Australia leads by example on energy storage

Published 04-NOV-2015 15:34 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Australia has the potential to become the world’s leader in domestic energy storage, according to a recent report published by the Climate Council, an independent organization providing information about climate change.

As part of a detailed 36-page analysis published earlier this month, the Climate Council predicts battery storage costs will fall dramatically with capacity expected to rise 50-fold before 2025, thereby unlocking the intermittent abundance of solar power.

Australian households are leading the world in the take-up of solar panels for domestic energy supply – but this has been relatively problematic due to long periods of insufficient sunlight i.e. cloudy days and nights.

Demand for solar energy is increasing

Technology is moving rapidly to change this as we have seen with breakthroughs from companies such as Dyesol (ASX:DYE), which is looking at installing ‘work anywhere, in any condition’ solar panels into commercial buildings.

And of course in battery storage.

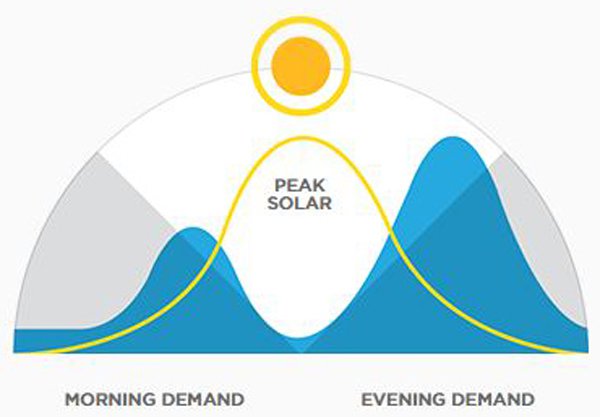

The average home uses more electricity in the morning and evening than during the day when the sun is at its peak.

Without a home battery, excess solar energy is sold to the power company and purchased back in the evening. This mismatch adds to peak demand and raises carbon emissions.

With a home battery, the average household can retain all the solar power it has generated by storing it for use at any time, day or night.

The Climate Council is backing new battery technology to effectively unlock the existing potential of solar power within a country that has a high propensity for solar adoption.

There has been rapid improvement made in the efficiency of batteries over the past decade, delivering better performance at a lower cost. The most sophisticated variety expected to dominate sales in the coming years are lithium-ion batteries, which use high amounts of lithium, graphite and cobalt in their design.

The Tesla Factor

One of the biggest factors that will precipitate the expected fall in storage is the advent of lithium-ion batteries which can be charged faster, discharged slower and hold more power than any other variety currently developed.

The world’s leader in manufacturing lithium-ion batteries for use in households and electric cars is Tesla Motors (NASDAQ:TSLA).

Tesla began construction of a huge Gigafactory in Nevada in 2014, with a view of reaching annual production capacity of 35 gigawatt-hours (GWh) by 2020. Tesla will also produce enough lithium-ion batteries to equip 500,000 electric cars on an annual basis.

Tesla Gigafactory in Nevada

At present, Australia has around 1.5 million homes with solar panels installed. Tesla has earmarked Australia as a prime proof-of-concept market, launching its 7 kWh Powerwall system earlier this year. Tesla has partnered with Reposit Power who will lead the rollout of Powerwall systems next year.

The Climate Council predicts that around 50 per cent of all Australian households will eventually adopt battery storage for their solar systems; creating a market of $24 billion.

It is hoped that by 2018, it will become more cost-effective for households to go ‘off-grid’ for their energy supply, as opposed to relying on existing energy supplies sourced from power stations.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.