s unknown at this stage, but shareholders don’t seem too rattled — yet. One US West Coast-based attorney, Christopher Melcher, didn’t seem to think there was much to worry about, putting it this way: “Their divorce will be handled as quickly as an Amazon delivery”.

Beyond Bezos’ divorce, the company has had a few positive news stories in 2019 so far.

Amazon continues to impress despite divorce dangers

On January 11, just a few days after the divorce was announced, The Washington Post published a story stating that Amazon was planning to use its massive cloud computing service to launch into the streaming market for video game play. This would open the way for Amazon to become a major player in the gaming industry, where Microsoft and Google are already competing.

Amazon’s entry could see users able to play these games without having to buy the consoles, which is fairly big news in the world of gaming.

But it’s worth keeping in mind that Jeff Bezos actually owns The Washington Post, so the positive coverage for Amazon right around such a critical time may not simply be a coincidence.

And while the news is big, the fact remains that Microsoft is promoting its own similar service called xCloud which would allow users to play games on consoles, PCs, and mobile devices; and Alphabet's (NASDAQ: GOOGL) Google is reportedly working on its own video game streaming platform, too.

January 18 saw some other positive news coverage for Amazon. The mega company has been increasing its ocean shipping service, reportedly sending nearly 4.7 million cartons of consumers goods from China to the US over the past year.

Amazon offering companies with manufacturing bases in China the option of beginning-to-end shipping, would be a big advantage in what is reportedly a highly fragmented ocean freight market.

According to USA Today, CEO of Ocean Audit, Steve Ferreira said: “This makes [Amazon] the only e-commerce company that is able to do the whole transaction from end-to-end. Amazon now has a closed ecosystem.”

CEO divorce or no, there are plenty of indications that Amazon’s world domination is going to continue unabated.

That includes its relationship with the government; and some would argue, its support of government surveillance.

In the last week, Amazon has faced scrutiny over its facial recognition software, with Bloomberg reporting that a group of activist shareholders were proposing that Amazon.com Inc. stop selling facial recognition software to government agencies until its board assesses the impact on people’s civil rights.

All in all, Amazon is somewhat of a moving feast at the moment — and you can be sure shareholders are watching closely.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.