Software junior rhipe outperforming larger tech peers

Published 20-FEB-2019 10:46 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the NASDAQ was in the midst of a decline that saw it crash by more than 20% between the start of October last year and December, Finfeed went searching for an oversold ASX tech stock.

Our stock of choice was rhipe Ltd (ASX:RHP), a leading provider of subscription software licensing in Asia Pacific. It is Asia-Pacific’s leading cloud channel company, providing technology partners with complete end-to-end cloud solutions, and helping them grow in the cloud economy.

rhipe has received numerous industry awards for its services and support division, particularly in relation to Microsoft Office365 implementation.

However, while awards are excellent endorsements of a company’s products and its performance, from a shareholder’s perspective it is mainly about profits.

This is particularly the case with relatively early stage IT groups where there are more failures than successes.

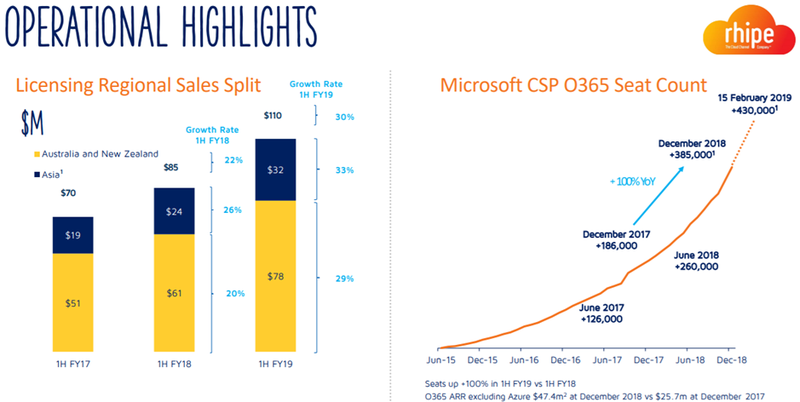

On this note, rhipe continues to go from strength to strength, having delivered an interim profit for fiscal 2019 that was well above broker expectations.

This resulted in its shares hitting an all-time high of $1.74, up nearly 30% since Finfeed identified the company (denoted by yellow line) as a ‘watch this space’ stock, in particular underlining the prospect of positive commentary regarding full-year guidance.

As well as rhipe’s strong first half performance, management’s upbeat full-year guidance contributed to the surge in the company’s share price.

rhipe looking to double 2019 broker forecasts

Not only did the net profit of $3.0 million represent year-on-year growth of 180%, it was well ahead of Bell Potter’s forecast of $2.2 million.

Providing further confidence was management’s full-year guidance for 2019 which pointed to a net operating profit in a range between $11.5 million and $12 million.

When Bell Potter reviewed the stock on February 1, 2019, the broker was forecasting a fiscal 2019 net profit of just $6.3 million.

This underpinned its ‘buy’ recommendation and 12-month price target of $1.62, which will no doubt be upgraded.

Blue Ocean Equities analyst Justin Pezzano noted on Tuesday morning that he had upgraded his price target to $1.90, saying “rhipe’s 1H19 result exceeded our forecasts across both the licensing and solutions divisions.

“The result was supported by strong growth, particularly in South East Asia as well as from its CSP license products which include higher margin Microsoft Office 365 and Azure.”

Management’s consistent record of under-promising and outperforming was also noted, with Pezzano highlighting the fact that the revised 2019 earnings expectations contained in the interim result was the second time the group had upgraded its guidance in fiscal 2019.

The company finished the first half in a strong financial position with cash of $23.2 million, up 34% from $17.3 million in December 2017.

With robust levels of recurring revenue, rhipe’s business model offers income visibility and earnings predictability.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.