Australia’s economy goes 100 quarters without a recession

Published 09-SEP-2016 12:09 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

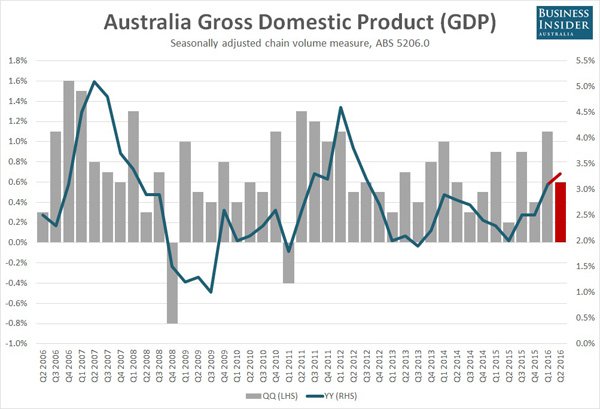

Australia’s second quarter gross domestic product results have been released showing that the economy grew by 3.3%, making it the strongest growth experienced since the June quarter in 2012.

This is now the 100th quarter that Australia has gone without technically experiencing a recession, closing in on the Netherlands’ record of 103 quarters of expansion.

A recession for those wondering is when you have two consecutive quarters of negative economic growth.

As can be seen on the ‘run rate’ chart of Australia’s GDP we have fared well over recent years, including during the 2008 GFC:

Household consumption expenditure being the main component making up the GDP figure grew by 0.4% for the quarter and 2.9% for the year.

Government expenditure was the other driver jumping 1.9% over the same period.

The Australian Bureau of Statistics noted that government investment increased 15.5%, largely driven by state and local government up 21%. This reflected an increased transfer of assets from the private sector which contributed to a 3.4% drop in private investment.

The rise in housing renovations outgrew the construction of new dwellings: the unwinding of the mining boom seeing non-dwelling construction detract 0.8ppts from the overall GDP figure. Western Australia, the mining mecca of Australia saw GDP drop off 2.6% as a result.

With the national economy as a whole coasting along we may see Australia break the record of the longest standing economy not to experience a recession. Quite a feat if achieved.

However others are saying that a nationwide recession is inevitable and that even our banks may be in trouble.

Time will tell if Australia is able to go a record breaking 104 quarters without a recession.

I guess we’ll take some advice from our sporting heroes and take it ‘one over at a time’.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.