Amid gold price pain, GTI Resources deserve a second look

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

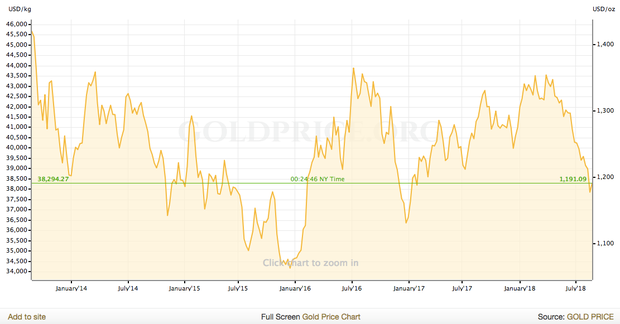

ASX gold stocks have no doubt taken a hit in the last few months, with the price of gold dipping to a 19-month low just a few weeks ago.

The gold price, now sitting around US$1192/oz, has taken a dive since April this year when it was up around US$1356/oz.

At the same time, and unsurprisingly, we have seen many ASX-listed gold stocks suffer in turn. Anova Metals (ASX:AWV) is down 72% in the last six months, and Alicanto Minerals (ASX:AQI) is down 66% in the same period. Even the $2.1 billion-capped St Barbara Ltd (ASX:SBM) is down some 8.6% in the last three months.

But there are small cap gold explorers on the ASX who aren’t faring as badly as you may think, upon a closer look.

One such company is the gold-focused metals play, GTI Resources (ASX:GTR).

Although it remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

While the small cap’s share price has slipped in the last few months, along with many of its gold peers big and small, a closer look at comparisons show that it has done quite well all things considered.

The micro-cap has outperformed not only the Comex Gold Futures index (GC) but also the S&P ASX 200 Gold index (XGD) since September 2017, as shown in the first chart below. In the same period, GTR also managed to outperform $1.6 billion capped WA gold giant Saracen Minerals (ASX:SAR), albeit with more volatility as is expected from a small cap.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

SAR is a gold standard player on the ASX, with an annual production of over 300,000oz per annum.

Its production comes from two WA projects, Carosue Dam Operation and its Thunderbox Operation. Both operations boast not only an extensive mine life, but potential for further exploration — and are located in WA’s Eastern Goldfields.

Which is exactly where GTR is looking to source its gold.

In July the company reported on its flagship Meekatharra Volcanic Massive Sulphide (VMS) Project in WA. The Meekatharra Project (E51/1556) is located ~55km south of Meekatharra in the Eastern Goldfields of WA, and is underlain by a sequence of mafic and felsic volcanics, which host a number of VMS base metal prospects and deposits within and adjacent to E51/1556.

GTR has been busy reprocessing available geophysical data and is set to commence on‐ground exploration at the project, targeting VMS-style base metal mineralisation. This includes the Austin VMS deposit, located within an excised licence in the southern‐central part of the project area, and the Murchison Wonder, Tasman and Flinders prospects to the northeast.

Gold price going forward, and implications for GTR

Over the last five years, the US dollar gold price has remained fairly flat, trading around the US$1100/oz mark — only ever moving about US$200/oz above or below that price.

With the US gold price slide since March/April, history would suggest we are now in for a price uplift or plateau, rather than a further slip. That said, many see a further slip as a definite possibility.

If there is a rebound in the gold price, small caps like GTR could quickly make back lost ground.

For a junior like GTR, its prospects or fundamentals aren’t what has changed in the last four months; like a whole swathe of other gold companies on the ASX, its share price has taken a hit due to negative sentiment plaguing the sector.

Consequently, when that changes, as it inevitability will, GTR could be ideally situated to return to its April high of $0.044 — which was an impressive 266% premium on its mid-September 2017 share price of $0.012.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Speaking of where GTR is situated, the small cap is fighting its battle for gold junior survival in one of the most prospective gold spots in the country; WA’s Eastern Goldfields.

A resurgence for WA’s goldfields

With a rich history of gold-mining in WA, the state is still known for the abundance of cash and jobs made possible through prolific mining in the region.

There are currently over 40 active gold mines in WA including big producers like the Telfer mine in the Pilbara, the Jundee gold mine in Wiluna and the Kalgoorlie super pit gold mine.

In 2017, Kalgoorlie Consolidated Gold Mines Pty Ltd poured its 60 millionth ounce of gold.

No doubt the Eastern Goldfields are seeing a renewed interest in recent years. Those with their hands on the right tenements, whether they be blue chips or micro-caps like GTR, are determined to continue WA’s golden run, regardless of the ups and downs of the US gold price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.