The Macro Themes Driving the Small Cap Market Right Now

Published 24-OCT-2023 08:37 A.M.

|

14 minute read

Another week in the small cap down cycle... sigh.

Patiently waiting for it to swing back to positive sentiment and for oversold small cap stocks to re-inflate back to normalised share prices.

But we have also seen pockets of positive sentiment in a couple of sectors with uranium and biotech stocks running recently.

So which market sector will run next?

Energy (oil & gas) looks like it’s about to get popular with new trouble brewing in the Middle East.

We are also hearing early rumblings that graphite might be the next commodity to have its time in the sun (more on this in a second).

So in anticipation that the broader small cap market will come back (it eventually always does)...

...OR that a particular sector roars back ahead of the broader market...

(like we have seen with uranium and biotechs).

And while broader small cap share prices are at their worst...

We have been trying to participate in more cap raises as they come along.

(this strategy worked for us during the last market down cycle around March 2020, but it may not be appropriate for everyone).

If you qualify as a s708 Sophisticated Investor and want to participate in these deals too register here.

(unfortunately, we are only allowed to show these deals to s708 Investors, these are are rules set in the Corporations Act and enforced by ASIC)

We are also looking at participating in an IPO for early next year, which we are allowed to invite everyone to because it has a full prospectus document - we will announce this IPO soon.

So even when the small cap markets are working through a down cycle, why do some small cap sectors have little runs against the negative sentiment tide?

Markets have changed a lot a over the last few decades.

Before the internet, stock prices were quoted in newspapers or on “trading floors” in stock exchanges.

The everyday investor had no real-time access to data and it was a relatively opaque place to put money to work.

Nowadays, everything has changed.

Everyone has access to the same information (good or bad) on their phone, on demand.

Combined with the ability to make and execute investing/trading decisions instantly.

That means markets are reacting to information in real time a lot quicker than they would have in the past.

As a result, the markets can anoint a certain sector into favour almost instantly in response to macro events or news.

We saw this a few weeks back when the market quickly caught on to the fact that uranium prices were trading at decade highs of ~US$70.

Investors started piling into uranium stocks (including us) - small and large - and it looked like positive market sentiment was back for uranium stocks.

We announced our Investment in African uranium explorer Haranga Resources (ASX: HAR).

We are invested to see the company repeat the success of other African uranium explorers like $400M Bannerman Energy - HAR briefly touched 26c per share - up over 200% from our initial entry price.

It was positive to see the market wake up to small cap stocks again, even if it was just in the uranium space.

Our other uranium Investments also went on a little run.

Okapi Resources (ASX: OKR) - went from ~7c to a high of ~19c per share in under 2 weeks - a ~250% move.

GTI Energy (ASX: GTR) - went from 0.7c to a high of ~1.1c per share in that same time period - a ~50% move.

We are holding on to all our Uranium positions because we think the Uranium run has only just started, even though the excitement has settled in the last few weeks as the U price took a breath.

The U price still remains at decade long highs... another material leg up in the U price should get things going again:

Basically the sudden turn in sentiment has re-rated most uranium stocks from their “down cycle” lows back to more reasonable share prices.

This is where investors who picked up uranium stocks during the times of broader low market sentiment are now sitting on decent paper gain.

Biotechs also took centre stage...

On the 5th of October Dimerix (ASX: DXB) announced a commercialisation deal worth up to ~A$230M.

Off the back of the news DXB’s share price went from 6c per share to a peak of ~23c per share - up over 300% in a few days.

A week later our pre-clinical cell therapy Investment Arovella Therapeutics (ASX: ALA) announced a licensing deal.

ALA’s share price ran to a high of ~9.5c after the news - 50%+ higher than where it was in early October.

Again, it was good to see interest flood back to a few small cap stocks in otherwise pretty desolate market conditions.

A select few small biotechs are now sitting above where they traded for the last 12 months, all it took was some positive sentiment and material news to re-inflate them back up from their oversold states.

Could the Oil and Gas sector be next?

