US$3.5BN kidney deal puts DXB’s current valuation in perspective

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 3,178,334 DXB shares and 1,278,334 DXB options at the time of publication. The Company has been engaged by DXB to share our commentary on the progress of our Investment in DXB over time.

Last month, a big pharma company swooped on two treatments for a rare kidney disease in a US$3.5BN deal.

Our biotech Investment Dimerix (ASX:DXB) is also focused on treating a rare kidney disease.

DXB is at an advanced stage in the development of its drug, currently conducting Phase 3 clinical trials.

DXB is currently capped at $27M, with an extra $8.7M in the bank following a recent capital raise at 8c.

DXB is the only company in the world right now in a Phase 3 clinical trial for its particular rare orphan disease and DXB is actively seeking pharma partners to help commercialise its treatment.

In March this year, DXB said it was in “advanced partnering negotiations with material offers received from multiple parties for various territories”...

If a deal is done, it could be at many multiples of DXB’s current market cap.

Today we will give an update on DXB’s progress, how the ‘rare kidney disease’ space is shifting, and how our DXB Investment is going.

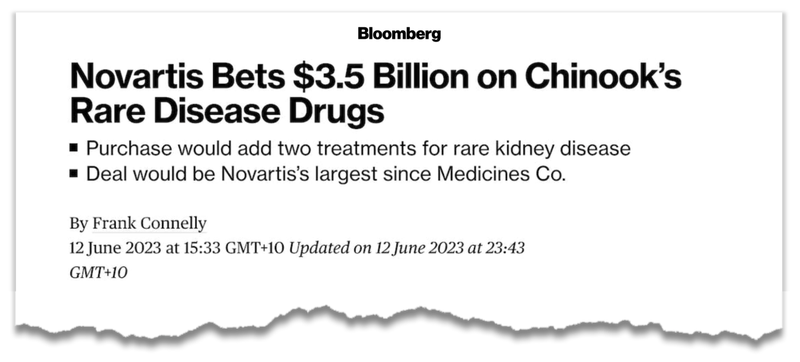

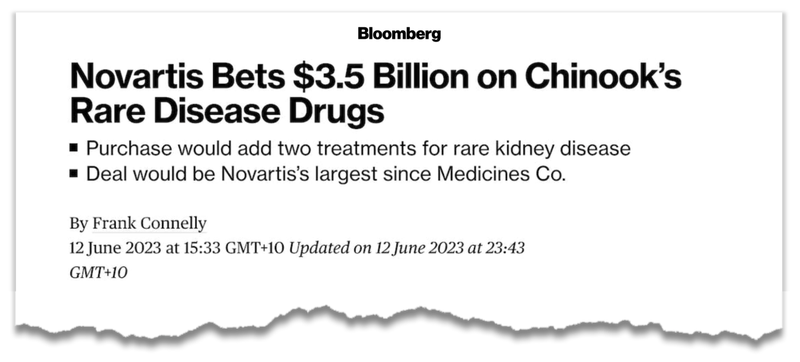

That $3.5BN deal in the kidney space occurred just last month.

The US$223BN pharma giant Novartis bought a mid-cap NASDAQ biotech company for US$3.5BN.

Just like DXB, this mid-cap biotech is also developing treatments for a rare kidney disease.

This $3.5BN deal sets a benchmark price by big pharma on later stage assets treating rare kidney diseases. It also highlights the M&A appetite for kidney drug development.

We have been Invested in DXB since August 2021.

There is now roughly six months to go before the major catalyst is due for which we first Invested.

The catalyst is “interim analysis” results from its current Phase 3 clinical trial.

These interim results should identify whether there is enough evidence to suggest that DXB’s treatment is working to reduce the effects of Focal segmental glomerulosclerosis (FSGS) - the rare kidney disease DXB is developing a treatment for.

Unfortunately, it's been a rough couple of years with our DXB Investment. Our Initial Entry Price was 20c, and the stock is now trading at 6.8c.

We are long term Investors and continue to hold the majority of our shares, recently increasing our position in the 8c capital raise.

We think the downward trend in DXB’s share price has been largely driven by:

- Broader weakness in the small cap biotech market;

- Some delays in the trial process; along with

- Additional capital raise needed to carry the company through to interim analysis results.

