Real Energy and Strata X develop three gas projects in merger of equals

Published 15-JUL-2020 12:14 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

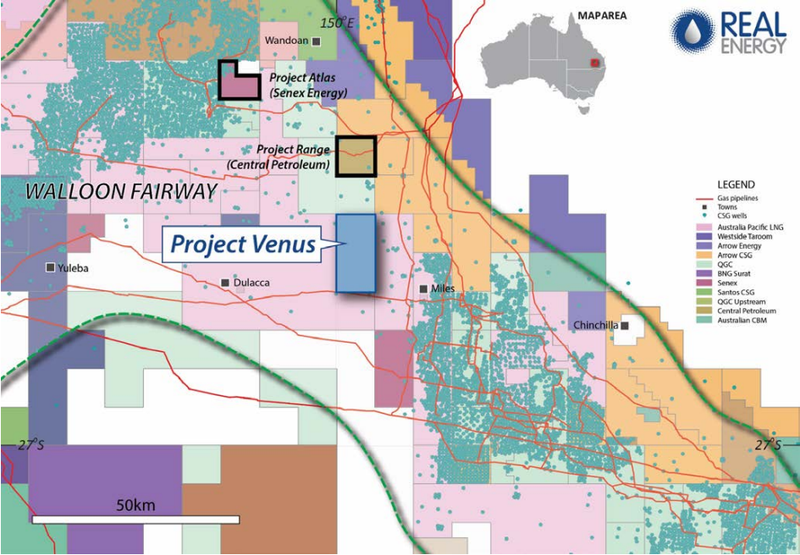

In a development that will create a material gas business with significant holdings in the Surat and Cooper Basins of Queensland, Real Energy Corporation Limited (ASX:RLE) and Strata X Energy Limited (ASX:SXA) have signed an agreement to create Pure Energy Corporation Ltd. This initiative, among other, will bring together their 50/50 joint venture of Surat Basin-based Project Venus under the one banner.

The terms of the binding Scheme Implementation Agreement (SIA) represent a merger of equals whereby Real Energy shareholders will receive one new Strata X Energy share for every three Real Energy shares.

This is a logical consolidation of the complementary Real Energy and Strata X Energy portfolios that will provide the platform to create a meaningful gas operator.

The Board of Directors of Real Energy, who collectively hold approximately 18% of Real Energy’s ordinary shares, intend to vote in favour of the proposal in the absence of a superior proposal and subject to the independent expert concluding that the offer is reasonable.

Cost cuts, leverage to growth markets and new technologies

As well as providing a unified approach in terms of developing projects, the removal of duplicate administrative functions and listing costs will provide significant cost savings to the proposed merged entity.

There are a number of factors that the combined Pure Energy group would have in common including wells drilled that have proven the gas resources are in place, including third-party certifications.

The primary technical risk is finding completion methods to prove commercial gas flows.

Proving commercial gas flows is the precursor to predictable reserves increases and substantial company growth.

Over the next 12 months, Pure Energy plans to use innovative well completion and non-frack reservoir enhancement methods designed to prove commercial gas flows.

The other key factor to bear in mind is that all three gas projects have ready gas markets.

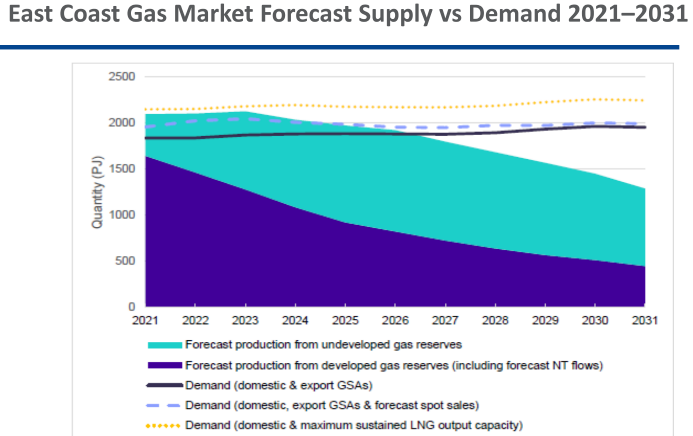

Creating a meaningful gas operator on the east coast

Commenting on the benefits of the merger and the potential shareholder returns that could potentially be achieved by the combined entity, Real Energy managing director Scott Brown said, “This is a compelling combination taking the best elements of both companies and having a strong portfolio of projects with positions in both the Surat Basin and Cooper Basin, and having a significant project in Botswana together with the potential to supply gas to east coast markets.

