SLM drilling “pegmatite grand canyon” - can it evolve to $610M LRS?

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 2,863,637 SLM shares. The Company has been engaged by SLM to share our commentary on the progress of our Investment in SLM over time. Some shares may be subject to shareholder approval.

The day has finally arrived.

It's been less than a month since we announced our newest lithium Investment, and they just announced commencement of drilling.

Our 2023 Small Cap Pick of the Year Solis Minerals (ASX:SLM) is now drilling what we are calling its pegmatite “Grand Canyon”, in Brazil.

SLM is our Pick Of The Year because it is in the same country, looking for the same battery metal with the same team that built $612M Latin Resources (ASX:LRS). which was our first Investment into the Brazilian lithium space.

LRS went from ~$40M capped junior to a $612M capped developer, delivering us a return of ~1,300% over the last 2 years.

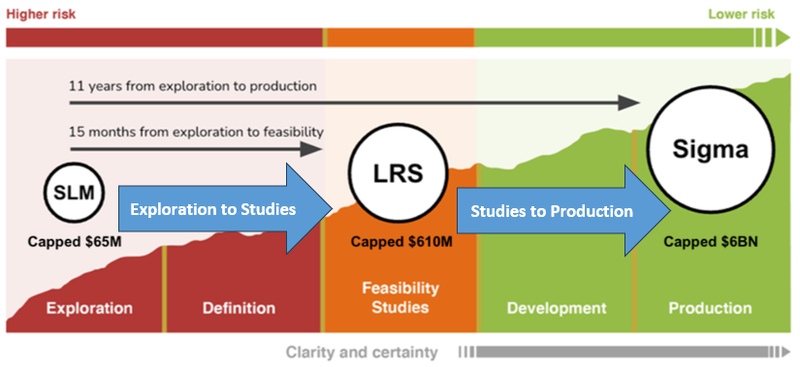

$65M capped SLM wants to become the $610M “LRS 2.0”.

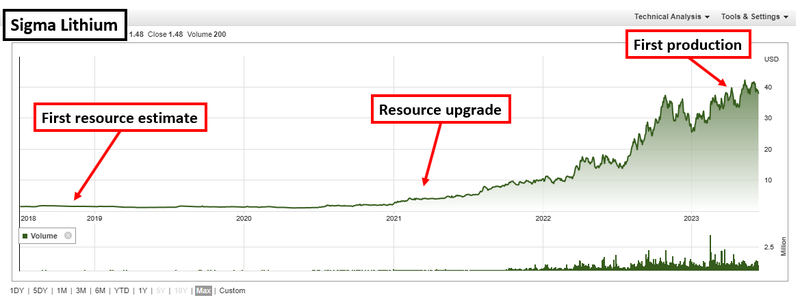

$610M LRS wants to become the $6.2BN “Sigma 2.0”.

Sigma Lithium became Brazil’s first ever lithium producer in April, and LRS is following the same playbook to hopefully evolve to a Sigma 2.0.

SLM is following the same play book as LRS, that is following the same play book as Sigma Lithium... .

Here’s how it looks on our mining company lifecycle diagram for these three Brazilian lithium players:

Hopefully if SLM can deliver some visuals of long spodumene intercepts in their current drilling campaign, and back it up with assay results above 1% lithium, they will be on their way to becoming LRS 2.0.

While it will take many years, lots of capital and plenty of drilling success, we can dare to dream that SLM may even eventually evolve to a $6.2BN Sigma... (this is highly speculative at this stage, let’s focus on SLM becoming LRS 2.0 first).