The worst of that downtrend may now be in the past - with an extra $8.7M in the bank DXB is funded for the medium term, and is now roughly 6 months out from key interim Phase 3 clinical trial results.

DXB is developing a drug for FSGS, a debilitating kidney disease for which there is no known treatment.

Owing to the rare nature of this disease, treatments for it are designated “orphan” drugs by the FDA.

Orphan drug designation encourages companies to research and commercialise treatments for rare diseases, via various financial incentives and an accelerated approval process with the FDA.

Ultimately, orphan drugs command more expensive pricing, which insurance companies are prepared to pay. This can contribute to an increased valuation on the companies that own the treatment (like with the $3.5BN purchase of Chinook which was for a rare kidney disease).

“Interim analysis” results for the first 72 patients in DXB’s Phase 3 trial for FSGS are now likely to be announced in Q1 of 2024.

Basically, “interim analysis” involves an independent committee (a Data Safety Monitoring Board) that has access to data on the trial saying, “yes keep going, DXB’s treatment is working and safe” or a “no stop, it isn’t working or isn’t safe”.

We think that a positive “yes keep going” result will significantly de-risk the clinical trial and put DXB at the forefront of any cashed up big pharma company looking to boost their presence in the renal (kidney) space.

On that front, in March this year, as we noted above, DXB said it was in “advanced partnering negotiations with material offers received from multiple parties for various territories”...

That was in March. Now that it's July, we think that there are two NEW external factors that may have accelerated DXB’s partnering deal process.

Two New Developments - Both Good for DXB

In the last few months there has been two key developments in the kidney space that we think positively affect the potential value of DXB’s treatment:

- Novartis bought Chinook for US$3.5BN, taking control of two late stage treatments for rare kidney diseases

- Travere Therapeutics failed its Phase 3 clinical trial for FSGS treatment Sparsentan.

Here is our quick take on each of these developments, and what it means for DXB:

News #1: Novartis buys Chinook for US$3.5BN

What Happened:

Last month Novartis’ US$3.5B acquisition bid for Chinook was accepted and the company acquired a range of assets that treat renal diseases. Chinook has two treatments for IgAN, which is an adjacent rare kidney disease that is different to FSGS.

How it affects DXB:

This deal sets a benchmark price by big pharma on later stage assets treating rare kidney diseases, and it also highlights the M&A appetite for kidney drug development.

(Source)

News #2: Travere Therapeutics fails its Phase 3 clinical trial for FSGS

What Happened:

Earlier this year the only other Phase 3 trial for FSGS FAILED to achieve the primary efficacy endpoint.

How it affects DXB:

Although not a direct competitor to DXB, this development greatly enhances DXB’s value given it is now the only advanced stage drug in development for FSGS on the planet.

This development adds a level of urgency on DXB’s treatment to succeed for patients with FSGS and, if successful, presents itself as the only solution in the market.

Of course, at the same time, this failure in the clinical trial does demonstrate the high risk nature of investing in small cap biotechs - clinical trials can and do fail.

(Source)

So, on the one hand we have a kidney deal done for $3.5BN, and on the other, DXB is now the ONLY late stage, Phase 3 trial, FSGS treatment in the market.

This leaves DXB as the closest hope of treating FSGS in the foreseeable future.

We think that these two pieces of news, particularly when read together, significantly advance the market value of DXB’s product, if the clinical trial is successful.

DXB study design now appropriate for China

Yesterday, DXB revealed that the Chinese regulatory agency that oversees medical trials and products has determined that DXB’s Phase 3 trial could be extended to the country.

An investigational new drug (IND) application will now be submitted and the country could be included in Part 2 of the Phase 3 study.

(Source)

DXB already has trial sites in Taiwan and Hong Kong and it is possible no additional sites need to be opened.

The upshot of this update is significant - China has roughly 100,000 FSGS patients and the market is estimated to reach US$2.2BN by 2027.

This would effectively add an additional 33-50% to DXB’s existing number of patients who could benefit from the company’s treatment.

We like it when our Portfolio Companies enter new markets and expand their overall footprint, so we are pleased that DXB has made an effort to enter China.

However, finishing the trial remains the company's number one priority.

And to finish off this trial, DXB has launched a capital raising with two separate offerings to provide sufficient runway to the company to achieve its primary objective.

