Investment Memo:

Vonex Limited

(ASX:VN8)

-

LIVE

Opened: 23-Feb-2022

Shares Held at Open: 3,273,162

What does VN8 do?

Vonex Limited (ASX:VN8) is an Australian telecommunications company providing innovative VoIP solutions, particularly to the Small and Medium Enterprise (SME) market segment.

VoIP stands for Voice over Internet Protocol - basically super clear and easy to manage phone calls over the Internet.

These calls are done via something called a PBX - PBX stands for Private Branch Exchange, which is a private telephone network used within a SME.

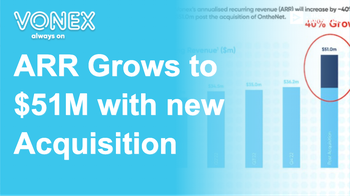

VN8 is employing an aggressive acquisition strategy to grow revenues at scale and claim market share more quickly than by organic growth alone.

What is the macro theme?

The importance of reliable and secure business interconnectivity has become even more prominent in a pandemic-impacted world, and so enterprises are placing greater priority on possessing and maintaining quality communication networks.

Additionally, the Australian telecommunications industry is especially prone to M&A activity.

Namely, bigger telco companies generally look to acquire smaller more nimble companies with expanding revenue and user bases in order to more quickly capture their growth, rather than do the hard yards of building and growing customer bases/ building new complementary divisions/ verticals.

Our Big Bet for VN8

VN8 grows to a size that attracts a takeover bid from a larger telco (at multiples of our Initial Entry Price) by acquiring and consolidating smaller telco businesses.

Why did we invest in VN8?

‘Hunt for Growth’ aggressive acquisition strategy

We believe that VN8 is on track to become cashflow positive in the near-term whilst claiming market share on a national basis through its ‘Hunt for Growth’ aggressive acquisition strategy.

As such, we think that it won't be too long before dividends become a reality, providing regular returns, and attracting more institutional investor interest.

The other realistic possibility is that VN8 looms as a potential target for a larger telco.

Typically the larger the telco, the more appealing it is for acquisition, as a quick and cost-effective way to either gain new customers or integrate a new vertical into an existing business.

What do we expect VN8 to deliver?

Objective #1: Become cash-flow and EBIDTA positive in FY22.

Becoming cash-flow positive is an important precursor for companies to begin paying their own way, rather than raise capital for survival. VN8 is almost there, with back to back cash-flow positive half year periods, but we would want to see it deliver it for a full fiscal year, and continue to do so going forward.

As a core measure of profitability, becoming EBIDTA positive would signal to the market that VN8 can deliver sustainable growth and, we believe, make it a much more attractive target for a larger telco business. This is the precursor to considering dividend payments for a company.

Objective #2: Grow users through integrated acquisitions and cross-selling opportunities

Part of the acquisition strategy is to integrate the assets and customers into the Vonex channel partner network. We expect the user base to grow organically through cross-selling opportunities while driving down costs through improving economies of scale.

A key milestone that we want to see VN8 achieve is 100,000 PBX users, an indication that the acquisition strategy is leading to organic user growth.

Market risk

The market may not like VN8’s acquisitive strategy. Just because the acquisition should benefit VN8 in the long-run doesn’t mean the market will enjoy the short term pain to the VN8 cash balance and shareholder dilution. Acquisitive strategies in no way guarantee that a larger telco will look to acquire VN8 in the end, particularly if user growth slows.

Funding risk

VN8 may need to tap the market for more cash to aggressively grow its business through acquisitions. This goes hand in hand with market risk

Competition risk

VN8 is swimming in a pool of competitors that could push them out of the market or make their acquisitions more expensive. Alternatively, a much larger telco invests heavily in the infrastructure that VN8 provides its customers - especially in the SME market segment. VN8 has a relatively unique product offering and experienced representatives in their distribution channels, however larger entities may decide to move into their niche.

What is our investment plan?

We initially invested in VN8 in mid 2020 with a 24 month horizon to see how the acquisition strategy would play out. We increased our holding in mid 2021, as we liked how management were executing this strategy, and intend to hold the majority of our investment in the year ahead.

The long-term strategy is to watch VN8 grow through acquisition until it is taken out by a larger telco company at a bigger valuation than we initially invested.

Disclosure: The authors of this article and owners of Next Investors, S3 Consortium Pty Ltd, and associated entities, own 3,273,182 VN8 shares at the time of publication. S3 Consortium Pty Ltd has been engaged by VN8 to share our commentary and opinion on the progress of our investment in VN8 over time.