Trade war to re-start

Published 01-MAR-2019 09:14 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Having spent the past four days clearing my desk of the accumulation which typically occurs during two weeks absence, I find I have time to pen a few thoughts. My main thought is nothing appears to have changed.

A reminder popped up in my diary this morning that the truce in the trade war between the US and China ends today. The timing is great, with US GDP showing a slowdown and Mr Trump still pressing on with his wall.

US GDP rose at an annualised 2.6% during the December quarter with momentum hit by weaker consumption. The number is well down from the 3.4% and 4.2% reported for the previous two quarters and suggests a trend may be starting.

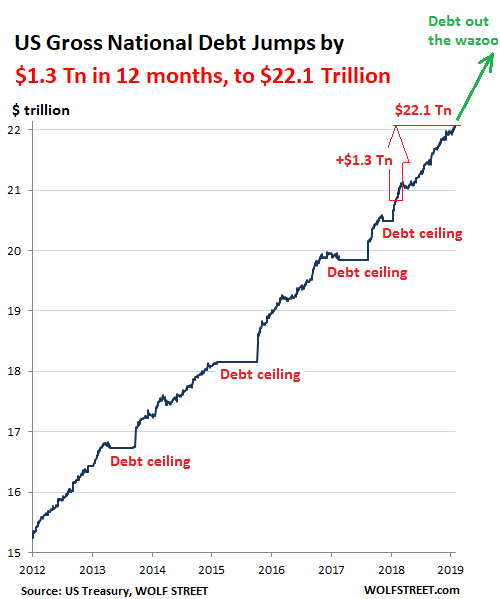

Delving into the numbers the US economy grew by US$1 trillion during the December quarter, remember that consumption represents 85% of that number, and government debt rose by – wait for it – US$1.3 trillion.

Mr Trump’s economic miracle is being pumped up by borrowings, the chart below reflects this nicely:

The reporting season appears to have been good overall with investors benefitting from special dividends from Wesfarmers, BHP and Rio to mention a few.

The NBN seems to find its way into more and more conversations and another such instance yesterday lead me to the internet where I found a recent letter to the Editor of the Australian Financial Review from Kevin Rudd. We all remember him. Mr Rudd opined in his very lengthy piece on the NBN that “It was never envisaged that the NBN generate a commercial rate of return”. The next time I get one of those statements from the ATO showing me how my taxes are spent by government I shall look for that line item.

Pressure appears to have come off interest rates, indeed there are forecasts of a cut by the Reserve Bank - although my forward synthetic interest rate curve doesn’t give it more than a 25% chance.

That said the more important aspects of our economy must be the high level of household debt, weak wage growth and insipid inflation. The up-and-coming budget to be read on 2 April will no doubt be full of election winning hand-outs, but the challenge will be in addressing the big items.

After a soft night on Wall Street our index futures are up 6 points and the Australian Dollar is weaker at US$0.7095.

Alex Moffat is a director at Joseph Palmer & Sons.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.