DXB raises $8.7M to fund its clinical trials

DXB recently conducted a capital raise for up to $8.7M through two separate offers.

We participated in the entitlement offer, increasing our position in DXB at 8c.

The terms of the deal were:

- Entitlement offer - $5.2M raised via an entitlement offer at 8c per share.

- Convertible note agreement - $3.5M raised via a convertible note agreement with US based fund manager Mercer Street Capital Partners.

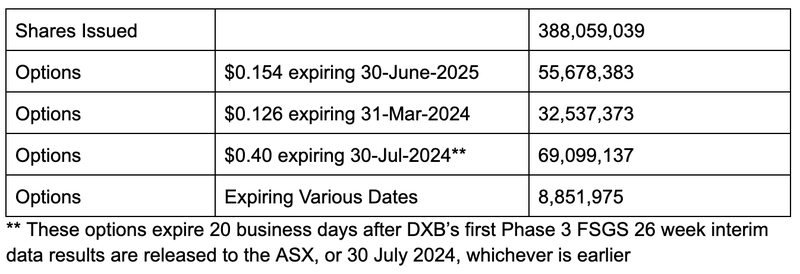

The entitlement offer also came with a set of two options for every two shares subscribed for under the rights issue:

- Short term option - One free option exercisable at 12.6c, expiring 31 March 2024.

- Long term option - One free option exercisable at 15.4c, expiring 30 June 2025.

DXB now has 388 million shares on issue as well as ~160 million options on issue.

Here is how DXB’s capital structure looks now:

Our take on the entitlement offer

One thing to note from the entitlement offer to existing shareholders is that DXB was initially looking to raise ~$8.5M.

DXB only raised $5.7M from the offer to existing holders, which means there is still a shortfall of ~$2.8M shares to place.

As is customary for entitlement offers, DXB still has three months from the offer closing date to issue that shortfall to investors who are interested in buying into DXB at the entitlement offer price.

This means that until the 29th of August 2023, there is a $2.8M block of shares available to buy off-market at 8c per share with two free attaching options.

As a result, there may be some resistance at 8c up until the 29th of August or until that shortfall gets placed to new investors.

Our take on the convertible note agreement

Under the convertible note agreement DXB raised $3.5M.

The agreement also applies a 10% interest rate meaning DXB is actually issuing ~$3.8M in convertible notes to the financiers.

The notes have an 18 month maturity and can be converted into shares over the life of the note at two separate conversion prices:

- Over the first three months after issuance - the noteholder can convert into DXB shares at 11c.

- After the first three months - noteholders can convert into DXB shares at the lesser of 11c and at 90% of the 2-day VWAP subject to a floor price of 5c per share.

At a high level, this means that over the next ~18 months we would expect to see the noteholder convert the ~$3.8M into DXB shares at a minimum of 5c per share and a maximum of 11c per share.

As a result we may see some selling pressure which might mean DXB’s share price trades sideways between that 5c and 11c range (assuming a big pharma deal or extremely positive clinical results don't come).

All of these instruments were to help DXB fund its Phase 3 clinical trial and get the company to a stage where a binary outcome (a positive result at the interim analysis) or an unexpected positive result (like a pharma deal) will help the company de-risk its project.

With the cash in the bank, now it is up to DXB to deliver on its clinical trial and drive value for the shareholders.

More details on the latest in the kidney disease treatment space

As we highlighted above, it has been a busy first half of the year for renal based biotech companies with two major developments that directly affect DXB:

- Novartis buys Chinook for US$3.5BN, taking control of two late stage treatments for rare kidney diseases

- Travere Therapeutics fails its Phase 3 clinical trial for FSGS

1) Novartis buys Chinook for US$3.5B

Last month Chinook Therapeutics Inc, a mid-cap biotech company listed on the NASDAQ, accepted a buyout bid from Novartis for US$3.5BN.

Novartis is one of the “big pharma” companies and recently axed 10% of its pipeline program to focus on five therapeutic areas (cardiovascular, haematology, solid tumours, immunology and neuroscience).

Given that renal (kidney) space doesn’t feature directly in these areas, it is a testament to the value of the deal that Novartis would acquire a company in the space.

In particular, Novartis took control of Chinook’s products to treat IgA Nephropathy, another rare kidney disease.

The key factor in driving the valuation is that Chinook is developing an “orphan drug” with near-term revenue potential for Novartis if the drug makes it to market.