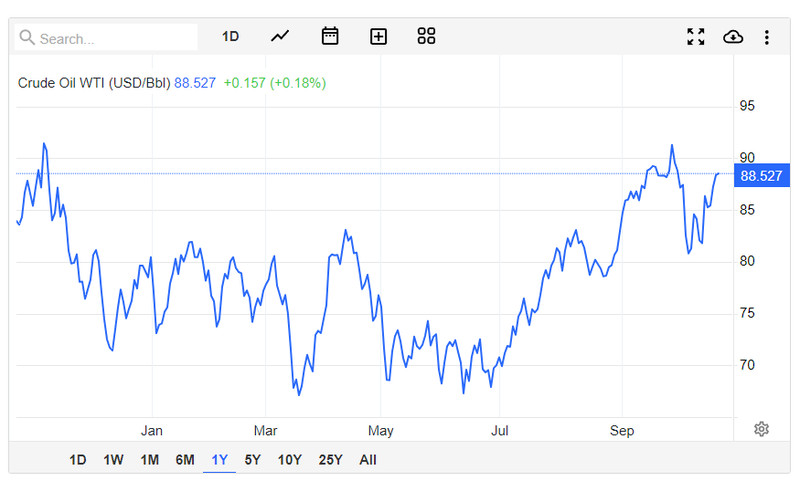

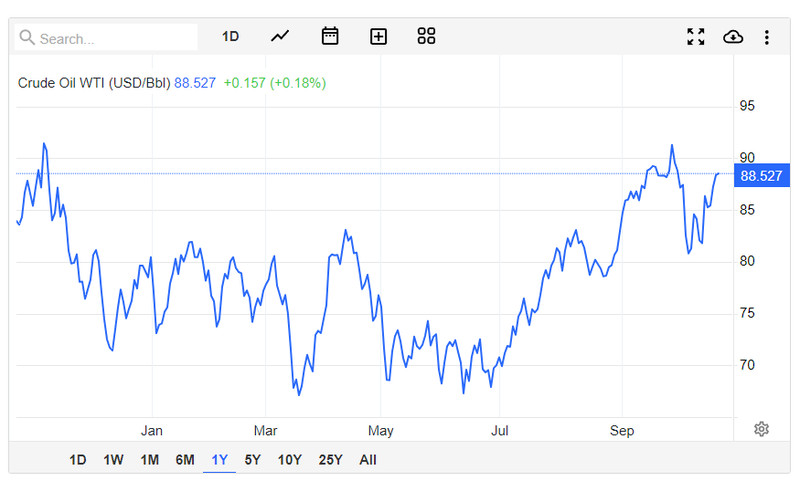

In the background, while market interest swings from one sector to another, oil & gas prices are on the rise...

It’s a sector that has been underinvested in for many years.

Oil prices recently hit $90 a barrel on the troubles in the Middle East - it's still very early to predict what might happen there.

Gas prices are rallying because of supply concerns.

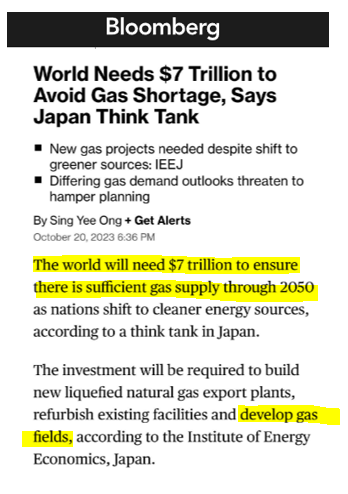

Yesterday, the Institute of Energy Economics in Japan released a report that said the world will need $7 trillion of investment to maintain stable gas supply through to 2050 (including development of new gas fields):

(Source)

Maybe next, the market will wake up to the reality of much higher energy prices and start a run on small cap oil & gas stocks?

As Investors in a few small cap oil & gas stocks we certainly hope so.

We are hoping that a perfect storm of macro interest and good material news from two of our oil & gas Investments lead to re-rates in their share prices.

Invictus Energy (ASX: IVZ) is potentially weeks away from delivering results from its current drilling campaign where a discovery could unlock an entirely new oil & gas basin in Zimbabwe (potentially as soon as within 17 days by our rough calculations)

Elixir Energy (ASX: EXR) - is about to start drilling its QLD gas project where it has a 395 Bcf contingent resource (which sits inside an initial 3.3 Tcf unrisked mean prospective resource).

While broader market sentiment is low, so are expectations in the lead up to oil & gas drill results, so we believe that any sniff of positive drilling results could rerate these small cap explorers from where they are today.

