Bevan Slattery, a shareholder’s best friend

Published 24-AUG-2018 10:56 A.M.

|

16 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The S&P/ASX 200 Telecommunications index (XTJ) has been one of the worst performing sectors over the last two years. It has fallen from more than 2000 points in mid-2016 to a July low of 976 points and is now sitting in the vicinity of 1140 points.

Telstra Corporation (ASX:TLS) has been largely to blame as it is by far the index heavyweight.

If you overlay a chart of the index with Telstra’s share price chart it is virtually a mirror image.

Yield chasers come unstuck

In the years leading up to Telstra capitulating, the strong performance was largely driven by those seeking a robust yield in an environment of declining interest rates.

Granted, Telstra was paying a handsome dividend, but neither earnings nor dividends were experiencing any significant growth, and in fact there were signs emerging in 2014-15 that the company was about to stall.

Which just goes to show that no matter how big the stock, investors should seek professional financial advice when considering any stock for their portfolio.

In January 2015, high-profile stockbroker Charlie Aitken who at that stage was also managing director of Bell Potter Wholesale increased Telstra’s price target from $6.70 to $7.00.

Although it should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

At that stage, Telstra was trading at $6.43. The answer to a question posed by my editor at that time, ‘Can Telstra really hit a high of $7 a share’, it was an unequivocable ‘NO’ with the reasons outlined in this link to my AFR article.

As indicated below, after hitting a high of circa $6.60 in February 2015, Telstra went into freefall and has never recovered, trading as low as $2.60 in June.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Unfortunately, Telstra hasn’t been the only casualty in the telco sector in recent years.

And that pretty much means all the big players, as the following three-year share price chart of Telstra, Vocus Group and TPG Telecom indicates.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Finding value in an oversold sector

While these trends could spark negative sentiment towards the broader sector, investors should remain open-minded.

One can’t assume that if the big corporates can’t make it, the small players haven’t a chance.

In fact, the smaller players have a history of identifying emerging trends and being nimble enough to capitalise on those opportunities without the distractions of running a huge telecommunications network.

Cast an eye back over the last 15 years and you will see that the telco sector has proven highly unpredictable with few constants that investors can clutch onto in terms of identifying that diamond in the rough.

Why 15 years? We have narrowed our research down to the post tech wreck period in order to remove the sometimes misleading one-off occurrences that emerge when conditions are extremely volatile.

It may come as some surprise, but the common denominator with the most consistent track record of delivering strong shareholder returns wasn’t a company – it was a person.

A man for all seasons

And it wasn’t Bill Gates or Steve Jobs, it was a home-grown, self-made man in Bevan Slattery who has not only delivered extraordinary returns, but demonstrated an uncanny ability to identify the next big thing.

However, it is one thing knowing the technology, it takes entrepreneurial skills and astute management to implement the strategies required to capitalise on opportunities.

Rather than just identifying emerging trends, Slattery has taken a ball and all approach whereby he keeps plenty of skin in the game as a major shareholder and controller, as well as a very hands-on approach on day to day operational matters.

An innovator rather than a follower

Slattery wasn’t gifted a seat on a board, nor was he fast-tracked through the corporate world, and one could say this has worked in his favour.

I first met Slattery shortly after he started as a co-founder of Brisbane-based PIPE Networks which commenced trading in 2001 and listed on the ASX in 2005 with a market capitalisation of less than $20 million.

Since then this young, ambitious but down-to-earth entrepreneur has tipped the telecommunications industry on its head, successfully beating the big players in developing new technologies and going from success to success in delivering shareholder returns Telstra investors could only dream of.

Slattery is now seen as the doyen of the telco industry in terms of identifying new opportunities, implementing state-of-the-art technologies and establishing market leading positions in whatever fields he targets.

Turning $12 million into $370 million

At the time of listing, PIPE Networks had fibre-optic networks in Brisbane and Sydney, providing a fast and economical alternative to the other telcos in its core business areas of dark fibre services.

The company quickly grew to become Australia’s largest internet exchange (IX) operator, providing peering services in six cities to more than 60 service providers including Primus, iiNet, WebCentral and Internode.

At the time of listing, the company’s clients included Virgin Blue, Flight Centre, ABN-AMRO Morgans, Hitachi Data Systems, Betta Electrical, Bechtel, Alcan, Queensland Rail and the Queensland Government.

Under the offer, PIPE Networks issued 8.75 million new shares at a of 40 cents to raise $3.5 million, bringing the total shares on issue to 30.75 million, implying a market capitalisation of approximately $12.3 million.

As has always been the case, Slattery maintained a major stake of 32.2% in the company, with the other founder Stephen Baxter also owning 32.2%.

In 2009-10 PIPE Networks was acquired by TPG Telecom (ASX:TPM) for $6.30 per share, implying a market value of $373 million, making it a +30 bagger.

