Star Combo surges on Bio-E acquisition

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Leading distributor and manufacturer of branded premium health and natural beauty products, Star Combo Pharma Ltd (ASX:S66) has made a transformational acquisition which will not only contribute underlying earnings of $14.7 million in fiscal 2019, but will also provide the group with strategic and competitive advantages across its core markets.

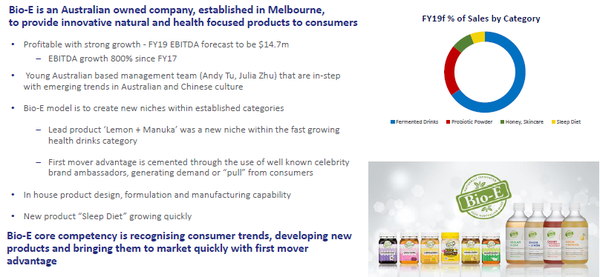

The new addition to Star Combo is Bio-E, a provider of innovative natural and health focused products to consumers.

The upfront consideration of $60 million represents a conservative EBITDA multiple of 4.1 relative to the group’s forecast fiscal 2019 earnings.

The raising comprises a placement of $50 million to professional and sophisticated investors at 55 cents per share and a share purchase plan of up to $1 million at 56 cents per share.

The vendors also received 30 million shares in Star Combo at 60 cents per share, equating to $18 million.

From a strategic perspective, the acquisition of Bio-E is consistent with Star Combo's strategy to grow its branded sales and product development capability, and provides an opportunity to combine the strong (TGA licensed) manufacturing and product development capability of Star Combo and the marketing and distribution expertise of Bio-E.

The acquisition of Bio-E provides Star Combo with the capability to quickly develop, commercialise, market and sell new products.

Five new products in pipeline in 2020

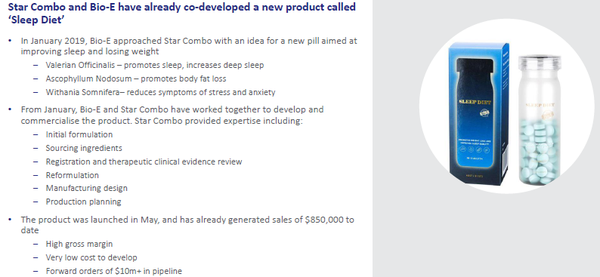

Star Combo and Bio-E have already collaborated to develop and commercialise ‘Sleep Diet’, a new pill aimed at improving sleep and weight loss, with forward orders of over $10 million since its launch in May 2019.

Highlighting the significance of the acquisition, Star Combo Chairman Richard Allely said, “This is a transformational acquisition for Star Combo and accelerates our transition from a contract manufacturing business to a fast growth, high margin, branded business.

“We first met Bio-E when we developed and formulated the new Sleep Diet product for them.

“Both companies quickly recognised the significant synergies by combining our business and bringing our complementary skill sets together.

“We are excited about the significant growth opportunities that both businesses have going into FY20.

“Star Combo’s Living Healthy brand is gaining traction in Australia and is now on shelves in China.

“Likewise, Bio-E new product Sleep Diet has generated over $10 million in new orders since its launch in May this year and we are expecting to launch up to 5 new products in FY20”.

Strong earnings growth and robust margins

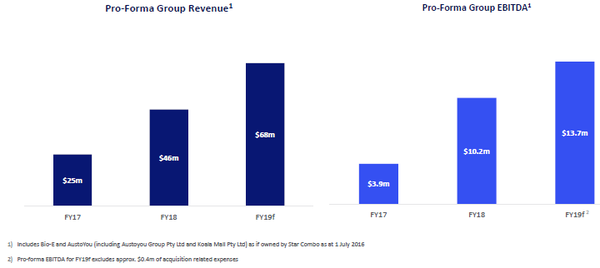

As an Australian owned company established in Melbourne, Bio-E has grown quickly in recent years, with fiscal 2019 revenue and EBITDA forecasts implying growth of 180% and 240% per annum respectively since 2017.