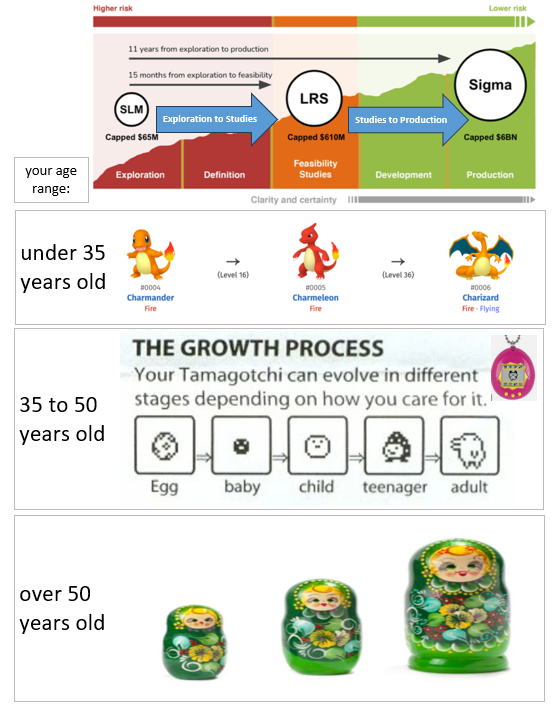

If you are under the age of 35 you probably liked Pokemon, think of it as a Charmander first evolving to a Charmeleon, then finally to a Charizard.

If you are a bit older, think of it as Tamagotchi (remember those?) growing from an egg to a child, and eventually an adult over time (with the proper food and care).

If you are older still, you can probably think of it as a set of those babushka dolls where there is a tiny one, medium one and a big one... maybe?

Whatever your age, and how you think of evolution based on your childhood experiences, the key point is, that for SLM to grow to an LRS 2.0, they need to to achieve the following things:

- Successful maiden drill campaign

- Drill core photo with spodumene

- Over 1% lithium assays

- Multiple extensional drill campaigns at over 1% assays

- Maiden JORC

- More drilling

- JORC upgrade

If SLM can achieve these AND deliver JORC resources in line with LRS, we hope they can move into a similar market cap ballpark as LRS (obviously there is a LOT of work, capital and exploration luck needed before that can happen, and there are no guarantees even if SLM do achieve it).

Earlier this week we wrote about what LRS needs to do to evolve to a Sigma 2.0, which would be similar to what SLM needs to do ASSUMING it can deliver what it needs to get to LRS status.

Today we are at the first of many steps needed for SLM to try and get to LRS 2.0.

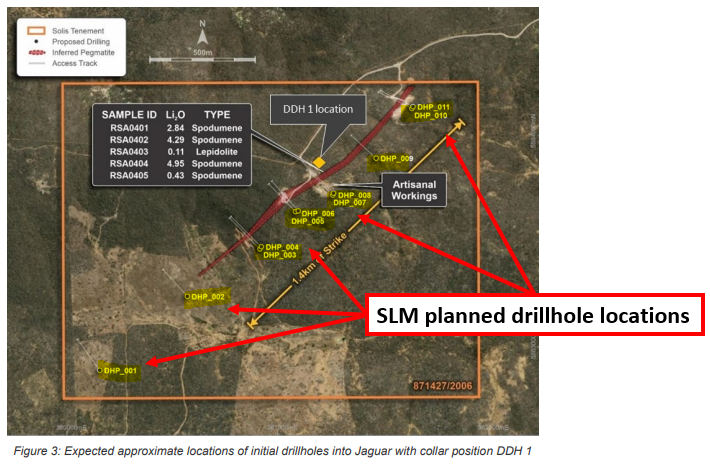

And it starts with putting a drillhole into what we have called “pegmatite grand canyon”:

SLM is planning 11 holes with a diamond drill rig, which is enough drilling to be able to declare a new lithium discovery - assuming drilling success of course - which is never a guarantee.

After recently securing $8M in a capital raise, SLM is well funded for this.

