White Rock prioritises Cirque prospect at Red Mountain

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals Ltd (ASX:WRM) has provided a promising update on the 2019 exploration program underway at the company’s Red Mountain high-grade zinc and precious metals project in central Alaska.

Recognition of the quality and potential size of the Red Mountain Project, as well as its exposure to the high flying gold and silver commodities has prompted a substantial increase in White Rock’s share price since June.

There are already two high grade deposits at the Red Mountain Project, being Dry Creek and WTF, with an Inferred Mineral Resource of 9.1 million tonnes at 12.9% zinc equivalent for 1.1 million tonnes of contained zinc equivalent.

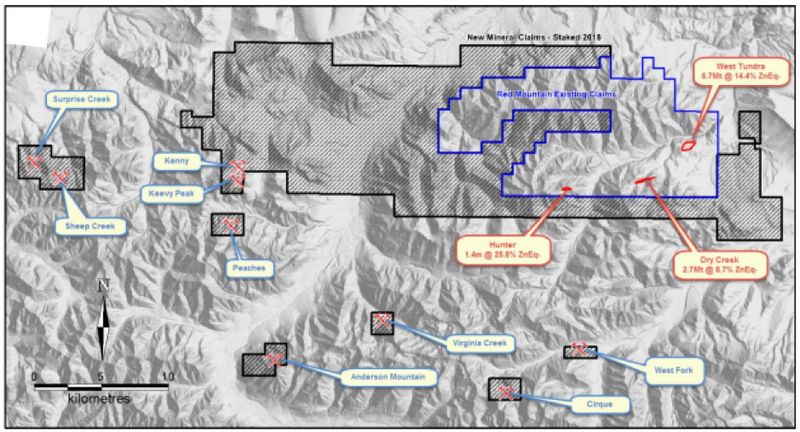

During the latter half of the 2019 field season, reconnaissance of historic VMS prospects has been completed with the Cirque prospect highlighted below identified as the highest priority area for follow-up.

The Cirque prospect which you can see lies to the south of Dry Creek, WTF and Hunter was discovered in 1976 by RAA, Getty and Phelps Dodge.

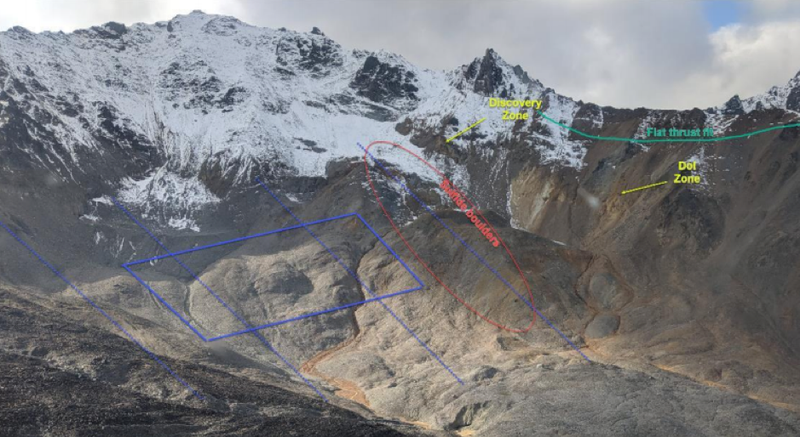

Massive sulphide float blocks, of up to 2 metres thick, occur within 300 metres of mineralised calcschist and carbonate outcrop.

Assays from 18 samples averaged 5.6% zinc, 1.7% lead, 49g/t silver and 0.5% copper.

A surface geophysics crew has now just completed a single fixed loop electromagnetic (EM) survey which is normally very accurate in terms of determining the potential of VMS deposits.

This was completed across two horizons of massive sulphide that extend east under glacial till cover.

Survey results provide promising leads

Modelling of the results by Newexco, a specialist geological and geophysical consulting firm, shows a clear long wavelength anomalous response on all four lines (see below), consistent with a single, strike and depth extensive, conductive horizon.

The conductance is low which may be consistent with a VMS horizon containing weakly conductive lead-zinc sulphides.

A second conductive horizon to the south is very weak with further surveying likely required to better define this feature.

Commenting on this latest development and its implied endorsement of the company’s decision to expand its land holding at Red Mountain, managing director, Matt Gill said, “The potential for multiple VMS deposits throughout the company’s large strategic tenement package, expanded to 475 square kilometres last year, is only now beginning to be understood.

“Our first ground geophysics survey on a historic prospect has identified the type of conductor that could reflect significant massive sulphide accumulations.

‘’We continue to be excited by the targets being generated and the opportunities that presents for follow-up drilling.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.