It is important to note Star Combo’s already strong position in product innovation, manufacturing and distribution, as this will enable the combined group to quickly gain traction from its expanded product base.

The group’s efficiencies across its vertically integrated model are evidenced by the comparatively high gross margins of 80%.

Based in Sydney, Star Combo’s products are distributed to both Australian and overseas markets.

Star Combo has offices and distribution agreements in China and currently supplies Australian pharmacy lines as well as distributing to over 450 Terry White and Symbion chemists and wholesale customers in Australia and China.

The distribution side of the company’s business was enhanced substantially in February when the company acquired the businesses of Koala Mall Pty Ltd and Austoyou Group Pty Ltd for A$10 million.

This was a game changing development for the group, particularly in terms of opening up direct selling channels to Chinese consumers.

The significance of this acquisition was reflected in the company’s share price reaction as it immediately surged from 55 cents per share to 85 cents per share.

New earnings metrics imply 100% share price upside

This Bio-E acquisition transforms Star Combo’s growth profile, and in doing so could potentially trigger a significant share price re-rating as a more aggressive PE multiple is attributed to the stock.

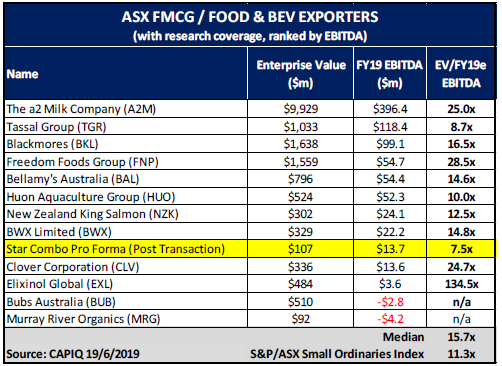

The likelihood of a share price re-rating is highlighted below in the comparisons of peers on an enterprise value to EBITDA basis.

Aside from the $1 billion Tassal Group (ASX:TGR), Star Combo’s EV/EBITDA ratio is the only single digit multiple.

Further, it is at a discount of more than 50% to the median sector average of 15.7.

Some of the comparable businesses are unprofitable, and there are few that generate the high gross margins of 80% that we previously referred to.

The implied enterprise value in the above table is based on the capital raising price of 55 cents per share.

Consequently, if Star Combo were priced in line with the median multiple of its peers, this would imply a share price of approximately $1.15.

Bearing this in mind, even though shares in Star Combo have increased more than 30% to a high of 92.5 cents in morning trading, the implied EV/EBITDA share price represents further upside of 25%.

As investors come to acknowledge the above growth trajectory and the prospect for sustaining strong earnings momentum, as should be indicated when management provides guidance in August, it could well be the case that Star Combo’s enterprise value will be more in accord with the group’s earnings expectations for fiscal 2020.

Other share price catalysts in fiscal 2020 include the proposed launch of up to 5 new products, as well as product registrations that are currently in the pipeline.

The key takeaways

The Bio-E acquisition is a company maker from many perspectives, but there are a few aspects that are worth highlighting.

Firstly, this is a highly earnings accretive addition to Star Combo’s business, effectively transitioning it to a business with robust profitability at an early stage.

The company is debt free with substantial infrastructure in place to ramp up production in response particularly to the fast growing Chinese health and well-being market.

Consequently, Star Combo has the ability to generate significantly higher revenues from increased production off a relatively fixed cost base, resulting in a substantial proportion of income dropping straight to the bottom line.

The group is a highly efficient, vertically integrated business that benefits from complete supply chain management.

This is extremely important in terms of the company continuing to benefit from healthy margins as it isn’t reliant on intermediaries at any stage between product manufacture and consumer purchase.

Not only does this provide optimum cost management, strong margins and competitive strengths, but it also assists the group in operating efficiently and providing its end markets with reliability of supply.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.