Bell Potter sees a number of catalysts for copper gold stocks

Published 26-AUG-2016 10:31 A.M.

|

11 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

When Evolution Mining (ASX: EVN) announced yesterday that through a wholly-owned subsidiary it had entered into a transaction with Glencore plc to acquire an economic interest in its Ernest Henry operations it prompted FinFeed to revisit an interesting paper released by Bell Potter analyst David Coates at the start of week.

It was almost as though he flagged the $880 million deal, but more importantly it reinforced the need to perhaps take a more in-depth look at not just the precious metal space, but also the potential implications of a medium-term rebound in copper.

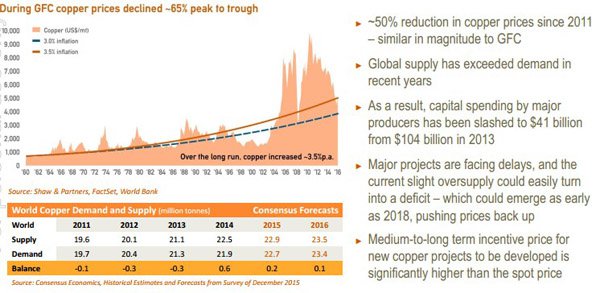

Perhaps the Ernest Henry transaction is a sign that the majors have started to move in anticipation of a recovery in the copper price. Indeed, it was only on Tuesday that Scott Williamson from Hartleys said, “Copper continues to have a strong demand outlook in the medium to longer term and without many new projects being developed at current spot prices we believe now could be the time to get back into copper”.

Sandfire Resources (ASX: SFR) is his top pick, but we will come back to look at individual stocks after examining underlying dynamics more thoroughly.

Coates focused on ASX listed gold equities for a number of reasons. Primarily though he noted that there had been some interesting substantial holding notices in the last week, and data relating to key price and relative value charts in the gold equities space brought Australian gold producers under the microscope.

Having recently looked at relative valuations of Toronto Stock Exchange (TSX) listed gold producers versus ASX listed gold producers Coates noted the former were trading at a premium of 41% to his universe of 19 local stocks.

It is important to be aware that historical share price fluctuations aren’t an indication of future trading patterns and similarly, this data should not be used as the basis for an investment decision.

When narrowing the gap to a more comparable list of half a dozen producers with multiple mines and market capitalisations of more than US$1 billion he noted the premium was an even greater 70%.

While a premium has traditionally been paid in the Canadian market he is of the view that the relative value of Australian top tier gold producers is hard to argue with for offshore investors genuinely seeking gold exposure, or even more importantly a Canadian company looking to acquire offshore assets.

Time to shift to safer jurisdictions

On the score of geographic diversification he referred to recent reports that Kinross Gold Corporation was looking to retreat from Chile, putting its main assets in that country up for sale. While this hasn’t been confirmed in detail by management, it has been widely reported.

The Canadian based group is the fifth largest gold miner in the world by output, and reportedly it has put its two main Chilean gold mines on the market. The company has suspended operations at both the Maricunga and La Coipa mines.

The former produced more than 200,000 ounces of gold equivalent last year, equating to about 8% of total production. It is no secret that there have been ructions between Kinross and Chile’s environmental regulator which involved the shutdown of the water system linked to Maricunga in March.

Coates is of the view that Kinross’s stated aim “to increase its exposure in safer mining jurisdictions” could see it and other major North American players running the ruler over heavily discounted Australian producers.

The other slant to Coates’s argument is that he sees the prospects of merger and acquisition activity occurring amongst Australian players with some perhaps taking the opportunity to diversify, specifically into copper.

Coates said, “In our view a gold producer diversifying into base metals, particularly copper, is a comfortable fit”. He highlighted that both Newcrest (ASX: NCM) and Oceana Gold Corporation (ASX:OGC) already have a material copper component to their revenues, and both Oz Minerals (0ZL) and Sandfire Resources (ASX: SFR) produce gold as a by-product.