(keeping in mind that exploration results could also be negative)

Another type of gas - A big result could bring the run

Last week NHE announced they had completed some repairs on their drill rig and are now doing the final prep prior to starting drilling.

7 years in the making and NHE is so close to drilling its first well at its giant helium project in Tanzania.

We are betting that NHE’s Managing Director Justyn Wood will be able to pull off a “string of pearls” discovery like he did with Hardman Resources all those years ago.

NHE about to drill the world’s largest prospective helium resource

We are waiting for NHE to spud its first well, and then expect the drilling to take less than a few weeks to complete.

Again, a big drill result by NHE here should catch the market off guard, given that most investors are currently watching the small cap market from the sidelines, as opposed to jumping in before results have been announced on speculating that the results will be positive.

Graphite stocks the next to run?

Graphite has had a shocking 2023.

Energy prices were low in the first half of the year, meaning energy intensive synthetic graphite (that is produced in a lab) became competitive with natural graphite (that is mined).

A few weeks ago, UBS put out a report saying that they think graphite is going to have a run.

(Source)

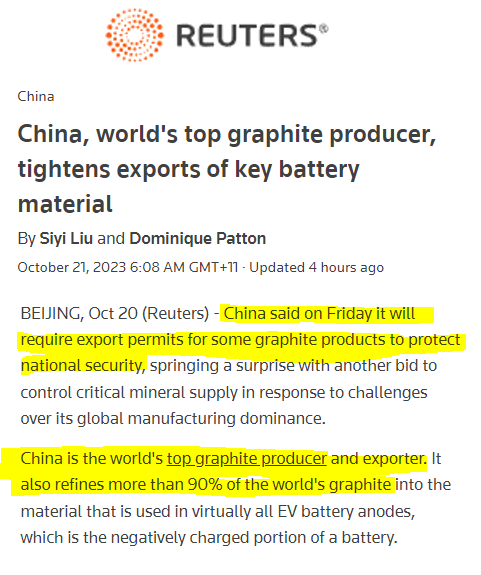

We also saw yesterday that China has slapped export restrictions on some graphite products to “protect national security”.

For some context - over 80% of graphite and almost 100% of graphite battery anodes are produced in China.

(Source)

And finally, the increasing energy prices that we mentioned earlier are making energy intensive synthetic graphite uncompetitive again.

We hope these are the very early signs of a graphite price run and market interest into graphite stocks with projects outside of China...

Like our two graphite Investments Sarytogan Graphite (ASX:SGA) and Evolution Energy Minerals (ASX:EV1).

Graphite stocks have been unloved (much like everything else in the market) so a positive swing in graphite sentiment will hopefully re-rate them back to normalised levels.

We will be providing a macro update on graphite on our graphite stocks soon.

Critical Materials: Long term macro thematics are still very strong:

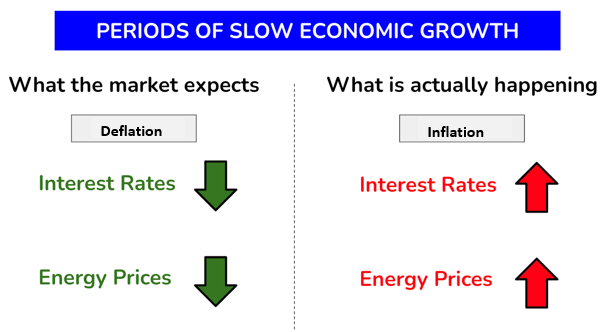

The current market is one of the most “macro impacted” we have seen over the last few decades.

Commodity prices are pricing in a slowdown in economic activity, interest rates are high, central banks are threatening more hikes, and energy prices are increasing.

Typically, when the markets expect economic growth to slow, we see energy prices start to fall, and central banks start talking about potential rate cuts.

Right now, we are seeing the exact opposite scenario play out.

Oil prices continue trading higher - hitting 12-month highs last week at ~US$94 per barrel.

(Source)

And central banks are signalling more rate hikes to try to tame inflation.

(Source)

We think the unexpected is happening because the world hasn't had to deal with all of these problems at the same time as a move to de-globalise supply chains.

Since the COVID pandemic, the world has started implementing measures to de-globalise supply chains.

