Acquisition of military tactical antennas to assist in expansion of Codan’s communications business

Published 27-JAN-2017 16:14 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Developer and distributor of proprietary communications systems and intellectual property used in minerals exploration, Codan (ASX: CDA), has entered into an agreement to acquire the 9300 range of military tactical antennas from Stealth Telecom FZC of Sharjah, United Arab Emirates for a total consideration of US$700,000

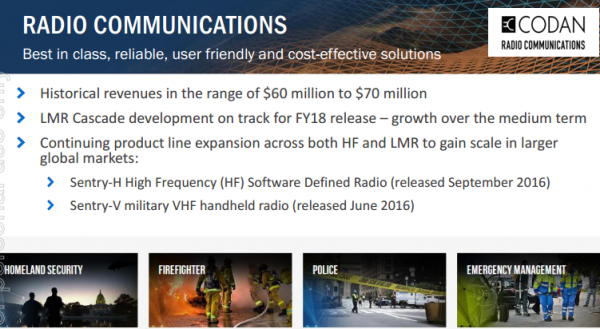

The acquisition is consistent with the group’s strategy to expand its radio communications product offering as it transitions to a total communications solutions provider.

Codan specialises in the development of robust technology solutions, particularly in the areas of communications, safety and security, providing a wide range of equipment to customers such as the United Nations, military groups, government departments and mining companies, often where their operations require equipment that can be used in remote and harsh environments.

Codan Radio Communications is a division of Codan, and it recently released the proprietary Sentry-V and Sentry-H tactical radios for the global military market.

Diversification of revenues through sales of gold detectors

Historically, the company’s revenues have been generated from sales of its gold detector equipment, as well as its communications products.

Management said in November that there had been continued strong demand for the group’s GPZ 7000 gold detector in Africa, and that this business had outperformed expectations for the month of October and robust sales had continued into November.

Given the current level of order activity the company provided underlying net profit guidance in a range between $20 million and $22 million for the six months to December 31, 2016.

Sales figures for the four months to October 31, 2016 provide some insight into the sales breakup between the two businesses. During this period the metal detection business contributed sales of $44 million, while the radio communications and tracking solutions business generated sales of $30 million.

Profit guidance points to strong growth of more than 40%

Management also provided full-year guidance in a range between $30 million and $32 million, representing an increase of at least 42% compared with the fiscal 2016 profit of $21.1 million.

While Codan’s share price has had a good run over the last 12 months and responded positively on Friday to the acquisition announcement, based on guidance it is trading on a PE multiple of 11, which is a substantial discount to the industry average PE multiple.

It should be noted that historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

Also of relevance in terms of assessing the company’s multiple against the sector average is the fact that it is debt free and forecast earnings per share growth is well ahead of the industry group average.

Investors should note that forward-looking statements may not come to fruition and those considering an investment in Codan should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.