Bezos briefly world’s richest billionaire

Published 23-AUG-2017 14:46 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Amazon CEO Jeff Bezos was the richest man in the world...for a day.

In fact it wasn’t even a day, it was a mere four hours.

When Forbes released its Richest Billionaires list on July 2017 this year, the man who seems to be taking over the world in just about every online retail sector, found himself at the top of the heap.

With a fortune of $90.6 billion, Bezos became the first person to ever top a net worth of $90 billion.

Yet, such are market dynamics, by the end of the day Amazon had retraced and Microsoft founder Bill Gates was once again named king of the billionaires hanging in there with $86 billion, almost $11 billion ahead of Warren Buffet and $13.2 billion ahead of Bezos who fell back to a measly $72.8 billion.

This quick video, briefly explains why Bezos held the mantle albeit ever so briefly.

Bezos has been a billionaire for more than 20 years, yet his wealth has surged in the last two years mirroring the recent surge in Amazon stock.

Predictions are that Bezos will soon surpass Gates.

According to leading US equity analyst James Camark, if Amazon completes its deal with Whole Foods, it could come close to doubling its stock. Completion depends on whether the Amazon-Whole Foods deal is deemed to violate anti-trust laws.

“Honestly, this could be the first trillion-dollar company. I mean there is very low risk for the FTC to not approve this deal. But if they do rubber-stamp it as a yes, I think there’s very little to stop this from becoming a $2,000 stock,” Camark said on CNBC’s Squawk Box.

With Amazon looking to purchase a meal kit business in the US and move into Australia in a meaningful way, having now purchased warehouse space, there is every chance that Bezos will be number one on the list next year.

There was an all-time high of 2043 people on Forbes’ World’s Billionaires list this year and there are more billionaires than ever before worth a total of $7.7 trillion.

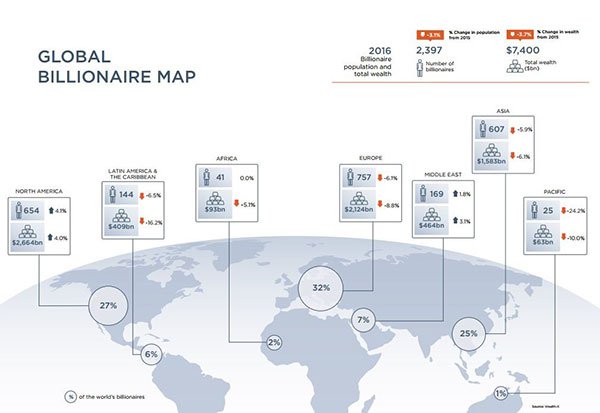

A recent report conducted by WealthX shows the breakdown.

Also of note, was that finance is still the most common industry to build a billion-dollar fortune, Asia is the fastest-growing region for the ultra-rich and the number of billionaires grew by 15.2% to 645 and their net worth climbed 19.6% to $1.69 trillion.

With that kind of growth, there’s hope for us yet, it would seem.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.