“Real Energy and Strata X Energy’s combined interest of 100% in the Project Venus and our broader portfolios enhances the likelihood of the merged entity becoming a meaningful gas operator in the east coast of Australia.

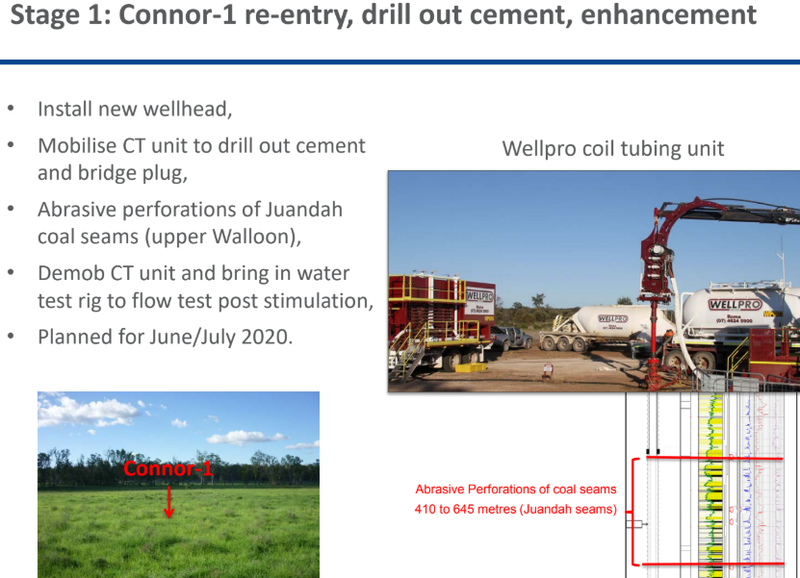

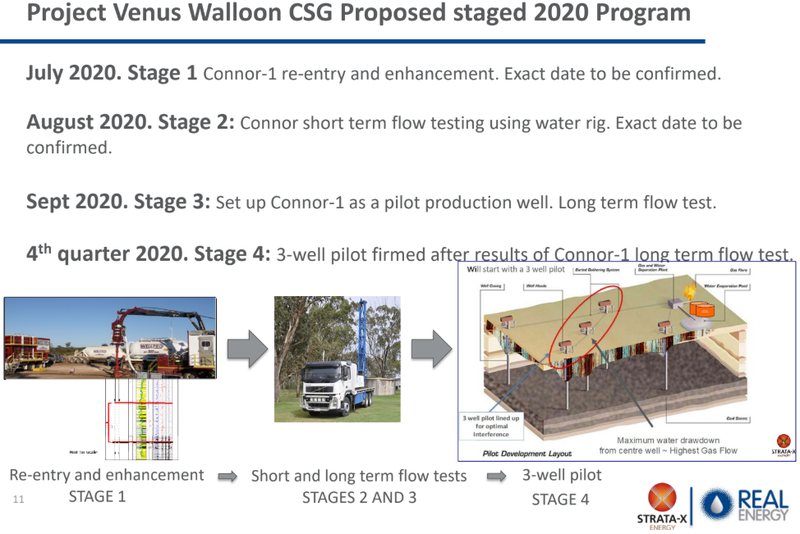

‘’Work on the Connor 1 re-entry on Project Venus is expected to commence in the next month, and from an operational perspective, it is business as usual while seeking shareholder approval for the merger.

