Aussies are waking up to higher returns through P2P lenders

Published 02-JAN-2018 11:20 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

For 16 months the RBA has kept the cash rate at the record low level of 1.5 per cent. That’s great if you have a big mortgage, but what about the savers?

Bank deposits are paying close to nothing on savings accounts, while for term deposits you’ll have to lock your money away for at least three years to earn a rate that starts with the number 3.

Furthermore, there are no interest rate rises in sight, at least in the near term. That’s due to the combination of ongoing low inflation, record low wages growth, uncertain consumer spending, a (finally) slowing housing market, as well as the still strong Aussie dollar.

RBA governor, Philip Lowe, defended the low level of interest rates, saying they were “continuing to support the Australian economy”. Going off the cash rate yield curve, we can see that financial markets don’t expect interest rates to rise until at least April 2019. Shane Oliver, AMP Capital’s chief economist, had a similar timeframe in mind, expecting the RBA to keep rates on hold until a hike late next year... at the earliest.

So, what are your options?

The situation doesn’t look to be turning anytime soon for investors, but there are a few options — some more palatable than others. Savers can simply accept their lot and cop a low return. Tightening the purse strings will help a little, but with inflation starting to rise, those savings are unlikely to keep pace with the rising cost of necessities.

That’s especially true after factoring in rising energy costs, largely due to the east coast gas crisis.

To get even a half-decent return on savings, many are feeling pressured to venture into more risky investments than they may be comfortable with. Shares and property certainly have the potential to deliver higher returns. Yet these options come with much more risk and are generally considered to be investments for the long-term since they require riding out short-term volatility.

But there is another option: peer-to-peer (P2P) lending. P2P lending — also known as ‘marketplace lending’, a broader term that also reflects funds from institutions as well as retail investors — matches borrowers with investors.

P2P lending involves borrowing funds from investors rather than directly from a bank or lender, with the P2P company acting as the intermediary between the parties.

This form of lending is attractive to both parties, with borrowers paying rates that are risk-based and can be half of that offered by bank personal loans, while investors receive attractive rates by providing funds.

And while P2P lending isn’t well known here, it is a mainstream way to save in the US — in fact it is believed to facilitate up to one-quarter of all personal loans. Its use is also surging in Europe and China.

P2P lending in Australia

In Australia, P2P lenders still have a way to go before they attract a significant share of the savings market that’s still dominated by the banks. But with interest rates the way they are, and looking likely to stay low for some time still, their presence is growing as borrowers search for lower rates than what is offered by the banks, while savers look to boost their returns.

The largest P2P lender in Australia is SocietyOne, which was also the country’s first. It has seen rapid lending growth with the value of loans matched via its platform surpassing A$350 million since its launch in August 2012. It also has a current loan book of more than A$200 million.

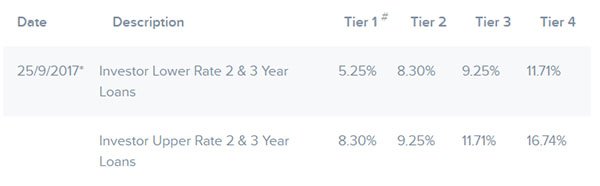

Here’s an example of the types of returns SocietyOne currently offer to investors:

SocietyOne lets investors select individual loans, a process that is automated based on investment mandates.

Other P2P lenders pool loans so that the lender can invest in a portfolio of consumer loans, which can help diversify and reduce the risk of being exposed to any single poorly performing loan.

How it works

The process begins with borrowers submitting loan applications to the P2P lender which are evaluated to verify identity, credit history, employment and financials. The risk of the loan will be assessed and a personalised interest rate given. The loan will then be funded by one or more investors that choose to take the loan on.

Potential investors review the available applications on the website and identify the borrowers they would like to fund, in part or in full. Investors will not be able to see any personal information from borrowers. Funds are then transferred to the borrower and their repayments will be made to the investor based on how much of the loan they funded.

The P2P lending platform simply connects people looking to borrow with people looking to invest, and takes a fee for the service.

Another local option is RateSetter, which launched in the UK in 2010 and arrived in Australia in 2014 as the first P2P lender open to retail investors. It now has over 8000 Australian investors registered to lend on its platform and has funded more than A$2 million in loans.

RateSetter checks the creditworthiness of borrowers and offers both secured and unsecured personal loans from $2,001 to $45,000, from six months to five years. Here are some of its current rates:

While these companies have established a presence in Australia in recent years, the number of P2P lenders operating in Australia is growing. So, if you are considering becoming a P2P investor or borrower, it is worth shopping around for the product most suitable to your personal situation.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.