20 gold nuggets, the ingots of tomorrow Part 2: Recession worries could push gold higher

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Yesterday Finfeed featured five gold stocks as part of a 20 stock overview we are compiling this week.

Obviously, the surge in the gold price has contributed towards our expanded coverage of the sector, but as we mentioned last week there appears to be a strong case for the precious metal to sustain recent momentum and perhaps track further north.

On this note, gold made a new high during trading on Tuesday afternoon (AEST) as it passed the US$1530 per ounce mark.

Last week, we cited geopolitical issues such as the trade war between the US and China as a near-term factor, and the November 2020 presidential election as a catalyst for uncertainty over the next 12 to 18 months.

There is the propensity for the US/China confrontation to negatively impact President Trump’s chances of retaining power, which while some would say is a positive, it is that sense of uncertainty that invariably has a negative impact on markets.

Mounting tension in Hong Kong has added a new dimension to the US/China conundrum.

Mark DeCambre from MarketWatch cited market strategists and geopolitical experts in saying that protests in Hong Kong could eventually deliver a more lasting blow to US and global markets.

The following is an excerpt from DeCambre’s article which contains commentary from two prominent market analysts.

“The increasing tension in Hong Kong, which could lead to greater intervention by mainland Chinese authorities, poses a risk to the region because Hong Kong is a major financial centre and its disruption could have implications for markets in Asia as well as spillover to Europe and the US,” Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, told MarketWatch via email.

“In addition, the Chinese media have already accused the US of being behind the protests — or at least encouraging them — tying the unrest in Hong Kong to the greater trade dispute with the US” Zaccarelli said.

“The big fear is that Beijing could respond with force of the kind seared into memories about Tiananmen Square.

‘’If so, assessments of the Politburo would also have to be revised to stand at a more pessimistic view.

‘’In turn, markets would have to become less hopeful of the degree and speed of progress possible on a whole host of fronts, including trade,” Ken Odeluga, market analyst at City Index told MarketWatch.

Zaccarelli said that even if Trump were willing to overlook a violent crackdown, it isn’t clear that Congress would.

10 year Treasury’s at record lows

Further evidence emerged on Monday that pointed to panic in the investment community regarding the prospect of a recession.

The US 10 year Treasury Note rate fluctuations have often been an accurate lead indicator in terms of measuring economic health and associated share market volatility.

The following chart shows the dip from more than 5% in 2007 to about 2.2% in 2008 which chimed in with the global financial crisis.

The rate is now hovering in the vicinity of 1.6%, having fallen from about 2.4% only three months ago and 2% just two weeks ago.

This combined negative sentiment took its toll on US markets on Monday as they fell nearly 1.5%, crashing below the psychological 26,000 point mark to close at 25,897 points.

While this represented a decline of about 390 points, things were looking much worse earlier in the session as the index fell below 25,830 points.

Amongst all this gloom and doom, one can only imagine that gold should continue to benefit from its safe haven status.

Today we look at five more companies, some of which have experienced strong share price support in 2019, while others may be the stars of tomorrow that are currently flying under the radar.

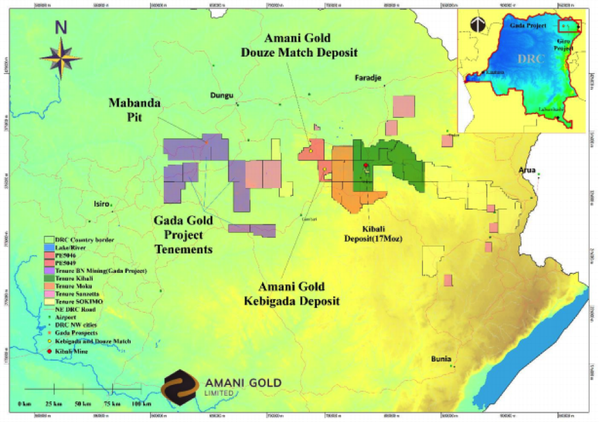

Amani to acquire 10 permits in DRC

During the June quarter, Amani Gold Ltd (ASX:ANL) signed a Memorandum of Understanding with Bon Génie N. Mining (BN Mining) Sarl to acquire 10 highly prospective gold Exploration Permits in the Democratic Republic of the Congo (DRC) through an 85.7% interest in BN Mining.

The Exploration Permits are collectively known as the Gada Gold Project and are approximately 80 kilometres west of Amani‘s Giro Gold Project as shown below.

The Giro Gold Project comprises two exploration permits covering a surface area of nearly 500 square kilometres.

It lies within the Kilo-Moto Belt of the DRC, a significant under-explored greenstone belt which hosts Randgold Resources’ 16 million-ounce Kibali group of deposits within 35 kilometres of Giro, as indicated above.

