Regeneus soars 60% as Japanese fund supports capital raising

Published 19-NOV-2019 14:36 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Regeneus Ltd (ASX:RGS), a clinical-stage regenerative medicine company, has placed the full shortfall of 9,437,872 shares under its recent Non-Renounceable Rights Issue.

The placement to a Japan-based institutional investor with extensive experience in the Japanese life sciences and regenerative medicine industry was conducted at an issue price of 8 cents per share for a total of $755,029.

This development was well received by the market with the company’s shares up more than 60% representing a premium to the placement issue price.

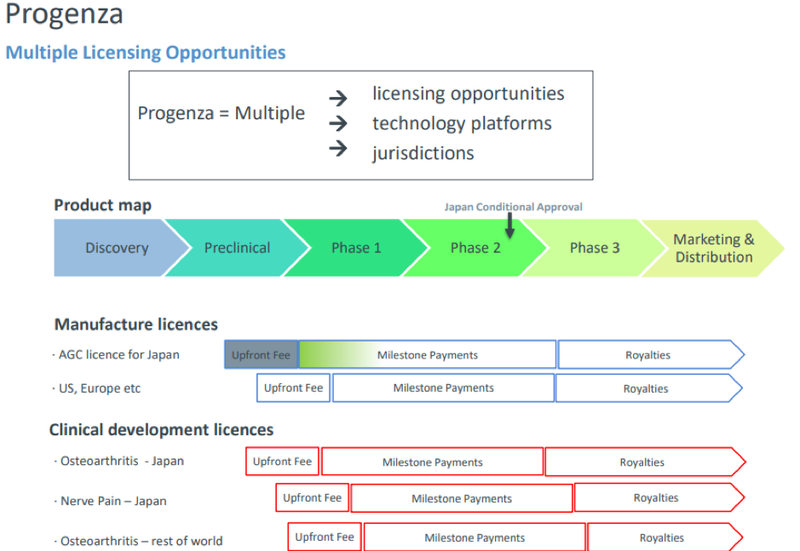

Regeneus uses stem cell technologies to develop a portfolio of novel cell-based therapies to address unmet medical needs in human health markets with a focus on osteoarthritis and neuropathic pain with its platform technologies Progenza and Sygenus.

Regeneus funded to commercialisation of Progenza in Japan.

The total cash raised from a recent Private Placement, the Non-Renounceable Rights Issue and this shortfall placement is approximately $5.5 million.

Importantly, the completion of the non-renounceable rights issue, together with a recent streamlining of the group’s internal operations and the pending Progenza licensing deal in Japan, will see Regeneus sufficiently funded to commercialisation in Japan.

A key priority to begin capturing this market, and executing on management’s strategy is the completion of a Phase 2 trial and the commercialisation of Progenza for the treatment of osteoarthritis.

This is the company’s immediate focus in the 2020 financial year.

Multiple share price catalysts in 2020

In terms of milestones, Regeneus is targeting a product launch in Japan in 2023 and is focused on securing a Japanese commercialisation partnership in the near term, a development that could well be a significant share price catalyst.

Discussing the significance of finalising the rights issue, Regeneus chief executive Leo Lee said, “We are pleased this transaction was completed with the support of an institutional investor with significant experience in the Japanese life sciences and regenerative medicine space, as we see it as validation of our commercialisation strategy for Progenza in Japan.”

While Regeneus has experienced some share price weakness in 2019, this is a company that delivered a 100% share price gain in a matter of weeks in July 2018.

A combination of news regarding licensing in Japan and a decision by the US Patent Office to allow the issuance of a patent covering the composition and uses of Progenza were the key drivers.

These factors are still relevant and very much at the heart of Regeneus’ future, suggesting the share price retracement may represent a buying opportunity.

Regards the latter, issuance of the patent for United States Patent Application No. 14/342479 entitled ‘Therapeutics using adipose cells and cell secretions’ provides commercial rights in the United States through to 2032.

Corresponding patents have been granted in Australia and Japan and are being pursued for grant in other key territories including Europe.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.