Put simply - countries are trying to wean off a reliance on imports and reshore supply chains from the raw materials we use to produce things all the way up to the factories that process them into final products.

The move brought about the concept of “critical minerals” and led to the launch of critical minerals strategies by governments worldwide.

Over the next decade,we think the move to de-globalise supply chains will be one of the strongest macro thematics in financial markets.

China caught onto this very early and is now a global leader in some of the most important parts of the critical raw materials supply chains.

Now, the smart money in the West is starting to do the same.

The USA’s biggest lithium chemical producer, Albermale attempted a $6.6BN takeover of Liontown’s Kathleen Valley lithium project in WA.

Chile’s biggest lithium producer, SQM, moved quickly to lock up a 19.99% stake in Azure Minerals lithium project in WA.

AND MinRes has been busy buying majority stakes in projects all across WA.

Any project that reaches a point of critical mass in jurisdictions that are seen as “safe” immediately starts to become strategically important to the majors operating in the critical minerals space.

As soon as they get big enough, they get swooped on by the majors with the big balance sheets.

We think that as supply chain fragilities become more apparent and governments move to restrict the flow of critical raw materials, the potential for bifurcation in raw material markets becomes more of a reality.

Things like the move to restrict exports of Nvidia computer chips (announced earlier this week).

(Source)

At a very high level - bifurcation would mean two separate markets for the same product with two different prices based on where the specific product comes from...

I.e. copper produced in Australia might trade at a premium to copper produced elsewhere...

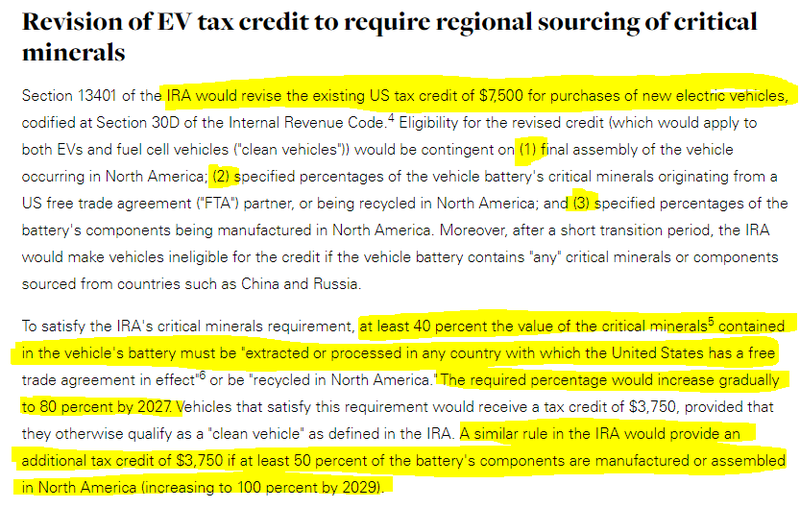

We think the US IRA has given the market a first look at how a bifurcated market would look with its US$7,500 in tax incentives on new electric vehicles limited to the cars produced using raw materials mined/processed inside the US or in one of its “friendly countries”.

Put simply, the US government has put in place incentives that could make products inside countries like Australia, the US and its free trade partners commodities more valuable than others.

The following interview with Nero Resource Funds Russel Delroy sums up perfectly the potential for “metals market bifurcation”.

For anyone who hasn't seen it, we highly recommend having a listen:

Our view is that over the next decade, we will see a wave of capital seeking raw materials projects in countries considered “friendly” or “safe” like Australia, the US, parts of South America and Europe.

Some commodities we think there is supply chain fragility right now are:

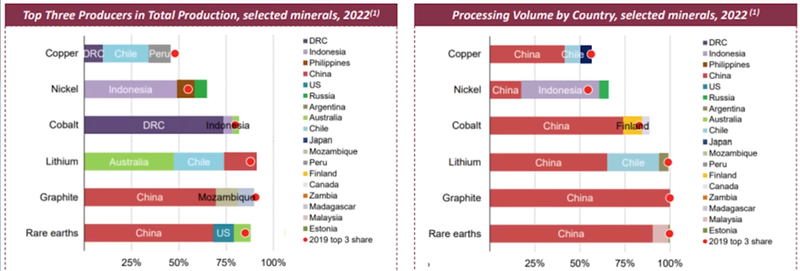

- Rare earths - ~65% of the world’s rare earths are mined in China, and over 90% are processed in China.