From a geological perspective, the Giro Gold Project area is underlain by highly prospective volcano-sedimentary lithologies in a similar structural and lithological setting as the Kibali gold deposits.

Both primary and alluvial gold was historically mined from two main areas, being Giro and Tora, and today these areas are mined extensively by artisanal miners.

Amani has outlined a gold resource at Kebigada within the Giro Gold Project of 45.6 million tonnes at 1.46g/t gold for 2.1 million ounces gold at a cut-off grade of approximately 1 g/t gold.

The Giro Gold Project global gold resource now exceeds 3 million ounces with the combined Indicated and Inferred Mineral Resource estimates for the Kebigada and Douze Match deposits at 82 million tonnes at 1.2g/t gold, for 3.1 million ounces gold.

The combined resource is based on a 0.6g/t gold cut-off grade.

Results from deeper drilling which is targeting high-grade mineralisation at Kebigada could provide near-term share price momentum.

However, investors have already enjoyed substantial capital gains over the last month as the company’s shares are currently up 150%, spurred on by the buoyant gold price and the agreement to acquire new permits.

Kingston aiming to define resource at Kingsley

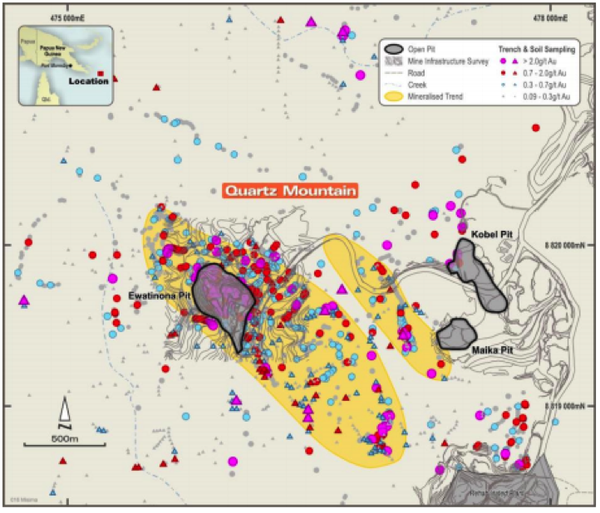

Kingston Resources (ASX:KSN) is a metals exploration company which is focused on exploring and developing the world-class Misima Gold Project in Papua and New Guinea PNG.

Kingston has a 70% stake in Misima which hosts a JORC Gold Resource of 2.8 million ounces.

Misima was operated as a profitable open pit mine by Placer Pacific between 1989 and 2001, producing over 3.7 million ounces before it was closed when the gold price was below US$300 per ounce.

With the gold price sitting some 400% above those levels, the prospects of Kingston bringing a high margin project back into production appear strong.

Also working in the company’s favour is the fact that it could potentially deliver a starter project in a relatively short period of time because of the advanced nature of exploration and access to existing infrastructure.

Management is also of the view that the Misima Project offers outstanding potential for additional resource growth through exploration success, and it is targeting extensions and additions to the current resource base.

In July, the company announced that it had completed first stage drilling at the Ewatinona deposit, delineating 8 metres at 2.6 g/t gold and 20 metres at 1.8 g/t gold, including 3 metres at 7.5 g/t gold.

Ewatinona, which contains a JORC 2012 Inferred Resource of 6.6 million tonnes at 1.0g/t Au for 220,000 ounces gold, is located within the Quartz Mountain area of the Misima Gold Project and is the first of a number of areas to be drilled this year as part of an ongoing exploration program.

Placer historically mined gold and silver from the Ewatinona, Kobel and Maika pits producing a combined 147,000 ounces at 1.8g/t gold.

Importantly, the current Ewatinona Resource is less than two kilometres from the historic mill location.

Kingston also owns 75% of the high-grade Livingstone Gold Project in Western Australia where active exploration programs are also in progress.

However, this hasn’t stopped the drill bit turning at the flagship Misima project, as the exploration programs are running concurrently.

While Misima grabs most of the headlines, Livingstone shouldn’t be overlooked as 2018 drilling included a four metre intercept of 76 g/t gold from 88 metres and 28 metres at 2.3 g/t gold.

The current round of reverse circulation (RC) drilling will provide JORC-compliant data within the existing 800 metre strike extent, as well as testing for new mineralisation at depth.

The results will contribute to a planned maiden Mineral Resource Estimate to be undertaken later in the year.

With first assay results from the drilling campaign due in September there is the potential for further share price momentum.

This would build on a stunning run which has seen the company’s shares increase approximately 50% in the last month.

