Acquisitions and organic growth to drive Motorcycle Holdings

Published 19-SEP-2016 16:06 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There is no better recipe for success than under promising and outperforming. Australia’s largest motorcycle dealership operator, Motorcycle Holdings (ASX: MTO) has done just that since listing on the ASX in late April with an IPO price of $2.00.

Only three months later management upgraded prospectus profit guidance by between 10% and 15%, which at the midpoint of that range represented an increase from $6.9 million to circa $7.8 million.

The company went on to announce a fiscal 2016 net profit of $8 million at the end of August, prompting Josephine Little from Morgans CIMB to upgrade earnings per share forecasts for fiscal years 2017 and 2018, while increasing the price target from $3.54 to $3.65.

However, at that point the company was trading at $3.76 and consequently a hold recommendation was maintained. It has since hit $4.00, but with broader market weakness resulting in a pullback to $3.75 perhaps it is a stock to reconsider given its strong blend of organic growth and potential earnings accretive acquisitions which aren’t currently factored into earnings projections framed by brokers.

It should be noted that broker projections may not be met and investors should seek professional financial investment advice. Further to this previous trading patterns are not an indication of future share price movements, and as such shouldn’t be used as a basis for investment.

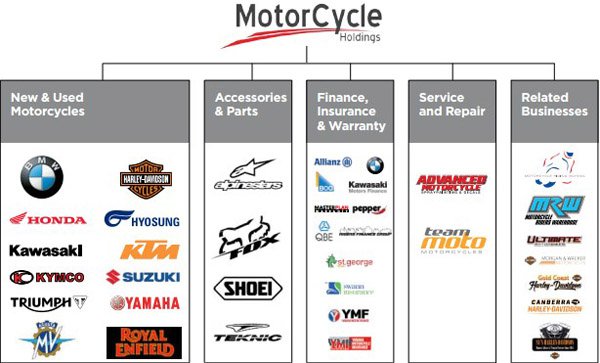

As a backdrop, MTO was founded 27 years ago and is Australia’s largest motorcycle dealership operator with 34 franchises operating out of 24 dealership locations in Queensland, New South Wales and the ACT.

The company sells both new and used motorcycles as well as distributing parts. It also generates income from services, repairs, finance, insurance and warranty products.

MTO’s strategy is to grow its dealership business both organically and through acquisitions. The capital raised in the IPO will assist the company in accelerating growth beyond the levels it has historically delivered as it takes a more aggressive approach to acquisitions.

However, it is worth noting that even prior to listing, the company generated compound annual pro forma EBITDA growth of 10.4% between fiscal 2013 and fiscal 2015.

Comments in last week’s annual report indicated that newly acquired dealerships were generating strong revenues and that continued growth should stem from acquisitions and through the group’s established network.

There is definitely substantial scope for acquisitions with 700 motorcycle dealerships across Australia and only two operators other than MTO owning more than four dealerships. This indicates the highly fragmented industry is ripe for consolidation.

As the company was only listed for a period of two months prior to the end of fiscal 2016, it didn’t undertake any acquisitions during that period but management said it is confident that opportunities will arise in the current year that meet its strict acquisition criteria.

On this note, in fiscal 2017 the company has already acquired new franchises in Queensland, MV Agusta and Royal Enfield, both of which are growing boutique brands with incremental sales potential.

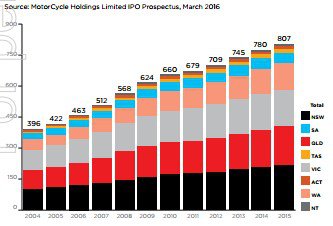

The following table demonstrates the consistent industry growth that has occurred in the sector over the last 12 years.

Josephine Little highlighted two potential acquisitions that would have a material impact on earnings. Peter Stevens is the second largest motorcycle dealership group in Australia, operating 14 outlets across eight locations with the majority located in Victoria. In the past, the group was the only Harley-Davidson importer in Victoria, however it now operates six of the 42 Harley Davidson dealerships in Australia.

Importantly, MTO isn’t represented in Victoria. Consequently, the acquisitions of the Peter Stevens business would provide access to a totally new market.

The other group that could come into play is Fraser Motorcycles which Morgans said was the third largest motorcycle dealer in Australia with four dealerships in New South Wales. The business also has one point of representation in both Melbourne and Perth.

It should be noted that previous trading patterns are not an indication of future share price movements, and as such shouldn’t be used as a basis for investment. Also, broker projections may not be met and investors should seek independent investment advice in relation to any of the companies mentioned in this article.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.