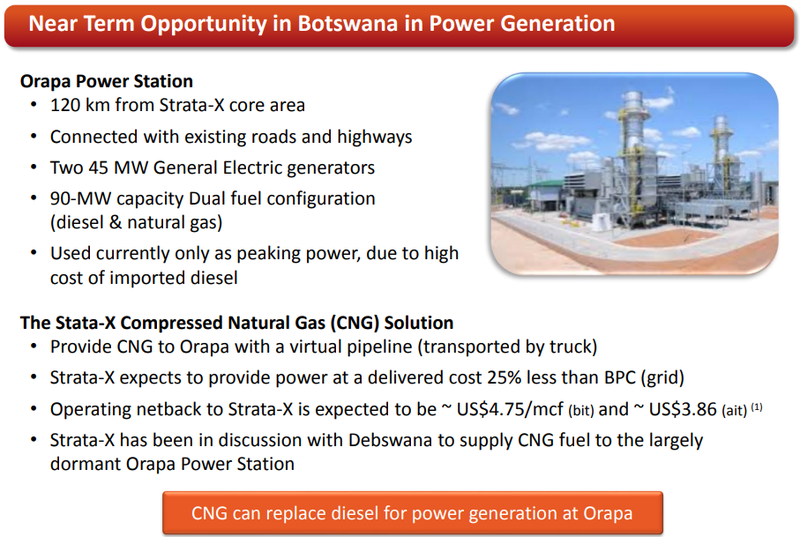

‘’Pure Energy will have exposure to highly prospective and significant projects including Project Venus in the Surat Basin, the Windorah Gas Project in the Cooper Basin, and the Serowe Gas Project in Botswana, and of course benefit from the opportunities that we are pursuing through Pure Hydrogen.

‘’We have lots of optionality to deliver value.”

Ron Prefontaine, chairman of Strata X Energy echoed Brown’s comments in saying, “It is an exciting time to be building a new company - Pure Energy, which will have a meaningful Queensland-focused gas-operated business and a great position in the Botswana CSG fairway together with the exciting hydrogen initiatives.

“This transaction plays to Strata X’s strengths of being a low cost and high-impact on-shore exploration and appraisal operator, which makes it an extremely attractive opportunity for both Real Energy and Strata X Energy shareholders alike.”

Management highlights leverage to growth markets and new technologies

Pure Energy’s vision is to lower emissions initially through substitution of methane for coal and diesel.

One of the group’s goals is converting methane to hydrogen and value-add graphite products using a hybrid methane pyrolysis method, positioning the company as a niche play in the energy sector.

On this note, the combined entity will be investigating the feasibility of building a methane to hydrogen plant in Gladstone.

The merged entity’s 100% owned broader asset portfolio in Australia and Botswana presents further upside potential.

Pure Energy will have a total 11.8 trillion cubic feet (Tcf) of prospective gas resource, 770 billion cubic feet (Bcf) of 3C and 353 Bcf of 2C gas resource.

This amalgamated Prospective Gas Resources is a combination of Project Venus’ Prospective Gas Resources 694 petajoules (Best), with Serowe CSG Project Prospective Gas Resources of 2.4 Tcf and the Windorah Gas Project Prospective Gas Resources of 8.8 Tcf which was adjusted for the reduced ATP 927P area following partial relinquishment in September 2019.

Cooper Basin and Serowe CSG Project ripe for development

Real Energy has extensive landholdings in the Cooper Basin where it is progressing the Windorah Gas Project.

Strata-X and Botsgas are working to finalise a Joint Operating Agreement with respect to the development of the Serowe CSG Project.

BotsGas Limited is an Australian oil and gas exploration and development company focused on opportunities for natural gas in the form of coal-bed methane (CBM) in Botswana.

The company’s target is to establish material gas reserves while jointly pursuing off-take agreements for the Strata-X/Botsgas joint ventures gas resources in Botswana.

Consequently, the two groups bring plenty to the table in terms of quality assets in emerging industries, while also having a healthy degree of diversification as a combined entity.

However, as Pure Energy Corporation Ltd a key focus will be on developing Project Venus, the 154 square kilometre ATP2051 permit in the Surat Basin as a Coal Seam Gas (CSG) Project.

This has a best estimate Prospective Gas Resource of 694 petajoules, and it is adjacent to gas pipelines.

The project is situated in the Walloon CSG fairway, a prolific gas-producing region with over 10,000 wells drilled.

As shown below, there are projects in various stages of development (green dots denote wells drilled), including Senex Energy’s (ASX:SXY) Project Atlas with a reported 2P Reserve of 144 petajoules, and just to the north of Project Venus, Central Petroleum’s (ASX:CTP) Project Range which has a reported 2C Contingent Resource of 270 petajoules.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.