Mako Gold making it big in Africa

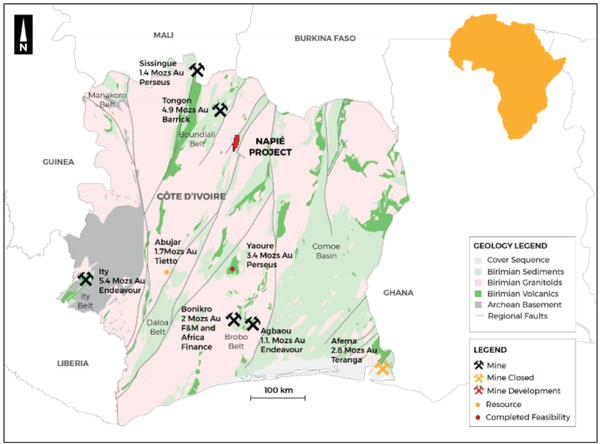

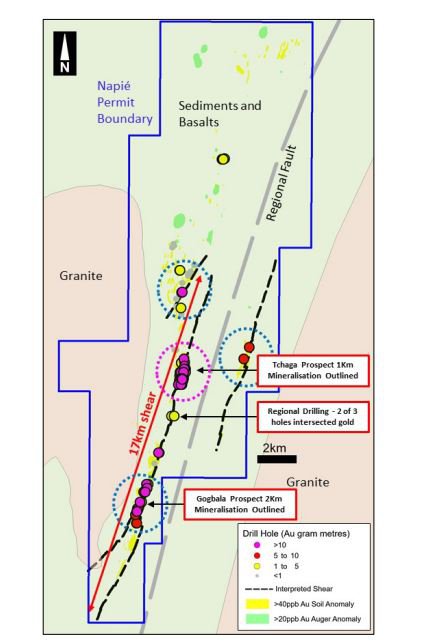

Shares in Mako Gold Ltd (ASX:MKG) surged nearly 30% in June/July as the company delivered impressive drilling results, extended the strike length of mineralisation at its Napie Project in Côte d’Ivoire, paving the way to earn up to 75% of that project.

More recently, the company has applied for two new permits in Côte d’Ivoire which would increase its land position by about 300 square kilometres to 520 square kilometres.

The region has been a happy hunting ground for the group with the completion of recent drilling increasing management’s confidence in outlining a gold resource.

The company has delineated promising grades at Napie, including 1 metre assays up to 7.5 g/t gold.

From a broader perspective, Mako received assay results from the final eleven holes of the company’s recent 27 hole/4.1 kilometre reverse circulation (RC) drill program at the Napié Project in Côte d’Ivoire.

Drilling results have been outstanding thus far with the Napié Project potentially comparable with the $31 billion capped Barrick Gold’s 4.9 million ounce Tongon project lying to the north-east and the $1 billion capped Perseus Mining’s (ASX:PRU) 3.4 million ounce Yaoure project situated to the south.

Mako is earning up to a 75% interest in the Napié Project under a farm-in and joint venture agreement with Occidental Gold SARL, a subsidiary of West African gold miner Perseus Mining Ltd (ASX/TSX:PRU).

Mako currently holds a 51% interest in the permit and is operator of the project.

As indicated below, the project is surrounded by large producing mines operated by multinational gold producers.

During the July drilling campaign, Mako extended the gold mineralised zone to one kilometre strike length on the Tchaga Prospect.

The wide and high-grade gold intercepts received from drilling to date have clearly identified an area which the company will focus on in its endeavour to outline a JORC compliant gold resource with further drilling.

Mako will now turn its attention to a follow up drill program to be conducted after the wet season.

Drilling will begin around November 2019, with several targets already identified.

The company’s focus will be on the Tchaga Prospect, particularly a one kilometre strike zone as seen below.

Nusantara Resources looking to extend beyond 11 years

Nusantara Resources Ltd’s (ASX:NUS) flagship project comprises the 1.1 million-ounce Ore Reserve and 2.0 million-ounce Mineral Resource Awak Mas Gold Project in South Sulawesi, Indonesia.

Nusantara has completed more than 135 kilometres of drilling across 1,100 holes.

Management’s development strategy includes the construction of a modern, low strip ratio open pit operation with ore processed by standard carbon-in-leach (CIL) processing delivering high gold recoveries.

Environmental approval has already been received for the project, which is favourably located in non-forestry land close to established roads, ports, airports, and grid power.

Nusantara’s second goal is to grow the resource base to a level which will support a mining operation beyond the initial project life of 11 years.

During the June quarter, detailed metallurgical testing and post-definitive feasibility study (DFS) Phase 2 test-work was completed.

