Adacel flies above the pack

Published 21-SEP-2016 15:58 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The last 12 months has been one of the best periods in Adacel Technologies’ (ASX: ADA) history with important contract awards, a profit upgrade in July and the delivery of an above guidance fiscal 2016 result in August.

The leading global developer and provider of operational air traffic management systems, speech recognition applications and advanced air traffic control simulation and training solutions has strong relationships with leading aviation groups throughout the world.

ADA’s longest active contract is with NavPortugal and it spans 18 years. The group’s largest customer is Lockheed Martin and this accounted for revenues of US$11.1 million in fiscal 2016. The average term of current contracts is 8.3 years, demonstrating the company’s ability to retain business and deliver earnings predictability.

Of course anything can happen in this market and predictability can change, so seek professional financial advice if considering this stock for your portfolio.

ADA generated a net profit of $9.2 million in fiscal 2016, representing year-on-year growth of 134% and exceeding Bell Potter’s expectations by 8%. Importantly, net cash more than doubled to $15.7 million in fiscal 2016 leaving the company well-placed to tender for new business and maintain its leading position in the development of innovative technologies.

Bell Potter only initiated coverage of ADA six months ago with a price target of $2.50, but this gradually increased leading up to the group’s full-year result. After the company provided an update yesterday the broker maintained its buy recommendation and 12 month price target of $3.75.

While Bell Potter analyst, Chris Savage, noted that the company didn’t provide quantitative guidance yesterday he is of the view that general outlook statements which pointed to the depth and diversity of its order book and optimism surrounding earnings growth in 2017 were positive signs.

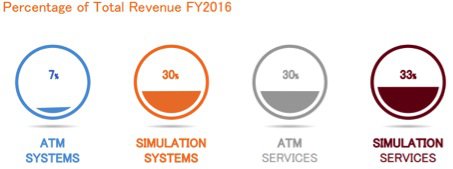

Savage is forecasting revenues to increase by circa 10% in fiscal 2017, and he is projecting earnings per share growth of 11% and 17% in fiscal years 2017 and 2018 respectively. A breakup of the company’s revenues across its various divisions in fiscal 2016 is outlined below.

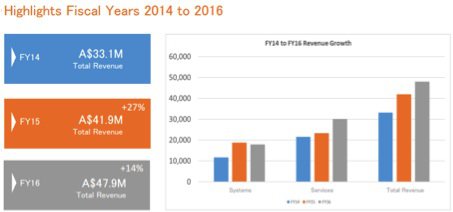

As can be seen from the following table, ADA has managed to substantially grow both the systems and services divisions of its business over the last three years. With regard to fiscal 2016, Savage highlighted the strong performance from the services segment which grew year-on-year revenues by 30%.

He noted that this was mainly attributable to a new Controller Training Contract (CTC) with the Federal Aviation Authority (FAA) and also growth in existing services contracts with customers including the FAA and the US Air Force.

While the abundance of good news flow saw ADA’s shares surge from 95 cents 12 months ago to hit a high of $3.55 following the profit upgrade in July, they have tapered off recently, arguably due to broader market volatility.

This retracement could be seen as a buying opportunity given that Bell Potter’s price target of $3.75 implies upside of nearly 35% to Tuesday’s closing price of $2.79.

However, previous trading trends are not indicative of future share price performance and they should not be used as a basis for investment. It should also be noted that broker projections are estimates that may or may not be met and independent advice should be sought before investing in ADA.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.