Right time, right place for stock of the week IPH as tech stocks soar

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

I have a liking for companies that operate in niche but fragmented markets where there are substantial opportunities for growth by acquisition.

Of course, the deals need to be done at the right price and management has to have the ability to successfully integrate new businesses, realising synergies and benefiting from the reduced costs of operating the acquired business under the one banner.

In terms of costs, these are often realised at the administrative level with the purchaser using its established hub of accountants, IT services and marketers to name a few to meet the needs of the new business.

My stock of the week is IPH Ltd (ASX:IPH), an intellectual property (IP) services company that has demonstrated its ability to generate strong organic growth, while also benefiting from acquisitions since listing as the first IP services group on the ASX in 2014.

IPH is the leading IP services group in the Asia-Pacific region, with specialist services spanning the protection, commercialisation, enforcement and management of most types of IP.

Near five-fold increase on IPO price

IPH’s practice areas include patents and designs which account for the majority of the group’s revenues, however it also generates income from services related to trademarks, domain and business names, while also providing commercial legal advice and litigation services regarding IT issues.

The group’s success is reflected in its share price which hit an all-time high of $10.34 in February, a substantial premium to the IPO price of $2.10 per share.

This implied a market capitalisation of $330 million, and today the company has a market cap of more than $1.6 billion.

The strength and resilience of the tech industry which is a significant source of revenue for IPH has been reflected in the performance of the NASDAQ which only this week broke through the 10,000 point mark for the first time.

Positive sentiment towards the tech sector has also been evident in Australia with the S&P/ASX 200 Information Technology Index (XIJ) rebounding from about 850 points in March to close in on the 1550 point mark in June, just 60 points shy of the near 20 year high of 1612 points notched up in February.

Its performance against the NASDAQ is represented by the green line on the above chart.

The performance of both indices has been an incredible feat given that markets have been decimated over the last three months due to the impact of coronavirus, and regards the XIJ, also bear in mind that the broader ASX 200 index is still more than 1000 points shy of a full recovery.

Acceleration in services provided to IP intensive industries to continue

Looking across tech stocks, it has largely been a case of adversity breeding opportunity as consumers and businesses have been forced to rely more heavily on digital and tech solutions to work and communicate remotely, as well as tapping into online entertainment and shopping during periods of isolation.

Many businesses have been pleasantly surprised at how efficient working remotely has been, to the point where there is likely to be an ongoing shift to this trend in order to reduce costs of exorbitant CBD rents, while also having the self-assurance that they are equipped to respond to future situations that require work from home protocols.

New opportunities have also arisen in the health and biotechnology sector with companies striving to find vaccines, come up with better forms of treatment to enhance survival rates, while also looking for new and better ways to prevent communication through the development of protective equipment and sanitisers.

Many of the initiatives that have emerged, and will continue to surface in the near to medium-term will be the subject of trademarks and patents, creating an ideal environment for a company such as IPH.

Acquisitions create ongoing complementary opportunities in new markets

From the outset, IPH was built on the back of the acquisition of Spruson & Ferguson, one of the leading IP services firms in the Asia-Pacific region, servicing over 25 countries from offices in Sydney, Singapore, Kuala Lumpur and supported by a representative office in Shanghai.

On acquisition, Spruson and Ferguson was a well-established company with a history dating back to 1887, including 17 years of operational experience in Asia.

The group had leading market positions in both Australia and Singapore, filing more Australian and Singaporean patent applications in fiscal 2014 and calendar year 2013 respectively than any other firm.

Spruson & Ferguson’s Singapore office acted as an IP service hub for Asia, giving its clients access to the group’s highly qualified and trained patent attorneys to provide a full-service solution for patent and design filing and prosecution services in 19 countries throughout the region.

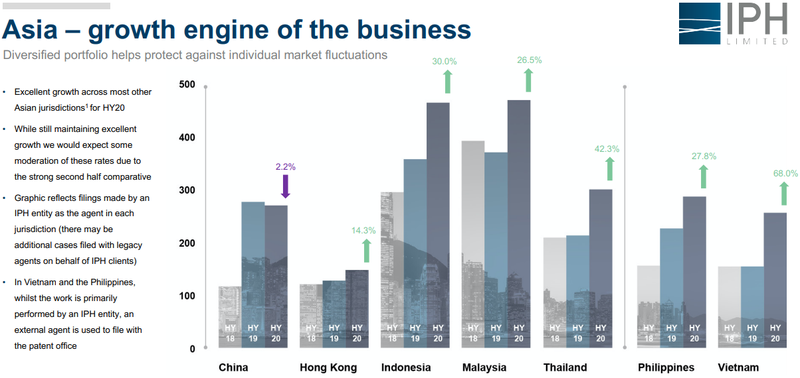

IPH has taken a measured approach towards acquisitions with quality rather than quantity being the priority, and it has been able to significantly strengthen its position in Asia.

This is an important region for the group, as indicated below.

The company continues to make new additions, including this week’s acquisition of New Zealand IP firm Baldwins Intellectual Property, a group that in its first full year of integration should add approximately $2 million in EBITDA.

While this isn’t one of IPH’s larger acquisitions, examining the metrics surrounding the deal provides an appreciation of the boost in underlying valuation provided by these additions before the company even recognises the financial benefits and scope for penetrating new markets.

To put this in perspective, IPH currently trades on an enterprise value to EBITDA ratio of approximately 14 based on underlying earnings projections for fiscal 2020.

IPH acquired Baldwins for approximately $7.4 million, and the business is expected to generate EBITDA of about $1.9 million in fiscal 2020.

This implies an enterprise value to EBITDA multiple of 3.9.

Once those earnings are attributed to IPH, theoretically they could positively impact its enterprise value to the tune of about $28 million (EBITDA of $2 million x 14 [IPH’s EV/EBITDA multiple]).

This has the flow-on effect of increasing the group’s market capitalisation which is reflected in the share price - on the day of the acquisition, IPH traded as high as $7.74, up 49 cents on the previous day’s close.

Though the company’s shares have recovered to some extent since the coronavirus sell-off, they are still some 40% shy of the February high.

As a guide, the consensus valuation is $9.69, implying upside of about 23%.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.