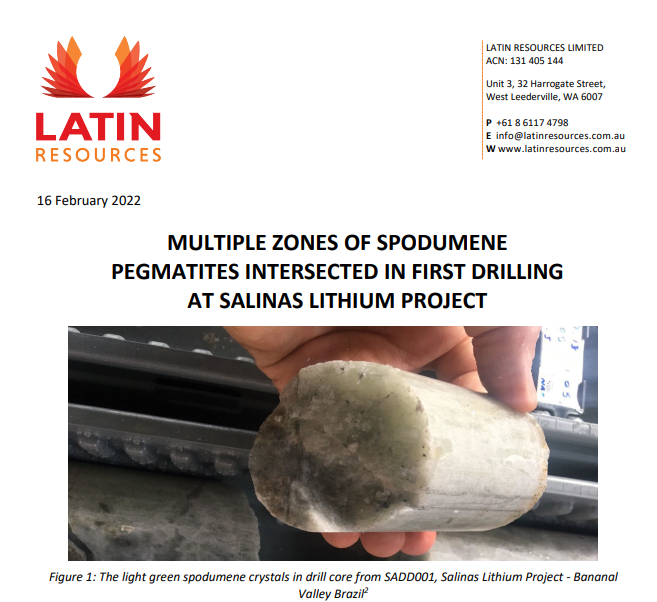

What we want to see next from SLM is an impressive photo of a shiny spodumene filled drill core.

SLM’s big brother LRS casually added $100M to its market cap in yesterday's trading on large volumes after a JORC resource upgrade earlier in the week:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

SLM is backed by the LRS team. LRS holds 17.79% of SLM shares.

We Invested in SLM to see it become LRS 2.0.

But as we saw above, LRS is not the biggest lithium company in Brazil... that crown goes to Sigma Lithium.

Sigma went from a <$200M capped junior explorer to producer, now capped at $6.2BN:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Now LRS is executing Sigma’s development playbook and looking to grow into its nickname as Sigma 2.0.

LRS has grown into a half billion dollar capped company and been a huge success for us.

Our focus is on picking companies with market caps <$50M, the ones we think can re-rate into billion dollar companies.

Following on from LRS, we are now making a bet that SLM can do the same - make a lithium discovery and re-rate by 10x from our initial entry price.

Of course at this point it is important to note that exploration stocks like SLM are particularly risky and a lot can go wrong. There is no guarantee that SLM will be successful with its exploration campaign, and even if it is, the lithium price could change, in turn, affecting the underlying economics of the project (among a range of other risks - see our risks section).

SLM has LRS as its biggest shareholder and LRS Managing Director Chris Gale as its chairman.

At the same time, SLM has Matthew Boyes as its executive director - the same Matthew Boyes that completed the Mount Ida acquisition for what’s now known as Delta Lithium (capped at $380M). Boyes has also spent some time as an in-country manager for LRS.

Before the Mt Ida acquisition, Delta was capped at ~$15M (and was called Red Dirt Metals).

We are hoping Boyes, with the LRS backing in Brazil, can go and deliver some success for shareholders with SLM.

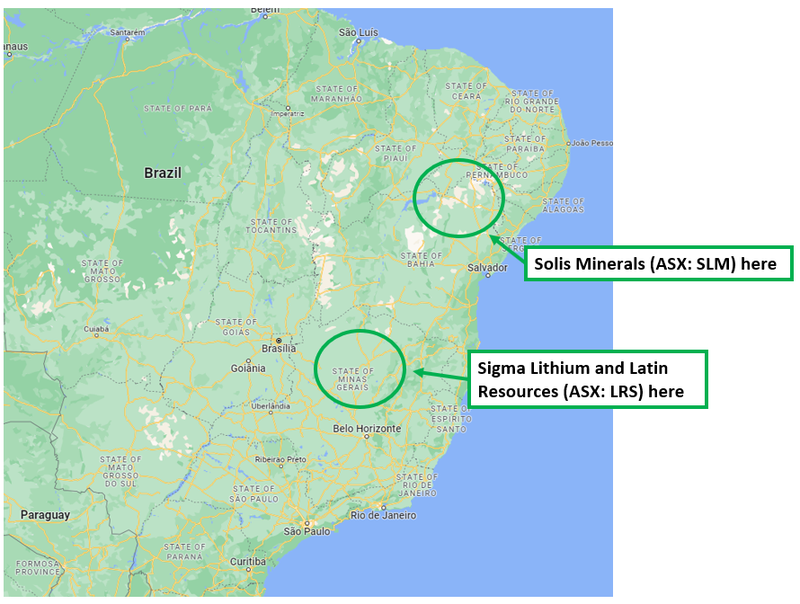

Whilst LRS and Sigma are both in Minas Gerais, so far there is no major player in the lithium space in north eastern Brazil - we are hoping SLM can open up an entirely new lithium province.