Coates also noted that Metals X (ASX:MLX) and Independence Group (ASX: IGO) execute this strategy to a positive market reaction. However, when speaking recently with the management of MLX, they indicated there was potentially merit in splitting the gold and base metals assets into two separate entities which could realise better value from a share price perspective.

This makes sense in that gold has traditionally been a safe haven investment option which is targeted during turbulent economic conditions or periods of low growth, while demand for copper increases during periods of global growth, providing price momentum.

Consequently, the safe haven investor would arguably prefer a pure gold play, while those who are bullish on the economic outlook are likely to favour a pure copper/base metal producer.

Currency movements help to cushion falls in commodity prices

However, the argument comes back to relative value and on this note it is useful to reflect on historical prices in Australian dollar terms as this illustrates the significantly lower impact commodity price gyrations have had on Australian producers as opposed to those in other regions.

When the gold price peaked at circa US$1900 in the second half of 2011 the AUD/USD exchange rate was $1.05, implying an Australian dollar gold price of approximately $1800.

Gold has recently been trading in the vicinity of US$1350 while the AUD/USD exchange rate is in the vicinity of US$0.76. This implies an Australian dollar gold price of approximately $1770.

In tandem with this nominal fluctuation in Australian dollar terms has been a significant reduction in costs of production as mining services groups have become price takers rather than price makers, suggesting not a lot has changed since the boom times in terms of margins being achieved by efficient Australian gold producers.

While currency movements have made for a slightly softer landing in relation to Australian copper producers, the extent of the decline in the copper price far outweighs the cushioning impact of exchange rate variations.

As a means of comparison, copper peaked at circa US$10,000 per tonne in early 2011 when the Australian dollar was at parity. Copper is currently trading in the vicinity of US$4630 per tonne, representing an Australian dollar price of AU$6100 per tonne, a decline of nearly 40%.

Stepping back just two years and looking at less extreme positions in the cycle in terms of both commodity prices and currencies it is clearly evident that Australian gold miners are in a much better position today than they were exactly two years ago.

At that stage with the gold price hovering around US$1280 and an AUD/USD exchange rate of US$0.94 prevailing, the Australian dollar gold price was approximately $1360, $400 shy of where it is today.

Consequently, one doesn’t have to compare extreme points in the cycle to understand that Australian gold producers are in a sweet spot at the moment.

Adding further spice to the story is news that has recently emerged regarding gold purchases by Central Banks in Russia and China.

Macquarie Wealth Management said this week, “Central Banks remained on the buy side of the gold market in the first half of 2016, though Venezuela’s falling reserves were, or will become a drag”.

Notwithstanding that, Macquarie said there is still no appetite for sales, and that the outlook is for lower but still substantive net purchases. Macquarie is of the view that Russia and China, which have accounted for roughly one third of the net addition to Central Bank reserves since 2010, will keep buying.

Which company is the best copper gold combo

For investors who are gold believers but are looking for a piece of the copper action there are a few options, one being Australia’s largest ASX listed gold producer, Newcrest Mining.

However, it has run hard over the last 12 months with its shares increasing circa 150% from approximately $11.00 to hit a high of $27.20 in mid-July before trailing off to current levels of about $23.50. This represents a slight premium to consensus 12 month price targets, suggesting there may be better value elsewhere.

The company also appears expensive from a PE multiple basis, trading at circa 23 times fiscal 2017 consensus earnings per share forecasts.

Oz Minerals is also looking expensive, trading on a fiscal 2017 multiple of 30. Today’s opening price of $6.65 represents an 8% premium to the 12 month consensus price target of $6.15.

Likewise, Independence Group is trading at a premium of nearly 10% to its 12 month share price target. The other drawback with it is that it is more of a multi-base metal commodity play with exposure to the volatile nickel price.

The past performance of these stocks is no guarantee of future performance and again this data should not be used as the basis for an investment decision.

While OceanaGold Corporation provides dual copper gold exposure, its operations extend to areas outside of Australia including higher risk jurisdictions such as the Philippines where its Didipio project is located.

