After lithium and cobalt: what comes next?

Published 06-JUN-2017 14:20 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

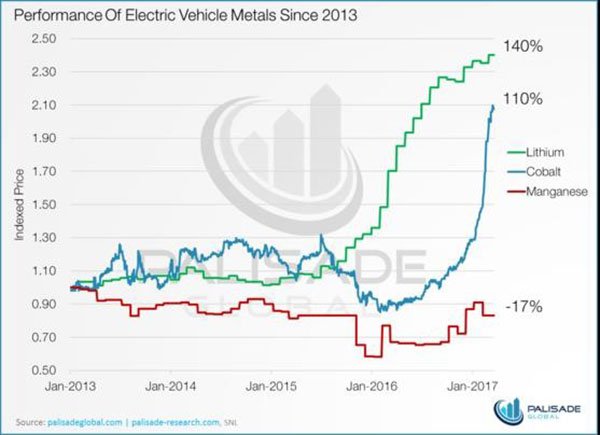

With lithium and cobalt stocks grabbing the limelight over the past few years, investors are searching for the next commodity to deliver serious yields in 2017.

Could it be manganese that is set to go on a bullish price run next?

You may not have heard much about manganese, but it’s a metal you may be about to hear a whole lot more about in 2017.

Often overlooked by investors, it could be the next metal to embark on a long rally in the same vein as lithium and cobalt over the past few years.

Of course commodity prices do fluctuate and investors shouldn’t base their investment decisions on commodity prices alone.

The ascent of this unassuming metal could be due to its (virtually unknown) relevance to the lithium ion batteries that power electric vehicles. If you are familiar with the battery revolution, you’ll also be aware of the role of lithium-ion batteries in off-the-grid power systems and other energy storage applications.

In a volatile year for commodities, manganese has been a surprise packet in 2017.

The metal has traditionally tracked iron ore prices, but a disconnect appears to have occurred with manganese performing strongly in the first quarter and remaining relatively resilient despite the iron ore price plunge.

As we alluded to earlier, manganese demand is driven by dual forces. It has a well-established role in the traditional steel market, but it also plays a pivotal, if unexpected, part in the more cutting-edge off-the-grid power space – a factor, it seems, investors have largely missed thus far.

With lithium and cobalt situated as the ‘poster boys’ of the battery metals market – fuelled heavily by Tesla, other EV car manufacturers including Toyota and Mercedes and electronics makers such as Samsung and Panasonic – manganese has been somewhat left behind.

However, this might be set to change as it becomes clear that manganese also has a critical role to play in clean energy applications.

Is manganese poised to become the next lithium?

Manganese is an irreplaceable metal in steel production, serving the essential function of removing oxygen and sulphur when iron ore is converted into iron. Manganese is also used as an alloy that increases both the strength and flexibility of steel.

It is the fourth most commonly used metal by tonnage – after iron, aluminium and copper. During the past ten years, steel production has increased on a global level, with the International Manganese Institute projecting that between now and 2020, the global steel industry will continue growing at a rate of about 2% annually.

The steel industry is poised to continue growing, providing a steady source of demand for manganese. The US alone needs about 500,000 tons of manganese per year, the majority of which is consumed by the steel industry.

But it is manganese’s less commonly realised application in clean energy that takes on fresh interest here, especially in relation to off-the-grid power storage — a market positioned to only increase in future.

NiMH batteries provide the prevailing battery technology for hybrid vehicles, including the Toyota Prius. Li-ion batteries, whose centrality has been highlighted by Tesla, are important because they have a higher energy density — meaning the amount of energy they hold by weight or volume — than any other type.

Interestingly, the lithiated manganese dioxide (LMD) battery is the most emergent technology to make use of manganese. LMDs are used to provide higher power output, thermal stability, and superior safety to regular lithium-ion batteries. Typically, an LMD battery uses 61% of manganese and a mere 4% of lithium.

It’s clear manganese has a role to play in the growth of the new energy sector – but could it be more important than first thought?

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.