But it is early days here, the drill rig has just arrived on site, SLM still has a lot of work to do.

Over the coming weeks we will witness SLM ploughing a series holes into pegmatite Grand Canyon to see how much lithium it contains, and how far it might extend...

SLM MD Matt Boyes is going to be on site when they pull out the first drill core - and we hope that means investors will get a photo of a shiny spodumene filled drill core.

Now drilling is underway - what do we want to see next?

1) During drilling - we want to see a photo of spodumene from the drillcores.

Spodumene is generally the host rock for high grade lithium.

Visual spodumene will be a positive first indication of potential economic lithium mineralisation.

Going back to the LRS drill program that delivered its discovery, the company started drilling in February 2022.

~2 weeks later the first visuals from the drill program were released.

Off the back of the visuals, LRS went from ~3c per share to ~4.2c per share - a return of ~40%.

But remember - the past performance of LRS here does not guarantee anything similar for SLM.

2) After drilling - it will be all about the assay results.

Spodumene in the drill cores is a good sign but as always, with exploration, it will be the assays that tell the full story.

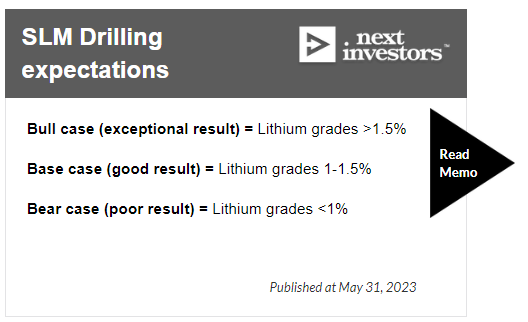

Ultimately we want to see SLM hit intercepts with lithium grades above the levels that are typically considered economic.

It’s never an exact science when it comes to grades, but the general rule of thumb when it comes to lithium projects is that grades of ~1% are considered economical.

The shallower the mineralisation, the lower the grades can be - the deeper the mineralisation, the higher the grades will need to be.

For some context, $6.2BN Sigma Lithium's resource has an average grade of ~1.43%.

SLM’s major shareholder LRS’s resource, has an average grade of ~1.34%.

These are resources developed from hundreds of drill holes, and SLM is just starting out now.

We are hoping lithium grades are above 1% to begin with and have set up our expectations as follows:

For context - by the time LRS had put out its first batch of assay results with lithium grades of >2% the company’s share price had hit ~21c per share.

At its peak, post discovery LRS was up ~600% from its ~3c share price before drilling started.

LRS ran from a market cap of ~$45M to a market cap of ~$337M less than a month after its discovery hole.

We are hoping SLM is able to deliver a similar style drill result and re-rate. Of course - this is exploration, and there is no guarantee that SLM can repeat LRS’ run or discovery on its first campaign.

The obvious difference between the two companies right now is the difference in pre-discovery valuations.

We are conscious of SLM having rallied relatively hard over the last two weeks, which means the market is pricing in higher expectations for the current round of drilling.

If SLM shoots the lights out and delivers results at or above our bull case we would expect the share price to re-rate higher.

If the results are at our base case or bear case, then the opposite could happen because investors are already pricing in drilling success.

SLM is currently capped at $75M (based on yesterday's close price of 95c).

🎓 To learn more about expectation setting going into drill programs check out our educational article here.

SLM is following the tried and tested lithium exploration playbook:

The lithium exploration process playbook goes like this:

- ✅ Map outcropping pegmatites - SLM has already mapped its outcropping pegmatite over a ~1km strike with widths in excess of 50m.

- ✅ Sample the outcrop to see if there is lithium - SLM has taken ~5 rock chip samples returning a peak lithium grade of ~4.95%.

- ✅ Confirm the presence of spodumene - spodumene is the source rock for the majority of the world’s lithium production. SLM has confirmed mineralised “spodumene bearing” pegmatites.

