Rhinomed’s Mute is fastest growing nasal strip in US

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Rhinomed Ltd (ASX:RNO), a leader in airway technology and the developers of MuteTM, has informed the market that its Mute nasal stent is the fastest growing product in the nasal strip category in US based drug stores.

Rhinomed is a Melbourne based technology firm with a focus on nasal, respiratory and breathing management technologies.

The company is monetising applications of its technology portfolio in the sport, sleep, well-being and drug delivery markets.

The DrugStores News Management's Annual Drugstore State of the Industry report lists Mute as the fastest growing product in the nasal strip category, growing sales at 56.6% in US Dollar terms and 57.2% in units for the 52 week period ended April 21, 2019.

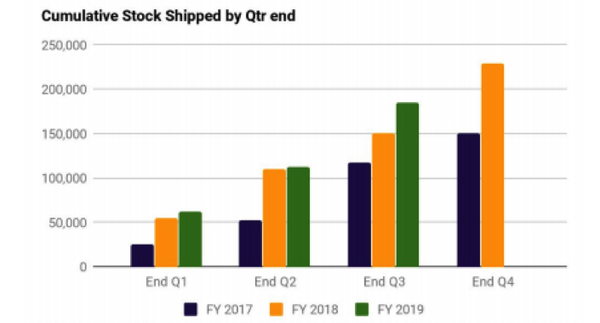

This development comes as the company’s broader operations are also delivering promising growth.

Revenue for the March quarter of more than $1 million represented a 64% increase on the previous corresponding quarter, and the year-to-date income run rate is tracking well ahead of fiscal 2018.

As well as the Mute product line, order volumes for the group’s new ProntoTM rechargeable vapour delivery technology have been encouraging.

New markets poised to deliver robust growth

While the US pharmacy (drug store) market consists of some 67,000 stores, Mute has only recently achieved distribution into 9000 of these stores.

Mute’s rapid growth against exceptionally well established and supported brands such as GlaxoSmithKline’s (LON:GSK) Breathe Right strip product demonstrates Mute’s growing appeal and its potential to achieve further distribution in the US drug store market and then more broadly within the food, mass and specialty retail markets in the US.

As the category leader, Breath Right and Breathe Right Extra achieved sales in excess of US$22 million from pharmacy alone and shipped nearly 2 million units to achieve more than 50% market share.

With only a small store presence and having only begun to make inroads in building brand awareness, the company believes Mute has significant potential to grow and disrupt the sector further.

Highlighting Mute’s premium position and its scope for growth in a niche market, chief executive Michael Johnson said, ‘’Rhinomed is pleased to see that the investment in building the Mute brand is delivering traction.

"Mute is the premium product within the category and is continuing to deliver strong margins for our retail partners.

"As the innovator within the market, Rhinomed will continue to build upon this success to expand our retail presence in the US and global pharmacy market.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.