At the time of acquisition, TPG estimated that PIPE Networks would contribute EBITDA of circa $53 million in fiscal 2010, more than four times PIPE Networks’ IPO market capitalisation.

Those who invested $10,000 in the PIPE Networks’ IPO (25,000 shares) walked away with $157,500 - not a bad day at the office.

Slattery leads the way again

Perhaps it pays to revisit some of the accolades that Slattery received in order to put his achievements at PIPE Networks and the others we are about to discuss into perspective.

Slattery was awarded “Young Entrepreneur of the Year” in the Northern Region finals of the 2006 Ernst & Young Entrepreneur of the Year awards.

In August 2009, he was awarded the ACOMM Australian Telecommunications Ambassador of the Year Award in recognition of his contribution as a visionary in the telecommunications industry and his personal quest to advance Australia’s access to technology and promote progress in the telecommunications market.

In March 2010, Slattery was also awarded the ATUG’s Charles Todd Medal for his contribution to the Australian Telecommunications marketplace including the construction of the $200 million submarine cable system connecting Sydney to Guam.

NEXTDC next cab off the rank

However, not one to rest on his laurels, by December 2010 Slattery was back in the game as the founder and chief executive of NEXTDC Ltd (ASX:NXT), a company formed to develop and operate the next generation of carrier and systems integrator with data centre facilities.

This was familiar territory for Slattery as he had extensive experience in designing, constructing and operating data centres with PIPE Networks.

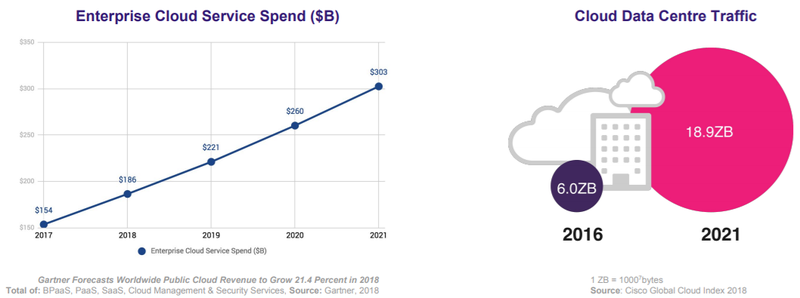

Further, Slattery had done his homework and determined that there was a shortage of third party data centre space which would be accentuated by the continued growth in internet traffic and data volumes, the emergence and growth of cloud (internet-based) computing, and increased outsourcing of data centres.

Be mindful of the fact that Slattery’s forward thinking behind the establishment of NEXTDC occurred nearly 10 years ago when many people hadn’t even heard of cloud computing.

Slattery projected that neutral data centre providers would be a key beneficiary of this market dynamic, with growing customer preference for neutral operators and the associated choice and flexibility with regard to carriers and systems integrators.

He believed that NEXTDC would be well-positioned to meet the demand from corporate and government customers in its initial target markets with continued supply constraints expected given barriers to entry such as limited site availability, the expertise required in constructing and operating a data centre, and the significant upfront capital investment.

The following data set shows Slattery was once again on the money.

And the shareholders that backed Slattery have again been rewarded handsomely.

The company’s current market capitalisation is circa $2.4 billion, and the following share price chart tells the story.

Note that the company has never traded at less than a 30% premium to its opening price.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

For those who are keen to extrapolate the figures as to how the bank balance would look if one had put the proceeds of their initial $10,000 investment in PIPE Networks into NEXTDC, these are the numbers.

The acquisition of 157,500 shares at $1.00 per share in NEXTDC would now have a market value of $1.1 million.

But wait, there’s more

In June 2015 Slattery brought Superloop Ltd (ASX:SLC) to market with a starting price of $1.00, implying a market capitalisation of $90 million.

Slattery retained a substantial share of the company, accounting for 66.7% of shares on issue.

Superloop was established to invest in telecommunications infrastructure, with the aim of becoming a leading independent provider of connectivity services in the Asia-Pacifc region.

Specifcally, Superloop’s initial focus was to invest in fibre optic telecommunications infrastructure between locations of high interconnection density such as data centres and submarine cable landing stations within Australia and Singapore - is that ringing any bells?

Slattery was positioning Superloop to cash in on both the submarine type fibre network systems such as the one he built while at PIPE Networks and the demands of data centres such as NEXTDC.

Superloop’s key assets at the time of listing were a 15-year exclusive right to a fibre network within the major metropolitan areas of Brisbane, Sydney and Melbourne and a recently acquired underground duct network in Singapore spanning approximately 120 kilometres.

That acquisition allowed the company to accelerate the rollout of its fibre optic network in Singapore.