IgA Nephropathy is an orphan disease (just like FSGS), which means that the treatment commands orphan drug pricing and has a 7 year exclusivity period.

🎓To learn more about orphan drugs read: Orphan Drugs Explained

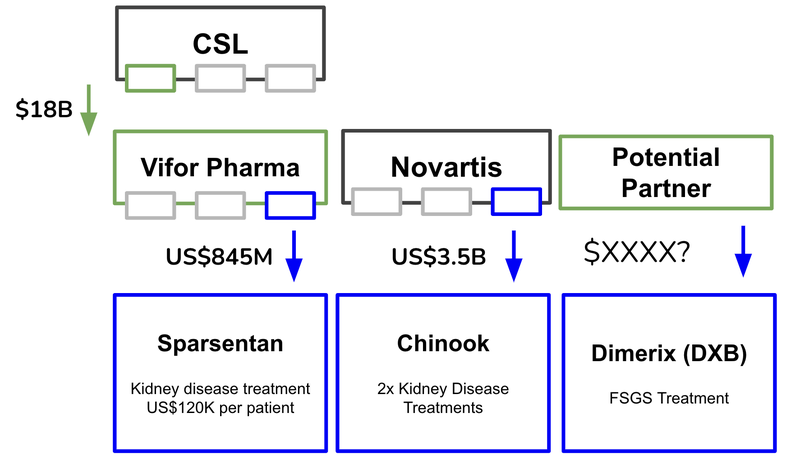

Novartis joins the growing growing list of big pharma companies entering the orphan drug renal space:

2) Travere fails Phase 3 Clinical Trial

The second key value driver for DXB has been the failure of Travere’s Sparsentan drug in its Phase 3 clinical trial for FSGS.

Although Travere was developing a drug for FSGS, it worked on a different point on the kidney destruction pathway to DXB.

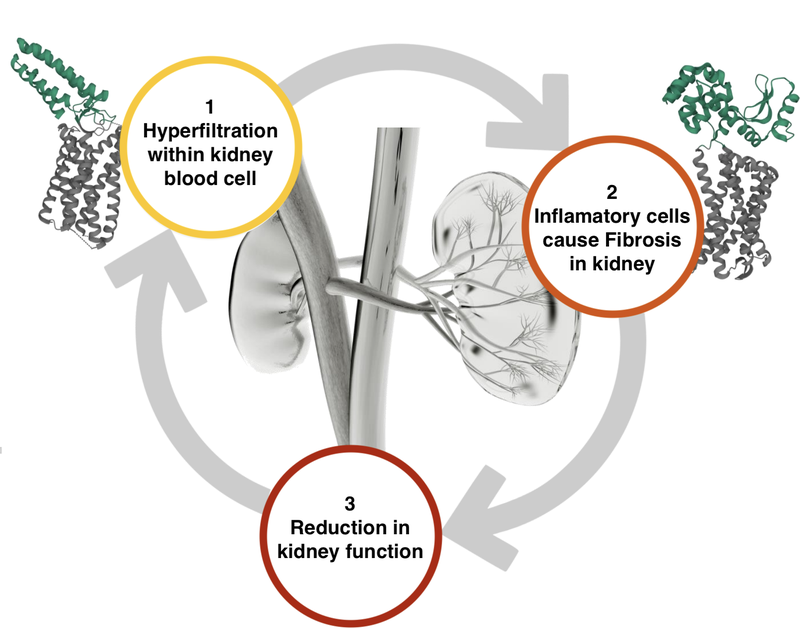

Here is what the kidney destruction pathway looks like for a patient with FSGS:

