Aussie wineries in a sweet spot

Published 24-OCT-2017 12:42 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

October was a bumper month for news on the global wine industry with promising developments emerging from some regions while other high profile production areas faced devastation.

Fires that have decimated much of Northern California will have a profound impact on the state’s US$58 billion wine industry, with destruction so widespread that it is still difficult to ascertain the impact on supply.

What we do know, however, is that fire-affected vineyards could be impacted by up to four years. Even a large proportion of those that escaped fire damage are likely to have lost a whole vintage due to smoked taint which can be so severe that it affects subsequent vintages.

Arguably the premier wine producing district in the US, Napa Valley has been severely affected. More than 1000 wineries are situated in Napa Valley and the nearby Sonoma region. This area reportedly accounts for approximately 85 per cent of US production, including most of the premium wine.

While this is devastating for the Napa Valley, the effects on supply will obviously have an impact on demand from other winery regions — including Australian labels.

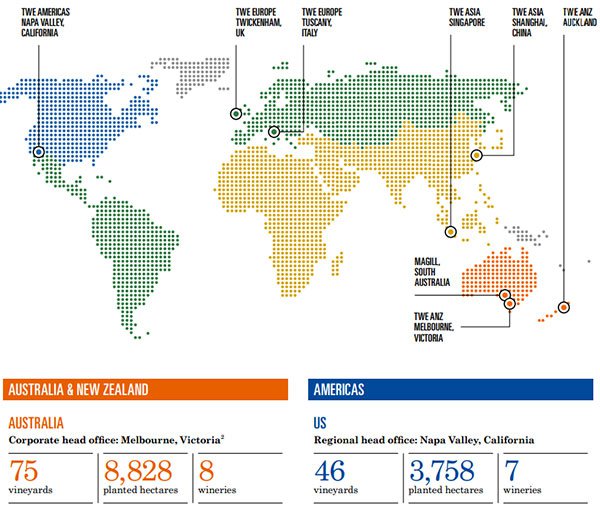

Our industry already has a prominent position in the US with ASX-listed Treasury Wine Estates (ASX:TWE) not only exporting large volumes of Australian wine to that region, but also involved in production from its own US-based vineyards. The group’s sizeable operations in Australia and the US are highlighted below.

The new concept Grange reflects TWE’s focus on premiumisation

TWE confirmed at its recent AGM that its operations haven’t been affected by the fires. While shareholders breathed a sigh of relief, there was also cause for celebration as the company unveiled the Penfolds g3 in Hong Kong, home to some of the world’s wealthiest wine collectors.

This wasn’t just the release of another vintage, but a whole new concept. The g3 will be a blend of three famous Grange vintages, 2008, 2012 and 2014 — with a $3000 price tag for one of these gems. Spill one of those and the stain on the carpet will be the least of your worries!

Broader industry data released last week reflected well on Australia’s wine industry. A news article released by the ABC indicates that China remains Australia’s most valuable wine market with year-on-year exports by dollar value increasing 42 per cent.

The report indicates that exports to greater China totalled $853 million, well above our next largest export market in the US which brought in $461 million. Total wine exports grew 13 per cent overall to $2.4 billion.

While this augurs well for our wine producers, it may also suggest that Australian wine drinkers should stock up their cellars. In the last decade the prices of Australian meats and seafood have risen substantially, largely due to the significant increase in demand from overseas markets such as the US, Japan and China.

With the added impact of a shortfall of wine supply coming out of the US, it is likely that Australian wine producers will be able to fetch substantially higher prices from overseas markets, which generally drives up the price of wine at retail outlets and restaurants in Australia.

Where to go for value?

With few ASX-listed players in the wine space, equity investors looking for exposure have very little to choose from. TWE is undoubtedly the big player with a market capitalisation of approximately $11 billion.

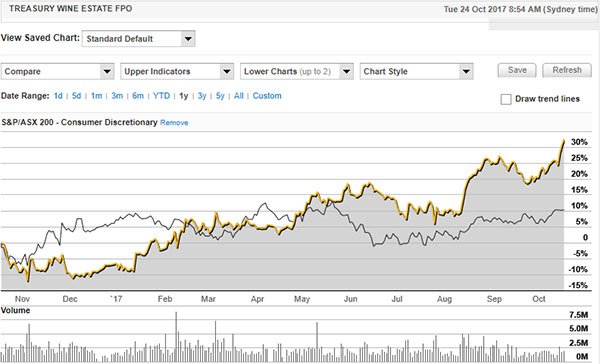

It was only on Monday that the company’s shares hit a record all-time high of $15.23, representing a substantial increase of circa 20 per cent since the start of August when they were trading below $13.00.

The following chart shows the strong outperformance of TWE against the S&P/ASX 200 Consumer Discretionary Index (XDJ) over the last 12 months. In particular, note the clear breakout since August.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Analysts at Citi ran the ruler across TWE in September, placing a sell recommendation on the stock with a price target of $10.90. Clearly, they see it as well over-priced at current levels.

However broker projections and price targets are only estimates and may not be met.

The company even looks expensive based on forward earnings per share estimates, trading on a PE multiple of 32 relative to consensus forecasts for fiscal 2018.

At the other end of the scale, Australian Vintage (ASX:AVG) is a mere minnow compared with TWE with a market cap of approximately $120 million.

However, it punches above its weight in export markets led by household brands such as McGuigan Wines, Nepenthe and Tempus Two.

Australasia and North America accounted for approximately $100 million in AVG’s sales in fiscal 2017, while the UK and Europe contributed $88.5 million. This area of the company’s operations was negatively impacted by the sharp depreciation in the British pound, a factor that shouldn’t have the same impact in fiscal 2018.

From an export perspective, the early signs are encouraging with AVG’s sales to Asia at this stage in the first half of fiscal 2018 up 60 per cent on the previous corresponding period. Consequently, the next 12 months could be one of transforßmation for the group, laying the foundation for significant expansion over a two-year timeframe.

Management isn’t being too bullish with its forecasts, pointing to 10 per cent profit growth in fiscal 2018 which would place the company on a PE ratio of approximately 20 relative to this year’s guidance — well below TWE’s heady multiple.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.