While Evolution Mining fits the thematic with the Ernest Henry deal modelled by Trent Allan from Citi as delivering annual production of 64,000 tonnes of copper (30% attributable to EVN equates to circa 19,000 tonnes), in essence remains a gold play with the Glencore transaction positioning it to generate 830,000 ounces in fiscal 2017 with all in sustaining costs of $930 per ounce, providing a healthy margin of circa $800 per ounce based on the current Australian dollar gold price.

While Citi upgraded its recommendation from sell to neutral and increased its price target from $2.30 to $2.55 on the back of the Ernest Henry deal, based on its metrics EVN appears fully valued relative to its closing price of $2.43 prior to entering a trading halt.

Sandfire Resources gets the nod as Australia’s best copper gold play.

That leaves Sandfire Resources and Metals X. Given the latter is looking to split its assets and it also generates income from other metals such as tin, SFR shapes up as the pick of the bunch with its assets based solely in Australia, a robust growth profile and a share price that looks fundamentally cheap.

Analysts at Macquarie Wealth Management like the stock, noting in July that fourth-quarter production from its DeGrussa project located in Western Australia exceeded its forecasts. The fact that the company had also moved from net debt to net cash for the first time since production began impacted the broker’s decision to lift its recommendation from neutral to outperform.

At that stage the share price target was increased by 3% to $6.10 and the broker said, “Incorporating the stronger fourth-quarter fiscal 2016 production results, higher cash balance and reduced debt and interest costs, fiscal 2016 earnings forecasts are upgraded by 7%”.

However, the broker has since recalibrated its numbers, lowering earnings estimates between fiscal years 2017 and 2019 inclusive by between 5% and 12%. It also reduced the share price target to $5.80.

However, Coates from Bell Potter is more bullish with his price target of $6.65. He noted the same positive developments referred to by Macquarie and added, “The fact that this has been done in a tough copper price environment is an indication of the quality of the DeGrussa project”.

It should be noted that broker recommendations, forecasts and target prices are projections that may not be achieved and financial investments should be based on this information.

SFR offers exploration prospects as the company has an impressive track record in terms of expanding resources and identifying valuable new projects.

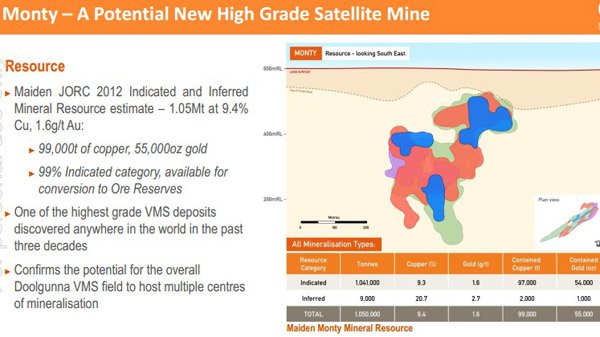

Near-term upside at DeGrussa will stem from the inclusion of production from the high grade Monty copper gold resource. This has an established maiden JORC 2012 indicated and inferred mineral resource estimate of circa 1 million tonnes at 9.4% copper and 1.6 grams per tonne gold, equating to 99,000 tonnes of copper and 55,000 ounces of gold.

However, it is early days at Monty and analysts are expecting this resource to grow as further exploration is undertaken.

While production from Monty will commence in 2017, the real kick comes in fiscal 2018, driving revenues from $482 million in fiscal 2017 to $663 million in fiscal 2018 based on Macquarie’s revised projections.

These forecasts indicate that profit will increase from $64 million in fiscal 2017 to $121 million in fiscal 2018, representing earnings per share of 76.2 cents. This indicates that the company is trading on a PE multiple of 7.1 relative to Thursday’s opening price of $5.41.

Coinciding with this increase in earnings is an anticipated lift in dividend from 12 cents per share to 23 cents per share, implying a dividend yield of circa 4.3% relative to the company’s current trading range.

It is worth noting that the broker’s fiscal 2018 projections are based on a cash copper price of US$2.18 per pound, seemingly conservative given that copper’s five-year trading range is between US$2.00 per pound and just over US$4.00 per pound.

Just in the last six months it has rarely traded below US$2.10 per pound and in mid-July was hovering in the vicinity of US$2.25 per pound.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.