Australia’s foreign debt balloons to $1 trillion as S&P labels it as ‘extreme’

Published 13-OCT-2016 17:10 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

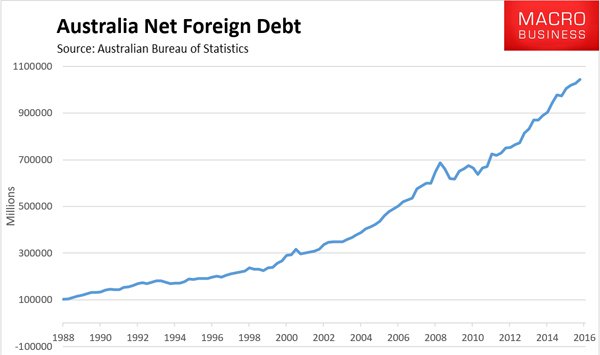

Australia may soon lose its coveted AAA sovereign credit rating following Standard & Poor’s decision to downgrade the nation’s long-term outlook from stable to negative, due to foreign debt liabilities reaching alarming levels.

This is what happens when you don’t pay your bills, as the Australia’s foreign debt rose from $970 billion to $1.045 trillion over the 12 months to June.

However S&P wasn’t the only body to point out Australia’s growing debt concerns.

The International Monetary Fund singled out Australia for its rapidly increasing debt, at a time when global debt levels have reached US$152 trillion.

Treasurer Scott Morrison tried to instil confidence noting that two other ratings agencies has affirmed Australia’s AAA rating.

The last time Australia lost its AAA rating was in September 1986, when both Moody’s and S&P downgraded to AA1. The rating fell again in August 1989 to AA2, before regaining its AA rating many years later in August 2002.

It should be noted however, that ratings given by these US run agencies have become politically motivated in recent years and used as financial weapons against China, Russia and European nations, to name a few.

The agencies have been accused of misleading the public as noted when they covered up for the big banks prior to the 2008 crash, when ratings agencies S&P’s, Moody’s and Fitch maintained an A+ rating on toxic mortgage-backed securities being sold by the banks.

This latest warning from S&P comes at a time when German banking giant Deutsche Bank faces bankruptcy following Angela Merkel’s decision to not bailout the struggling bank and as the US Department of Justice seeks to fine Deutsche US$14 billion for fraudulent activities prior to the 2008 financial crisis.

Many top analysts believing that should Deutsche Bank go under it would make the Lehmann Brothers collapse look like a picnic.

What impact would that have on Australia?

Coupled with our report on how we are potentially facing an unavoidable recession due to the alarming debt levels in the private sector as well, following 100 quarters of growth, the latest warning from S&P begs the question whether Australia has lived beyond its means and has bitten off more than it can chew.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.