- 🔄 Drill below the outcrop to see how much high grade lithium is there - Drilling is now underway...

If SLM hits high grade lithium then it should be enough for the company to declare a new discovery.

A new discovery forms the basis for our SLM “Big Bet” which is as follows:

Our SLM ‘Big Bet’

“SLM discovers and defines a large resource, leading to a long term re-rate in the company’s share price by >1,000%”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - some of which we refer to earlier in today’s note. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

To monitor SLM’s progress since we first Invested and to track how the company is doing relative to our “Big Bet”, we maintain the following SLM “Progress Tracker”:

Can SLM become the LRS (or even the Sigma) of North East Brazil?

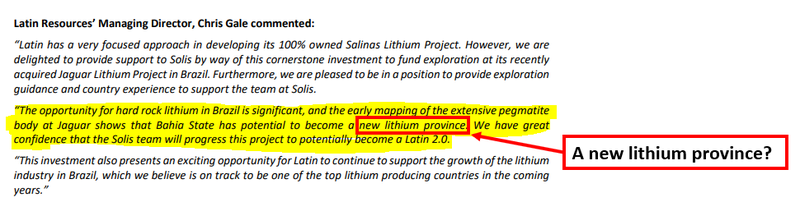

In SLM’s capital raise a few weeks ago, LRS cornerstoned ~$3M of the $8.1M raise.

After the raise is completed, LRS will end up holding ~17.79% of SLM.

But the reason for the cornerstone investment by LRS is what really stood out to us.

LRS’s Managing Director (and SLM’s Chairman) Chris Gale said the following in an LRS announcement released on the day of the SLM cap raise:

According to Gale, SLM’s project could potentially open a new lithium province in Brazil.

Until now, most of the lithium exploration in Brazil has focused on the hard rock projects near Sigma in the state of Minas Gerais in central Brazil.

That region is now geologically well understood from a lithium perspective, and new companies are popping up on an almost daily basis looking to emulate LRS and Sigma’s success in that region.

The north east of Brazil, however, remains largely untouched when it comes to lithium exploration...

SLM, backed by LRS, is looking to be the first mover in the region.

We are hoping that in a few years time, SLM will have established itself as the major lithium player in northeastern Brazil, be it through drilling its existing projects or through acquisitions.

It's not a guarantee, but it's our bet with our SLM Investment in any case.

What are the risks?

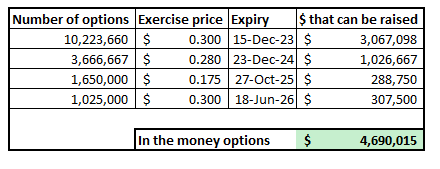

Update on funding risk:

Over the last few weeks SLM has managed to significantly reduce near term “funding risk” by raising $8.1M in capital and having some of its in-the-money options exercised.

SLM’s $8.1M raise was split into two separate tranches (tranche 1 which was completed last week raising $3M).

The second tranche of the placement (~$5.1M) is expected to be issued in July following shareholder approvals.

SLM is now in a position where after the second tranche of the placement is issue it will have:

- $8.1M in cash raised at 55c per share.

- $1.8M cash in the bank at 30 March 2023.

- $2M financing facility available (just in case SLM needs it).

- $4.7M in the money options which could theoretically be exercised by holders to bring in more funds to SLM. We have noticed that over the last few weeks option holders have already converted ~$1M.

The primary risk for SLM now is exploration risk:

There is always a chance that the drill bit delivers nothing material OR delivers results below market expectations... which appear pretty high right now.

In SLM’s case, where expectations are relatively high, the company’s share price would suffer if the company was unable to deliver the drill intercept the market is expecting.

This is the primary risk we are watching for SLM over the coming weeks/months.

To see all of the risks we listed in our SLM Investment Memo click on the image below:

Our SLM Investment Memo:

Click here for our SLM Investment Memo, where you can find a short, high level summary of our reasons for Investing.

In our SLM Investment Memo, you’ll find:

- Key objectives for SLM

- Why we are Invested in SLM

- What the key risks to our investment thesis are

- Our investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.