- Graphite - ~80% of the world’s graphite is mined in China, and almost 100% of all graphite battery anodes are produced in China.

- Lithium - Australia is the world's biggest lithium miner, BUT China controls ~60% of all processing capacity.

- Cobalt - over 70% of the world’s cobalt is mined in the DRC, and China is responsible for ~75% of its processing.

- Nickel - ~50% of the world’s nickel supply comes from Indonesia, and ~60% is processed in Indonesia/China.

- Copper - most of the world's copper is mined in South America, but again, China controls just under 50% of the world's processing capacity.

(Source)

Uranium is another commodity that we think should be featured on the above list.

~40% of the world's uranium comes out of Kazakhstan, and ~20% of the world's enriched uranium from Russia.

The uranium market is especially fragile because the biggest consumers of uranium/nuclear power (France and the USA) are almost exclusively reliant on imports for their nuclear fuel supply.

We hold Investments in companies looking to discover, define and develop projects across these commodities in jurisdictions we think will see capital inflows over the coming decade.

We just need to wait out this down cycle in small cap market sentiment.

In the meantime, the upcoming “swing for the fence” drill results from IVZ and NHE should keep things interesting for us...

What we wrote about this week 🧬 🦉 🏹

IVZ drilling final targets - 17 more days until we find out?

IVZ put out an update on its Mukuyu-2 well yesterday. The well is currently at ~2,750m of the planned Total Depth (TD) of ~3,750m. We expect the well to be completed within ~11 days, then wireline logging to take another ~5-7 days. We should start to see final results from the well before the end of November.

Surprise, LCL’s Colombian Gold project might be coming back...

On Monday, we got a big surprise. LCL’s environmental licence was APPROVED at its Colombia gold project, which is the last major step before production is allowed.

Could the Colombia gold project be back on after a long, dormant period? The gold price is moving up, too.

MNB one step closer to first production with $14M from development bank

On Tuesday, MNB announced a term sheet for $14M of debt funding from the Industrial Development Corporation of South Africa. It’s full steam ahead as our fertiliser and green ammonia Investment gets one important step closer to production.

Quick Takes 🗣️

GAL hit more PGE’s at its Norseman project

LCL presents at the Australian Nickel Conference

MAN permitting another well at US Lithium Project

MNB - Angolan president name drops Minbos in address to nation

PFE lithium acreage in the US now 12% bigger

SLM kicks off its second lithium drill program in Brazil

Macro News - What we are reading 📰

Copper

Glencore to shed 1200 jobs and shut Mount Isa copper mines by 2025 (AFR)

Oil and gas

Africa’s High Impact Wells 2023 - The scores so far! (TROVE)

Oil and gas Capex renaissance (Lykeion)

Uranium

US sees a role for nuclear technology in Africa’s energy shift (Bloomberg)

Graphite

China, world's top graphite producer, tightens exports of key battery material (Reuters)

Lithium

Battery metal prices collapse on supply glut, cool Chinese EV demand (AFR)

Rio Tinto says lithium boom is cooling, for now (AFR)

Albemarle walks away from $6.6b Liontown bid (AFR)

Biotech

What’s been eating CSL? Blue chip company feels the Ozempic effect (AFR)

⏲️ Upcoming potential share price catalysts

Updates this week:

- IVZ: Drilling oil & gas target in Zimbabwe, Mukuyu-2 (Q3, 2023)

- IVZ put out an update on its drill program on Friday. See our deep dive on the news here.

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- NHE looks like its almost ready to start drilling. See the update from site here.

No material news this week:

- EXR: Daydream-2 appraisal well, QLD

- TYX: Second round of drilling at its lithium project in Angola.

- PUR: Drilling its Argentine lithium project in Q4-2023.

- TMR: Maiden JORC resource for its gold project in Canada.

- LYN: Assay results from its Bow River nickel-copper-PGE project in WA.

- 88E: Flow test well, Alaska (Q4, 2023)

- TMR: Maiden JORC resource estimate for its Canadian gold project

- GGE: Drilling for helium in the US (Q4 2023)

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (March 2024)

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.