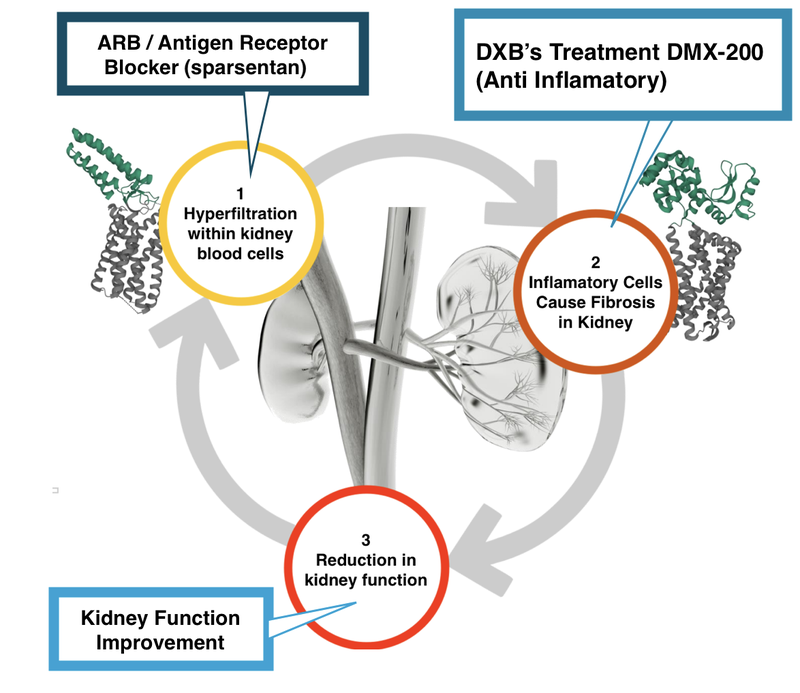

Here is what it (hopefully) will look like with DXB’s treatment in combination with an Antigen Receptor Blocker (ARB) like Sparsentan:

Sparsentan is an ARB, meaning that it is working on the first (1) part of the kidney destruction pathway.

This is different to DXB’s treatment, DMX 200, which is an anti-inflammatory and works on the second (2) part of the kidney destruction pathway.

In its clinical trial, Travere failed to prove that its product, Sparsentan, was effective at improving kidney function when compared to a placebo.

It was unfortunate for Travere (and people with FSGS) that it did not succeed the “statistically significant” threshold required in a clinical trial.

This means that DXB is the only advanced staged company left developing a treatment for FSGS.

Both of these two developments cast a large spotlight on DXB, particularly in the pharmaceutical world.

The world is now watching, and any positive outcomes at its Phase 3 clinical trial we think will be met with great interest from big pharma.

What is coming up next?

🔄 Completion of recruitment (144 patients)

We’re looking for additional patient recruitment updates on the 144 patients DXB needs to complete Part 2 of the trial which could unlock accelerated marketing approval. The latest update has placed the number at 116 enrolled patients as of 28 April 2023.

🔄 The big catalyst: interim analysis results (Part 1 data outcome)

Based on what we know about the timeline and structure of DXB’s Phase 3 trial, we anticipate the interim analysis results in Q1 2024.

The results in the interim analysis will come via the independent Data Safety Monitoring Board (DSMB) which will essentially determine if the trial should continue through to the final endpoint, as it has access to unblinded data from the trial.

The DSMB decision will be binary and a positive result we think would be a proxy for determining the efficacy of DXB's treatment - i.e. if it's getting results along a key metric for kidney function improvement then the DSMB will recommend the trial continue.

This is a binary result for DXB and as such we only have a bull and a bear case:

- Bull Case: Enough evidence to continue the trial

- Bear Case: Trial paused or stopped

What could go wrong

For DXB, there have been some key risks which have materialised that have negatively impacted the share price.

In particular the risks associated with early stage biotech companies that include “delay risk” and “funding risk”.

When DXB raised $20M in August 2021 there was an expectation that this would fully fund them through to the interim analysis results and that the results could be due by the end of 2022 (subject to patient recruitment).

However patient recruitment rates have been slower than anticipated and the interim analysis results are likely to be early 2024.

This is one of the key risks with early biotech companies and particularly with ones treating rare disease, where there are fewer patients with the disease to recruit.

The share price has reflected this, with the company trading down 66% from our Initial Entry Price.

However, with funding now secured the key risk hanging over DXB’s head is just the “Clinical Trial Outcome” risk...

If DXB fails in its clinical trial, it would be a significant setback for the company and our Investment.

Note, we think that commercialisation risk has been somewhat mitigated with the $3.5B Chinook acquisition and Travere failed clinical trial.

We think that if the trial results are positive, then DXB should have an easier time commercialising its treatment.

Our DXB Investment Memo

In our DXB Investment Memo you’ll find:

- Key objectives for DXB

- Why we Invested in DXB

- What the key risks to our Investment Thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.