The average gold recoveries showed an improvement in the test-work used as the basis for the DFS, which increased the overall recovery assessment for the project from 91.1% to 93.3%.

Historical gravity and whole ore leach test-work was conducted using different parameters to the post-DFS Phase 2 test-work (e.g. coarser grind size, no gravity recovery, lower cyanide addition), which contributed to the lower recoveries seen in these earlier tests.

The post-DFS Phase 2 program results validated the design parameters selected for the DFS and provided a more robust basis for the prediction of gold recovery.

As highlighted in the DFS, management believes there is potential for the Awak Mas Gold Project to realise a grade uplift when the ore body is mined.

This would have a positive impact on project economics, potentially providing share price momentum.

Nusantara has traded strongly over the last three months with its shares increasing approximately 70% from 14 cents in May to peak at 24 cents at the end of July, just shy of its 12 month high of 25.5 cents.

Importantly, it has held around these levels, and with a number of potential catalysts likely to emerge in the second half of 2019 there could be further upside to come.

Success at Currans Find sends Venus Metals soaring

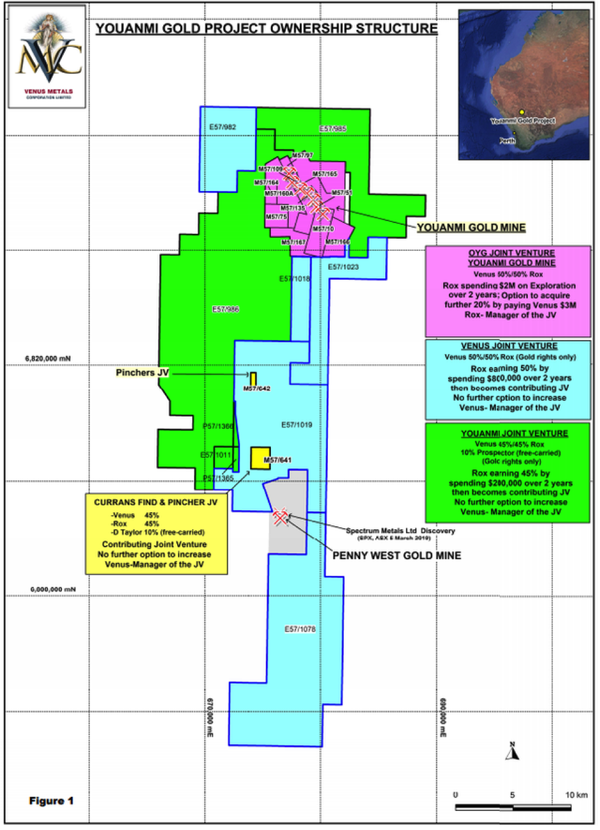

Shares in Venus Metals Corporation Ltd (ASX:VMC) more than doubled in the last two months as the company consistently delivered outstanding drilling results from its stage II exploration program at the Currans Find North Prospect, part of the Youanmi Gold Project.

Management plans to follow-up these impressive results with a geophysical survey to detect sulphide bodies that may host gold mineralisation as observed in recent drilling.

This should assist the company in delineating relatively clear targets for the stage III drilling campaign which will explore down plunge and along strike from the high grade mineralisation detected to date.

There is speculation that Venus could be the next Spectrum Metals (ASX:SPX), a group that delivered a company making discovery in March.

Interestingly, the discovery lies just to the south-east of the M 57/641 Currans Find tenement owned by Venus, Rox Resources (ASX:RXL) and Doug Taylor in a 45%/45%/10% joint venture.

It is worth noting that the higher grade intersections in Spectrum’s results weren’t all that much wider than those encountered by Venus Metals, and the grades were similar.

The gold was encountered at depths of around 250 metres, suggesting that there may be upside at Penny’s Find as deeper drilling is undertaken.

It would appear that this is front and centre in management’s mind given that it has already made plans to commence diamond drilling in the near term, a strategy that could identify further high-grade mineralisation at depth.

Examining companies that benefit from precious metal by-products

Tomorrow we will take a slightly different tack in identifying five companies that are operating base and precious metal projects.

Such projects are well sought after by the big miners as they often boast large resources that deliver long life production.

Most importantly though from a precious metals perspective, the cost of producing the prime metal is reduced substantially as the owner benefits from gold/silver credits.

Such companies are increasingly coming under the spotlight because of the strong performance by both gold and silver, as well as the favourable foreign exchange rates.

This has been evidenced by support for smaller exploration companies from majors such as Rio Tinto (ASX:RIO), South32 (ASX:S32), Oz Minerals (ASX:OZL) and Sandfire Resources (ASX:SFR).

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.