On completion of the IPO, Superloop was debt free and either the operator or owner of strategic networks in Australia and Singapore.

The company continued to assess other Asian markets where it saw similar opportunities to expand the business.

Having made acquisitions in Australia and overseas and delivered substantial organic growth, the following is a snapshot of the company’s progress over the last three years.

The aforementioned data was released on Monday when the company delivered its fiscal 2018 result.

This resulted in the company’s share price rallying some 10%, and it is now trading not far shy of its 12 month high of $2.60. However, it is worth noting that the company appears to have been caught up in the telco sell-off, having fallen from $3.48 in September 2016.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

What is worth noting though is its outperformance against the likes of Telstra.

The following is a three-year chart which shows Superloop’s (yellow line) virtual flatline performance over the last two years compared with that of Telstra.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Owns and operates 640 kilometres of fibre

Superloop’s vision is to be the most trusted enabler of connectivity and managed services in the Asia Pacific region.

The company owns and operates over 640 kilometres of carrier-grade metropolitan fibre networks in Australia, Singapore and Hong Kong, connecting more than 275 of the region’s key data centres and commercial buildings.

Superloop has constructed a core network in Singapore connecting major data centres, key enterprise buildings and cable landing stations.

The network includes a diverse loop to the Singapore Stock Exchange (SGX) for secure, real-time data transactions.

In Hong Kong, Superloop has established a 110 kilometre fibre optic network to initially connect 30 strategic sites including the Hong Kong Stock Exchange data centre.

The company has constructed TKO Express, the first submarine cable to connect the traditional carrier hotels located in Chai Wan on Hong Kong Island and the data centre campus located at Hong Kong Science and Technology Park’s Tseung Kwan O Industrial Estate on the mainland.

TKO Express is the world’s largest fibre core count subsea cable system.

Submarine cable infrastructure provider, SubPartners, will expand Superloop’s trans-Australian and international capacity, giving the company ownership of international submarine cable capacity as a member of the INDIGO consortium which is constructing the INDIGO West cable system (Singapore to Perth) and the INDIGO Central cable system (Perth to Sydney).

In a sense, Slattery is engineering and upscaling west coast Australia - Asia-Pacific telecommunications in a similar fashion to PIPE Networks with an increased level of sophistication.

Slattery identifies another emerging industry

Megaport Ltd (ASX:MP1) was founded by Slattery in 2013 with the aim of becoming a global leader in the fast growing elastic interconnection services market.

Elastic connectivity is a term used to define a connection which provides customers with the flexibility to vary their connectivity service requirements based upon their actual demand.

Customers can provision an elastic interconnect between other participants for as short as a day or for as long as a year, for as small as 1Mbps to as much as 100Gbps.

Using Software Defined Networking the company has developed a platform that provides customers with the ability to provision interconnection services between their network and other networks and cloud providers already connected to the Megaport Fabric.

Building it and they will come

Services can be directly controlled by the customer via a device such as a mobile phone or tablet, their computer or Megaport’s open application programming interface (API).

The latter is a software intermediary that allows two applications to talk to each other.

Since commencing operations in January 2014, Megaport has grown all areas of its business.

The following demonstrates the attractiveness of its model.

The company delivered its fiscal 2018 result on Wednesday that featured a sharp uptick in year-on-year annualised revenue.

This increased more than 50% from $14.6 million in June 2017 to $23.8 million in June 2018.

Monthly recurring revenue which provides strong earnings predictability increased from $1.2 million to $2 million.

There was also impressive growth in customers and data centres with the latter increasing from 165 to 221.

Service provider relationships include Google, Microsoft, IBM, Oracle and Alibaba Cloud.

Megaport customers accessing multi-cloud increased more than 200% in fiscal 2018, and based on the following forecasts provided by Gartner it would appear that this strong growth trend is likely to continue.

Megaport achieved a major milestone in opening its North American headquarters in San Francisco that will be used as a base of operations to for its North American expansion into the initial markets of Los Angeles, San Francisco Bay, Seattle, New York, Chicago, Washington DC, Dallas and Toronto.

The company has already been quick to generate revenues from this region with North America accounting for circa 27% of the group’s fiscal 2018 revenues.

Once again, Slattery has pounced on an emerging market and Megaport shareholders have been the winners.

The company hit an all-time high of $4.56 in June, representing an increase of 270% relative to the opening price of $1.25. Also, at no time since listing on the ASX in December 2015 has the company traded lower than its opening price. The following 12 month share price chart shows the recent strong momentum.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

As the company came to the market, Slattery was the largest of the top 20 investors with a stake of 47.1%.

Granted, Megaport has delivered a handsome financial gain for Slattery, but as has been the case with all of the companies he has brought to market, he has had the confidence to put his own money behind the ventures.

It pays to watch this space as his next foray can’t be far away.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.