BASF is betting on high purity manganese to supply battery makers

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

German multi-national chemical company, and the largest chemical producer in the world, BASF SE (ETR: BAS), recently unveiled ambitious plans to boost investment in battery cathode active materials (CAM), including a new family of manganese-rich products.

This is a clear response to the rapidly growing Electric Vehicle industry in Europe, a continent with some of the fastest EV adoption rates in the world.

Europe is leading the way with regard to EV manufacturing, but, as the recent pandemic made evidently clear, global supply chains can be easily disrupted. This means creating local supply chains is paramount to meeting manufacturing targets.

BASF is seeking to become the most sustainable CAM producer, with a best in class CO2 footprint.

Speaking at the Vienna Motor Symposium, Peter Schumacher, President of BASF’s Catalyst division, recently shared the company’s plans for the European EV market, highlighting the importance of securing local sources of supply.

While Schumacher discussed the broader industry landscape and other important metals such as nickel and cobalt, his comments represented a vote of confidence in the value of high-purity manganese as a battery raw material.

This was particularly true in terms of manganese’s ability to minimise costs and achieve supply chain security, while delivering an optimum end product in terms of environmental impact.

Schumacher also reiterated the increasing use of high-purity manganese as a vital component of lithium-ion batteries for electric vehicles.

Highlighting the significance of manganese rich products in achieving optimum outcomes from an environmental, financial and product efficiency perspective he said, "The market for CAM materials will become more differentiated over time, and a strong technology toolbox is essential to be in a leading position of this development.

“One example will be manganese-rich products, for which we have a very strong IP position.

“This new product family will play a crucial role in future for the low-cost segment.”

In focusing strongly on supply chain security, Schumacher highlighted that his company had taken the decision to establish a robust position in Europe whereby it could readily source battery cathode active materials, including a new family of manganese-rich products.

Near-term initiatives include the development of two new production sites in Europe.

New plants for precursor materials in Harjavalta, Finland and cathode active materials in Schwarzheide, Germany (see illustration below) will come on stream next year.

Schumacher’s views on the increasing use of high purity manganese have been echoed recently by prominent motor vehicle producers. Volkswagen and Tesla have each announced plans to mass produce a new battery that requires a high proportion of manganese with no cobalt (Tesla at ~ 33% Mn, and VW over 50% Mn).

Both automakers expected the new cathode formulation design to reduce costs without compromising performance.

Derisking the challenges of surging metal prices

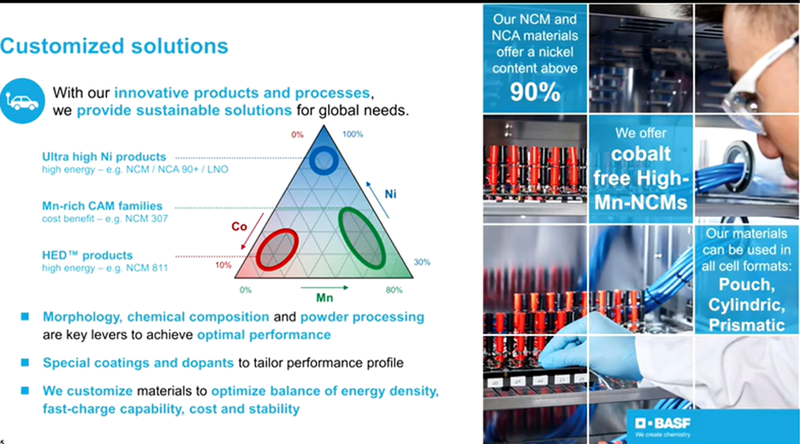

BASF is at the forefront of pushing cathode active materials (CAM) innovation to meet the needs of its customers.

The group has the technological flexibility to support its customers by tailoring products to their exact needs.

Some of the key focus areas are higher driving range and faster charging times, and on this note the company is currently offering a broad CAM portfolio in the industry with a focus on Ni-rich NCM products and low or even no cobalt for high energy density.

As alluded to earlier, manganese-rich products are likely to be at the forefront, and BASF has a very strong IP position in this area.

This new product family will play a crucial role in future for the low cost segment, particularly given that manganese is abundantly available at much lower cost than nickel or cobalt.

Supply reliability is a key focus for the company, and Schumacher noted that manganese doesn’t seem to be constrained, effectively de-risking the challenge of surging metal prices that the industry is experiencing, a trend that is likely to produce even further headwinds as supply struggles to keep up with accelerating demand. BASF’s plans bode well for producers of high purity manganese. As more automakers commit to accelerated electrification of their fleets and manganese content in battery formulations trends upwards, the gap between projected supply and demand continues to widen. The most recent market analysis from Cairn Energy Research Advisors and CPM Group estimates that overall demand for high-purity manganese will be thirteen times higher in 2030 than it is today.

Schumacher highlights hidden carbon dioxide contributors

BASF noted that cathode materials are a wonderful example for the importance of sustainable chemistry in many value chains for downstream industries such as the EV industry.

However, sustainability challenges lie beyond just the CO2 footprint, and these are hidden in areas such as the extraction and treatment of raw materials.

In terms of addressing these issues the company believes the starting point must be the mines and metal refineries.

This is one of the key contributors of the CO2 footprint of the battery as minerals or metals like nickel, cobalt and lithium are many times only available in very low concentration in the respective ore bodies.

Isolating and refining metals requires substantial energy as metals need to be converted into an electrochemically active material, and the cathode material is the key raw material that drives performance and they represent a significant cost of a battery.

Production is very energy intensive at temperatures above 600 °C and energy efficient production is key to reducing the CO2 burden further.

So far, the supply for cell manufacturers in Europe and in North America almost exclusively relies on deliveries from Asia.

BASF believes that this is not sustainable and the risk of significant supply disruptions would not come as a surprise.

Hence, the group has established a global production footprint, ensuring customer proximity and its modular expansion concept allows the company to be a reliable growth partner for its customers to support the massive transformation that lies ahead.

‘We invest in recycling’ says Schumacher

Recycling for battery materials requires smart chemistry to achieve highest metals recovery returns with lowest energy input.

By offering the best-in-class CO2 footprint, BASF can help further reduce the CO2 burden of EVs – over time, the group would like to close the loop to avoid further resource and CO2 intensive mining and refining.

Schumacher stressed that BASF always believed in having the supply of key raw materials in close proximity to customers.

He said that local production and local content for battery materials was the key to ensuring a resilient and sustainable supply chain, and it is this underlying thesis that has driven the company to develop production facilities in Europe.

As well as shortening logistical routes, BASF will also reduce its dependence on imports from remote areas.

Together with the group’s established production plants in Asia and the US, BASF will be the first truly global cathode active material producer in the world to support the rising demands of its customers in all regions locally. It is an imperative for BASF to have the supply chain of key raw materials in close customer proximity.

Responding to the needs of its downstream customers, BASF is committed to a sustainable future, and looks to be playing its role in the development of a sustainable battery value chain, with locally sourced, high purity manganese to play a major role.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.